What is an HCC (Hierarchical Condition Category)?

Hierarchical Condition Categories (HCCs) are a Medicare risk adjustment model used to predict the future healthcare costs of beneficiaries based on their chronic conditions. Each HCC represents a category of clinically related ICD-10 diagnoses that carry similar levels of medical complexity and projected cost.

The Centers for Medicare & Medicaid Services (CMS) uses HCC scores to adjust payments for Medicare Advantage plans and some fee-for-service programs. A higher HCC score reflects greater expected healthcare needs—and, therefore, higher reimbursement rates.

In practice, HCC coding ensures that providers who care for medically complex patients are appropriately compensated for the intensity of care those patients require.

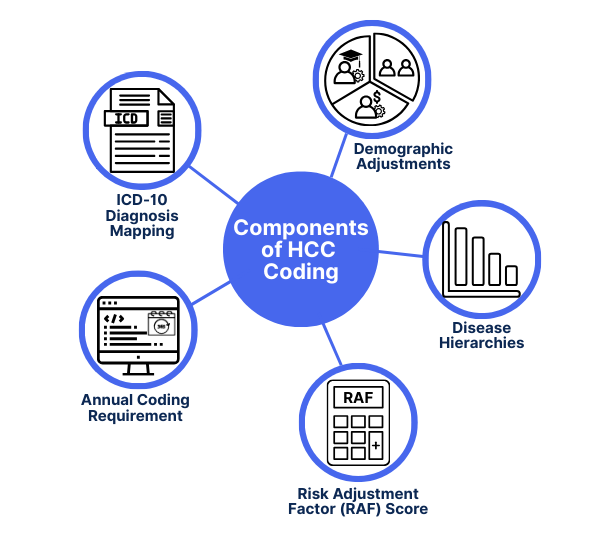

Key Components of HCC Coding

HCC coding is built on the idea that not all chronic conditions have equal impact—and that healthcare providers serving high-risk populations should be reimbursed accordingly. The system relies on specific structural elements to calculate risk and adjust payments:

- ICD-10 Diagnosis Mapping: HCCs are based on documented ICD-10-CM codes. Only certain codes are mapped to HCCs, and accurate documentation is essential for reimbursement.

- Disease Hierarchies: Conditions are grouped hierarchically. If multiple related conditions are reported, only the most severe (highest-weighted) HCC is counted to avoid overcompensation.

- Demographic Adjustments: Age, sex, disability status, and dual eligibility (Medicare + Medicaid) are factored into the risk score alongside condition categories.

- Risk Adjustment Factor (RAF) Score: Each patient is assigned a cumulative RAF score based on their HCCs and demographics. This score drives payment adjustments.

- Annual Coding Requirement: HCC codes must be captured annually. Chronic conditions must be redocumented each year—even if they are ongoing—to contribute to reimbursement.

These components form the backbone of CMS’s value-based payment logic—and proper HCC coding plays a key role in revenue cycle health for Medicare providers.

How HCC Coding Works in Practice

In the real world, HCC coding isn’t just a back-office process—it directly affects how much Medicare pays for patient care. Here’s how the workflow typically unfolds:

- Patient Encounter and Documentation: During a visit, the provider evaluates the patient and documents any active chronic conditions. Precision in ICD-10 coding is crucial—only specific diagnoses map to HCCs.

- Code Abstraction and Validation: Clinical or billing staff assign ICD-10 codes and ensure that documentation supports the severity and chronicity of each condition. This coding data feeds into the HCC mapping engine.

- Risk Score Calculation: CMS (or a Medicare Advantage organization) compiles the HCCs and demographic data into a Risk Adjustment Factor (RAF) score. This score predicts healthcare costs over a 12-month period.

- Payment Adjustment: The RAF score influences capitation payments for Medicare Advantage plans and certain value-based care arrangements. Higher scores = higher reimbursement to account for increased clinical complexity.

- Annual Refresh: Since risk scores reset each year, providers must re-document chronic conditions annually—even if they are stable or unchanged.

Inaccurate or missed HCC coding can lead to underpayment, compliance risks, or missed opportunities to support high-need patients appropriately.

HCC Billing and Compliance Considerations

Because HCC coding influences reimbursement at a systemic level, it’s subject to strict rules—and frequent audits. Accurate documentation is critical not just for payment, but also for regulatory compliance.

Common HCC Billing Mistakes:

- Missing chronic conditions due to lack of specificity in notes or improper coding.

- Failing to re-document ongoing conditions annually, resulting in lower RAF scores.

- Upcoding or assigning unsupported diagnoses, which can trigger CMS audits and penalties.

Best Practices for HCC Compliance

- Ensure that all HCC-eligible diagnoses are clearly documented in the medical record—including their status and treatment relevance.

- Review encounter documentation to confirm that the “MEAT” criteria (Monitoring, Evaluating, Assessing, or Treating) are met.

- Use real-time coding support tools or audits to catch omissions before submission.

For organizations participating in value-based programs—such as ACOs, direct contracting entities, or Medicare Advantage plans—HCC accuracy directly affects not just revenue, but performance benchmarks and shared savings.

Frequently Asked Questions about HCCs

1. What does HCC stand for in healthcare?

HCC stands for Hierarchical Condition Category—a CMS risk adjustment model used to predict healthcare costs based on patient diagnoses and demographics.

2. How are HCCs different from CPT or HCPCS codes?

3. Who uses HCC coding?

HCCs are used in Medicare Advantage, ACOs, and other value-based care programs. They are essential for organizations operating under risk-sharing models or capitated contracts.

4. Do HCCs affect fee-for-service Medicare?

While fee-for-service (FFS) claims don’t rely on HCCs for reimbursement, CMS still uses HCC data to measure patient complexity, risk-adjust benchmarks, and set future rates.

5. How often do providers need to report HCC codes?

Annually. Even if a patient has a stable chronic condition, it must be redocumented each year to be counted in their risk adjustment score.

6. What happens if HCCs are missed during coding?

Missing HCCs can lead to underpayment, lower RAF scores, and lost revenue—especially for providers in Medicare Advantage or shared savings models.