What is the Conversion Factor (CF) in Medicare Reimbursement?

The Conversion Factor (CF) is the dollar multiplier used by the Centers for Medicare & Medicaid Services (CMS) to convert a service’s Relative Value Units (RVUs) into a final payment amount under the Medicare Physician Fee Schedule (MPFS). It translates the relative resource value of a CPT or HCPCS code into an actual reimbursement amount in dollars.

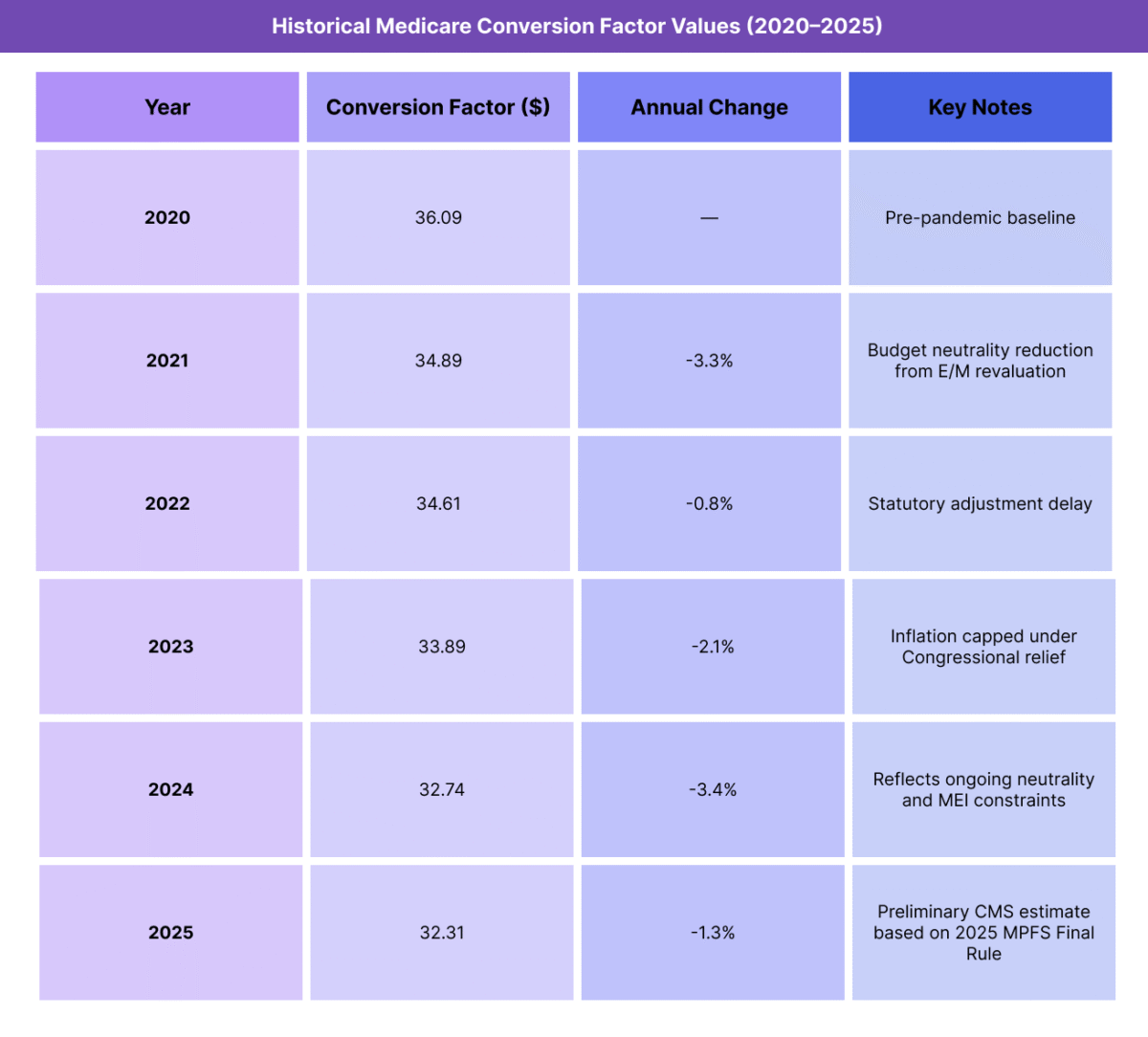

Each year, CMS updates the Conversion Factor to account for changes in inflation (MEI), budget neutrality, and legislative adjustments. This annual revision ensures that total Medicare spending for physician services remains stable even as code values or practice costs shift.

Formula:

Medicare Payment = [(Work RVU × Work GPCI) + (Practice Expense RVU × PE GPCI) + (Malpractice RVU × MP GPCI)] × Conversion Factor

For example, if the total adjusted RVU for a procedure is 5.00 and the Conversion Factor is $32.50, the Medicare-allowed payment equals $162.50.

The CF links the Resource-Based Relative Value Scale (RBRVS) methodology to CMS’s budgeted spending framework, making it one of the most visible indicators of federal reimbursement policy. Because commercial and Medicaid payers often peg their rates to a percentage of the Medicare CF, its value influences healthcare payments nationwide.

Key Components of the Medicare Conversion Factor (CF)

The Conversion Factor (CF) translates the value of medical services, measured in Relative Value Units (RVUs), into a dollar payment amount under the Medicare Physician Fee Schedule (MPFS). Each year, CMS updates the CF based on a combination of economic data, statutory rules, and legislative action.

The CF ensures that Medicare payments reflect both changes in practice costs and federal spending targets, maintaining long-term stability in the program.

1. Medicare Economic Index (MEI)

- The MEI measures inflation in physician practice costs, including wages, rent, supplies, and equipment.

- CMS uses MEI data to determine the baseline inflationary adjustment to the Conversion Factor each year.

- If MEI rises, CMS may increase the CF to offset cost growth — though this is often limited by budget neutrality laws.

2. Budget Neutrality Requirement

- By law, CMS must maintain budget neutrality in physician payment updates.

- When total RVUs or payment policy changes increase projected spending, CMS reduces the Conversion Factor to offset the difference.

- This mechanism keeps overall Medicare Part B expenditures consistent but can result in year-over-year payment reductions even when costs rise.

3. Legislative and Policy Adjustments

- Congress periodically enacts laws that modify or freeze CF updates (e.g., the Consolidated Appropriations Act or pandemic-related relief).

- These interventions prevent steep payment cuts in years when RVU or budget neutrality adjustments would otherwise lower the CF.

- CMS also incorporates temporary add-on payments or adjustment factors for specific programs, such as Quality Payment Program (QPP) incentives.

4. Annual Rulemaking and Update Process

- CMS publishes proposed and final CF updates each year through the Federal Register as part of the MPFS rulemaking cycle.

- The proposed rule (midyear) outlines projected CF changes, while the final rule (issued in November) confirms the official rate effective January 1.

- Each update reflects a combination of MEI data, policy adjustments, and Congressional mandates.

5. Relationship to Commercial and Medicaid Payments

- Many commercial and state Medicaid programs use the Medicare CF as a benchmark multiplier — e.g., paying 110% or 120% of the Medicare rate.

- As a result, changes to the CF ripple through the broader U.S. reimbursement ecosystem, influencing contract negotiations and physician compensation trends.

How the Medicare Conversion Factor (CF) Works in Practice

The Conversion Factor (CF) is applied automatically within the Medicare Physician Fee Schedule (MPFS) to calculate the final reimbursement for each covered CPT or HCPCS service. It converts the total Relative Value Units (RVUs) — already adjusted for geographic cost differences via GPCI — into a dollar-based payment rate.

For physicians, compliance teams, and billing specialists, the CF represents the final step in Medicare’s reimbursement formula.

Step 1: Determine Total Adjusted RVUs

- Each CPT or HCPCS code has three RVU components: Work, Practice Expense (PE), and Malpractice (MP).

- CMS adjusts each component for geographic variation using the Geographic Practice Cost Index (GPCI).

- These adjusted RVUs are summed to produce the total adjusted RVU for that service.

Formula:

Total Adjusted RVU = (Work RVU × Work GPCI) + (PE RVU × PE GPCI) + (MP RVU × MP GPCI)

Step 2: Apply the Conversion Factor

The Conversion Factor multiplies the total adjusted RVU to generate the final Medicare payment.

Example:

- Total Adjusted RVU = 5.00

- Conversion Factor = $32.31

- Payment = 5.00 × $32.31 = $161.55

This simple multiplication links complex cost modeling to a uniform, transparent payment value across all physician services.

Step 3: Integrate CF into Claims Processing

- The CF is embedded within CMS’s and MACs’ (Medicare Administrative Contractors) claim systems.

- Providers do not manually apply the CF — it is automatically calculated during adjudication when claims are processed.

- The CF value in effect on the date of service determines the payment rate, even if the claim is submitted later.

Step 4: Use in Forecasting and Contract Modeling

- Billing and finance teams use CF data for revenue forecasting, budget planning, and payer contract negotiation.

- Many private insurers peg their fee schedules to the Medicare CF (e.g., “125% of Medicare”), so changes to the CF can directly affect commercial reimbursement rates.

- Multi-site organizations use locality-specific GPCI values with the CF to model regional payment differentials.

Step 5: Annual Updates and Monitoring

- The CF is updated each year through the CMS MPFS Final Rule, published in the Federal Register.

- Practices and compliance teams track CF updates to anticipate year-over-year revenue shifts, especially during times of policy change or budget neutrality adjustments.

- Software vendors and clearinghouses typically update CF data automatically in EHR and billing systems on January 1 of each calendar year.

CF Billing, Reimbursement, and System Limitations

The Conversion Factor (CF) is one of the most influential—and debated—elements of Medicare’s reimbursement system. It directly determines how Relative Value Units (RVUs) are translated into dollars under the Medicare Physician Fee Schedule (MPFS).

While the CF was designed to maintain budget neutrality and payment consistency, it has become a point of friction for providers as the gap between real-world inflation and payment growth continues to widen.

How the CF Determines Reimbursement

- The CF converts the total adjusted RVUs of a service into its final Medicare-allowed payment.

- Increases or decreases in the CF apply uniformly across all CPT and HCPCS codes, making it a powerful lever in national reimbursement policy.

- Each annual update reflects the combined influence of:

- The Medicare Economic Index (MEI) (inflationary factor).

- Budget neutrality adjustments.

- Legislative mandates and temporary payment relief measures.

- A single percentage change in the CF can represent billions of dollars in total Medicare spending.

Budget Neutrality Constraints

- CMS is legally required to maintain budget neutrality in physician payments.

- If new services or RVU revaluations increase total spending, CMS must reduce the CF so that total Medicare expenditures remain stable.

- This mechanism often results in payment cuts, even when inflation and practice costs rise.

- Congressional action occasionally overrides these cuts (e.g., temporary CF freezes or partial restorations), but such relief is often short-lived.

Impact of Inflation and MEI Lag

- The CF typically lags behind actual cost inflation, as MEI-based adjustments are often reduced or delayed due to budget neutrality offsets.

- This misalignment leads to real-dollar declines in physician reimbursement over time.

- Between 2001 and 2025, the CF has declined by nearly 25% in nominal value, while general inflation has risen more than 60%, eroding purchasing power across all specialties.

Specialty and Service Impact

Because CF changes apply uniformly, all services are affected equally—procedural, cognitive, and primary care alike.

However, the effect can vary by specialty:

- Primary care and cognitive services experience a greater impact since they rely on high volume and lower margins.

- Procedural specialties may offset lower CFs through higher service intensity or alternative payment models.

- These dynamics can unintentionally distort specialty mix and provider behavior over time.

Administrative and Policy Challenges

- Annual uncertainty in CF updates complicates budgeting, forecasting, and payer contracting for providers.

- The year-end rulemaking process often triggers advocacy and lobbying campaigns to avert cuts, creating operational instability.

- Policymakers continue to debate reform options, such as:

- Automatic inflation indexing tied to MEI.

- Partial budget neutrality exemptions for specific services.

- Two-tier models that stabilize CF growth for primary and preventive care.

Broader Payment System Implications

- Because the CF anchors many commercial and Medicaid fee schedules, its reductions extend far beyond Medicare.

- Hospitals, independent practices, and health systems alike cite CF compression as a leading driver of revenue shortfall and consolidation pressure.

- Reforming CF methodology has become central to discussions about long-term physician payment sustainability and healthcare equity.

CF and Its Impact on Quality, Access, and Health Equity

The Conversion Factor (CF) not only drives Medicare reimbursement rates but also influences physician behavior, care quality, and healthcare equity across the broader U.S. system. Because the CF serves as the financial “engine” of the Medicare Physician Fee Schedule (MPFS), its trajectory affects how providers allocate time, resources, and attention between patient care and practice survival.

Stability and Predictability in Care Delivery

- The CF provides a uniform, transparent benchmark that anchors national reimbursement, enabling consistent financial planning across specialties and payers.

- Predictable CF updates promote stability, allowing organizations to invest in staffing, technology, and quality-improvement programs.

- However, frequent CF cuts or freezes create volatility that can force smaller practices to reduce service lines or defer capital improvements, indirectly influencing care quality.

Influence on Physician Workforce and Retention

- Declining CF values over time have reduced inflation-adjusted physician income, particularly in primary care, behavioral health, and geriatrics.

- This has contributed to provider burnout, early retirement, and consolidation, especially among independent or rural practices.

- When the CF fails to keep pace with rising costs, clinicians are less likely to accept new Medicare patients, constraining access for older adults and individuals with chronic conditions.

Impact on Care Quality and Patient Access

- Lower CF growth limits practice investment in preventive and coordinated-care models, which are essential to quality outcomes under value-based initiatives.

- Practices operating under thin margins may prioritize higher-reimbursed procedural codes over cognitive or care-management services, skewing the clinical mix.

- Over time, inadequate CF adjustments can lead to fewer participating providers in Medicare networks, increasing patient travel times and wait lists.

Equity Considerations and Rural Disparities

- CF reductions compound inequities in low-GAF or low-GPCI localities, where baseline reimbursement is already lower.

- Rural and safety-net providers experience disproportionate strain, as they rely more heavily on Medicare and Medicaid payments.

- To mitigate these effects, CMS has explored bonus structures and rural payment adjustments tied to CF updates, but implementation remains uneven.

Policy Reform Toward Sustainability and Fairness

Policymakers and professional associations continue to advocate for:

- Automatic MEI-based inflation indexing of the CF to prevent real-term erosion.

- Integration of quality performance adjustments to reward high-value, equitable care.

- Targeted CF floor protections for primary-care and safety-net specialties.

These reforms aim to align payment updates with actual practice costs and ensure that reimbursement promotes—not undermines—long-term care equity.

The CF’s Role in the Shift to Value-Based Care

- As CMS advances toward value-based payment, the CF remains a baseline anchor ensuring continuity and comparability between fee-for-service and alternative models.

- A rebalanced CF—responsive to inflation and quality outcomes—could stabilize physician payment while reinforcing Medicare’s transition toward sustainable, equitable healthcare financing.

Frequently Asked Questions about the Medicare CF

1. What is the Medicare Conversion Factor (CF)?

The Conversion Factor (CF) is the dollar amount used by the Centers for Medicare & Medicaid Services (CMS) to calculate Medicare payment rates under the Medicare Physician Fee Schedule (MPFS). It converts a service’s Relative Value Units (RVUs)—which measure time, skill, and resources—into a final reimbursement value in dollars.

2. How is the Conversion Factor calculated?

The CF is derived from a formula that considers several elements, including:

- Medicare Economic Index (MEI) – Reflects inflation in physician practice costs.

- Budget Neutrality Adjustments – Ensures total Medicare spending remains consistent.

- Legislative Actions – May freeze, cap, or increase the CF through Congressional intervention.

Each year, CMS publishes the updated CF as part of the MPFS Final Rule.

3. How does the Conversion Factor affect Medicare reimbursement?

The CF determines the dollar value assigned to each CPT® or HCPCS service. It multiplies the service’s total adjusted RVUs (including GPCI adjustments) to produce the Medicare-allowed amount.

Formula:

Payment = [(Work RVU × Work GPCI) + (PE RVU × PE GPCI) + (MP RVU × MP GPCI)] × Conversion Factor

Even small changes in the CF can have a major impact on physician payments nationwide.

4. Why does the Conversion Factor change every year?

CMS updates the CF annually to reflect:

- Inflationary changes tracked by the MEI.

- Spending neutrality adjustments that offset increases in total RVUs.

- Legislative mandates from Congress or temporary relief programs.

This annual update process ensures Medicare payments evolve with economic conditions and policy priorities.

5. Why do CF reductions occur even when costs rise?

Medicare law requires that any policy change increasing spending be offset elsewhere to maintain budget neutrality. When new codes or valuation adjustments raise total costs, CMS lowers the CF to balance the overall budget. This mechanism often results in payment cuts, even during inflationary periods.

6. What is the relationship between the CF and the Medicare Economic Index (MEI)?

The MEI measures inflation in physician practice costs and serves as the economic baseline for CF updates. Ideally, the CF should increase in line with MEI growth, but budget neutrality rules often limit or delay those adjustments, causing Medicare reimbursement to lag behind actual cost trends.

7. Why is the Conversion Factor important beyond Medicare?

The CF is the industry benchmark for physician reimbursement. Many commercial payers, Medicaid programs, and ACOs peg their rates to the Medicare CF—often as a percentage multiple (e.g., 110% of Medicare). As a result, changes in the CF ripple across the entire U.S. healthcare payment landscape.