What Are HCPCS Codes?

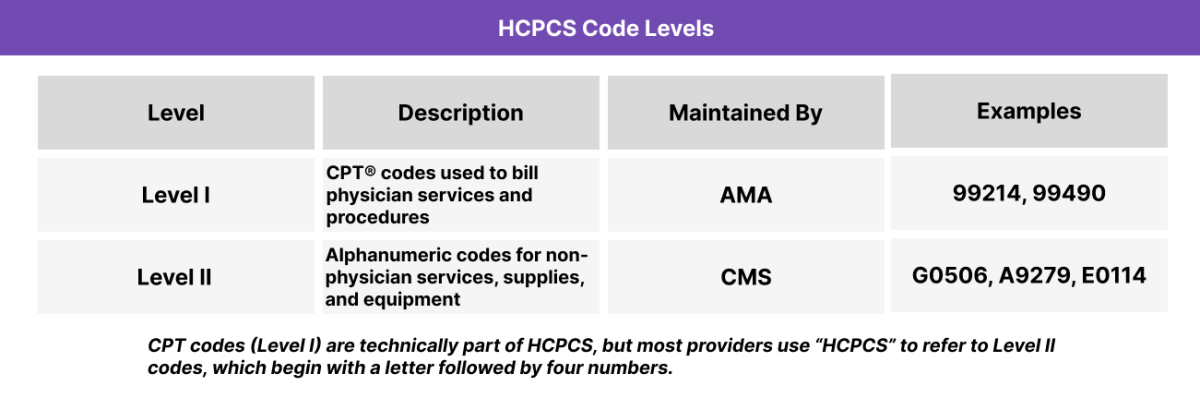

HCPCS codes (pronounced “hick-picks”) are part of the Healthcare Common Procedure Coding System, a standardized set of medical billing codes used to report non-physician services, supplies, equipment, and medications. While CPT codes describe physician-delivered procedures, HCPCS expands coverage to items like ambulance transport, prosthetics, and durable medical equipment (DME).

Maintained by CMS (Centers for Medicare & Medicaid Services), HCPCS codes are critical for billing Medicare, Medicaid, and some commercial payers. Most providers use Level II HCPCS codes, which start with a letter and represent services or items not covered by CPT.

Clinii-enabled care teams may encounter HCPCS codes when billing for telehealth, care management, home visits, or chronic condition supplies—especially in Value-Based Care models.

Key Components of HCPCS

- Stands for: Healthcare Common Procedure Coding System

- Overseen by the Centers for Medicare & Medicaid Services (CMS)

- Used for billing non-physician services, supplies, and products

- Includes items like ambulances, wheelchairs, orthotics, and injectables

- Most commonly used format is Level II (e.g., G0506, A9279, E0114)

- Often used alongside CPT and ICD-10 codes on claims

- Required in Medicare billing and many state Medicaid programs

- Supports billing in chronic care, home health, and care coordination contexts

HCPCS is divided into two levels. Level I codes come from the CPT code set, while Level II codes cover everything from home health supplies to transportation and administrative services

How HCPCS Codes Work in Practice

In everyday billing and care workflows, HCPCS codes are used to report services and supplies that aren’t included in CPT—but are still critical for delivering comprehensive care.

HCPCS Code Assignment

- EHRs and billing platforms often auto-suggest HCPCS codes based on charted activity, especially for services like:

- Care management (e.g., G0506 for CCM initiation)

- Telehealth (e.g., Q3014 for originating site)

- Supplies (e.g., E0114 for a walker)

HCPCS Claims Submission

- HCPCS codes appear on the CMS-1500 claim form or equivalent.

- Providers link HCPCS codes to ICD-10 diagnosis codes to demonstrate medical necessity.

HCPCS Common Use Cases

- Chronic Care Management (e.g., G0511 in FQHC/RHC settings)

- Durable Medical Equipment (DME) (e.g., wheelchairs, glucose monitors)

- Transportation (e.g., ambulance mileage)

- Medications administered in-office (e.g., J codes for injections)

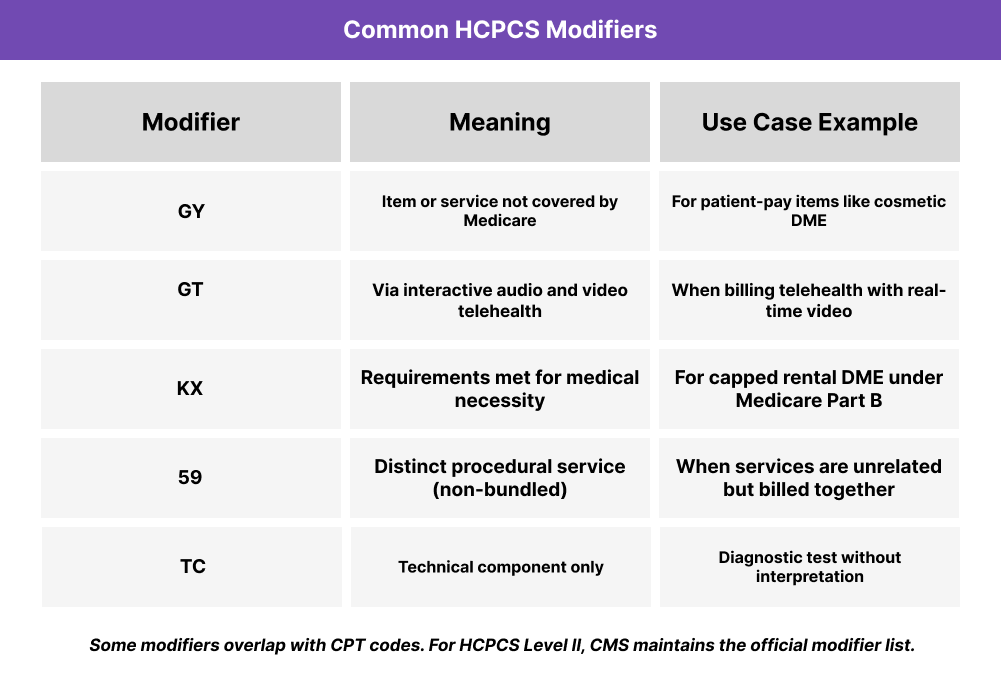

Billing Rules and HCPCS Modifiers

Key billing rules for HCPCS codes:

- HCPCS Level II codes are required for Medicare and many Medicaid claims involving non-physician services.

- Must be submitted on the CMS-1500 or UB-04 claim form with a linked ICD-10 diagnosis code.

- Many HCPCS codes are site-specific—correct place-of-service codes must be included.

- Units matter: Quantities must reflect how much was used (e.g., per injection, per mile, per 15 minutes).

- Coverage varies by payer and state Medicaid program—always verify fee schedules and NCD/LCD policies.

Frequently Asked Questions about HCPCS Codes

1. What are HCPCS codes?

HCPCS codes are billing codes used to report non-physician services, equipment, and supplies — such as wheelchairs, injections, or telehealth visits. They’re required for Medicare and many Medicaid claims.

2. What does HCPCS stand for?

HCPCS stands for Healthcare Common Procedure Coding System, a standardized billing system managed by CMS (Centers for Medicare & Medicaid Services).

3. How are HCPCS and CPT codes different?

CPT codes describe physician services and procedures (Level I), while HCPCS Level II codes report items and services not covered by CPT, such as DME, drugs, or ambulance transport.

4. Do all providers need to use HCPCS codes?

Not always. HCPCS codes are mostly required for Medicare, Medicaid, and certain payer contracts. Providers in FQHCs, RHCs, and care coordination programs use them more frequently.

5. What is a G code or J code in HCPCS?

G codes and J codes are types of HCPCS Level II codes.

- G codes often relate to chronic care or telehealth (e.g., G0506).

- J codes are for drugs and injections (e.g., J3490).