What Are Medicare Administrative Contractors (MACs)?

Medicare Administrative Contractors (MACs) are the regional private organizations contracted by the Centers for Medicare & Medicaid Services (CMS) to administer Medicare claims processing and payment operations. They serve as the operational bridge between CMS policy and the day-to-day reimbursement of healthcare providers across the United States.

Each MAC handles a defined jurisdiction—a geographic area that includes multiple states or territories—and manages Medicare Part A (hospital) and/or Part B (physician and supplier) claims within that region. MACs also oversee provider enrollment, coverage determinations, medical review, audit activities, and customer service functions for participating healthcare entities.

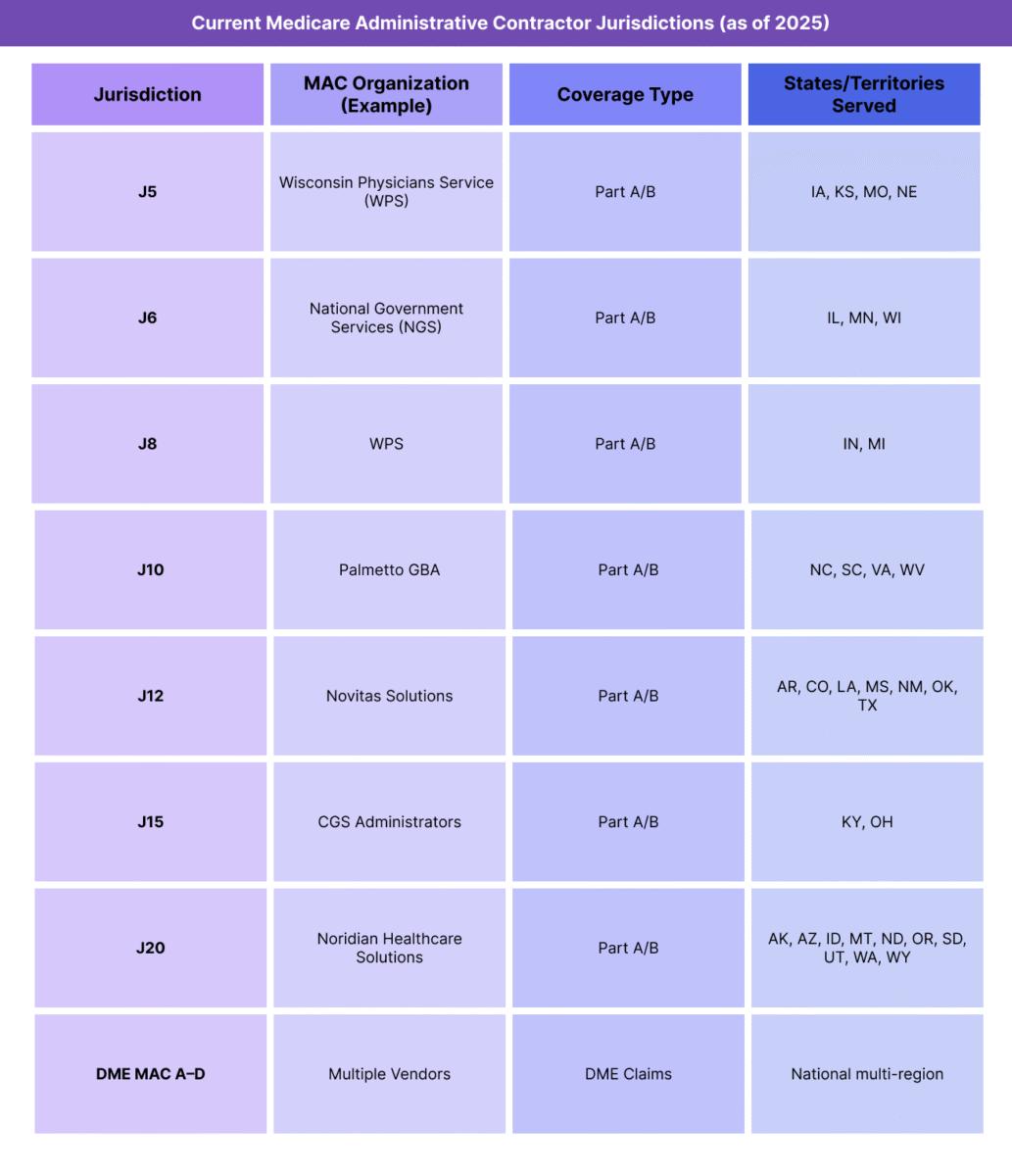

Created under the Medicare Modernization Act of 2003, MACs replaced the older fiscal intermediary and carrier model to streamline operations and ensure uniform application of Medicare rules across regions. Today, there are twelve Part A/B MACs covering the fifty states and territories, along with specialized DME (Durable Medical Equipment) MACs for equipment and supply billing.

By implementing CMS policy, adjudicating claims, and applying the Medicare Physician Fee Schedule (MPFS) with the current Conversion Factor (CF), MACs ensure that provider reimbursement aligns with federal standards while maintaining regional responsiveness.

Key Components of Medicare Administrative Contractors (MACs)

Medicare Administrative Contractors (MACs) operate as CMS-authorized regional administrators for all major Medicare payment and compliance functions. They form the infrastructure that converts CMS policy and rulemaking into real-world claims processing, provider oversight, and payment execution.

Each MAC manages specific jurisdictions, processes Medicare Part A and/or Part B claims, and serves as the primary point of contact for provider education, enrollment, and appeals.

1. MAC Jurisdictions and Geographic Organization

- CMS divides the United States into 12 primary A/B jurisdictions, each managed by one contracted MAC organization.

- Jurisdictions are defined by state boundaries and Medicare population volume, ensuring balanced workloads.

- In addition to A/B MACs, CMS contracts with 4 Durable Medical Equipment (DME) MACs that administer claims for DME suppliers across overlapping multistate regions.

- These jurisdictions ensure consistent rule application while maintaining local responsiveness for provider support and regional trends.

2. Core Functional Responsibilities

- MACs are responsible for executing nearly all operational aspects of the Medicare fee-for-service (FFS) program, including:

- Claims Processing – Adjudicating Medicare Part A and Part B claims, applying payment rules from the Medicare Physician Fee Schedule (MPFS) and current Conversion Factor (CF).

- Provider Enrollment and Credentialing – Verifying provider eligibility and maintaining compliance with CMS participation standards.

- Coverage and Medical Review – Reviewing claims for medical necessity, documentation sufficiency, and adherence to local coverage determinations (LCDs).

- Audit and Program Integrity – Conducting pre- and post-payment reviews, identifying improper payments, and referring suspected fraud or abuse to CMS and OIG.

- Appeals and Customer Support – Managing redeterminations and provider inquiries at the first level of the Medicare appeals process.

3. Governance and Oversight

- MACs operate under multi-year CMS contracts, with performance evaluated on accuracy, timeliness, and provider satisfaction metrics.

- CMS retains policy authority, while MACs handle implementation, execution, and compliance monitoring.

- The MAC J-number system (e.g., J5, J8, J12) identifies jurisdictions and facilitates policy referencing in CMS documentation.

How Medicare Administrative Contractors (MACs) Work in Practice

Medicare Administrative Contractors (MACs) are the operational backbone of Medicare’s fee-for-service (FFS) payment system. They serve as CMS’s field-level administrators—turning national policy, coding rules, and payment formulas into real-time claims decisions and provider reimbursements.

Every healthcare provider or supplier participating in Medicare interacts with their assigned MAC for claims processing, enrollment, coverage guidance, and appeals.

Step 1: Provider Enrollment and Credentialing

- Before billing Medicare, a provider must enroll with their regional MAC through PECOS (Provider Enrollment, Chain, and Ownership System).

- The MAC verifies credentials, practice ownership, and compliance with CMS participation requirements.

- Once approved, the MAC assigns a Provider Transaction Access Number (PTAN) and activates billing privileges.

Step 2: Claims Submission and Processing

Providers submit electronic claims (837P for professional, 837I for institutional) directly to their MAC via Electronic Data Interchange (EDI) or clearinghouse.

The MAC applies CMS rules, such as:

- The current Medicare Physician Fee Schedule (MPFS)

- Applicable Geographic Practice Cost Index (GPCI)

- Conversion Factor (CF) for the current year

- Coverage and documentation requirements based on National Coverage Determinations (NCDs) and Local Coverage Determinations (LCDs)

The MAC’s claims adjudication system validates coding, eligibility, modifiers, and medical necessity before issuing payment or denial.

Step 3: Payment and Remittance Advice

- Once claims are processed, MACs issue Electronic Remittance Advice (ERA 835) detailing payment amounts, adjustments, and denial codes.

- Payments are typically made via Electronic Funds Transfer (EFT) within 14–30 days of claim receipt.

- MACs also generate paper remittance summaries for smaller practices that do not use ERA files.

Step 4: Provider Education and Compliance Support

- MACs maintain ongoing relationships with providers through:

- Webinars and training sessions on billing updates and policy changes.

- Email listservs for regulatory announcements and fee schedule revisions.

- Help desk support for claim errors, NPI issues, or EDI rejections.

- They also publish LCDs (Local Coverage Determinations)—policy interpretations that clarify CMS rules for specific procedures or diagnoses within a jurisdiction.

Step 5: Appeals and Redetermination

- If a claim is denied, providers may file a first-level appeal (redetermination) with their MAC within 120 days of the denial notice.

- The MAC’s appeals unit reviews submitted documentation and either upholds or reverses the initial decision.

- Further appeals (Levels 2–5) move beyond the MAC to independent contractors, ALJs (Administrative Law Judges), and the Departmental Appeals Board.

Step 6: Program Integrity and Audit Coordination

- MACs coordinate with Recovery Audit Contractors (RACs), Comprehensive Error Rate Testing (CERT) contractors, and Zone Program Integrity Contractors (ZPICs) to detect improper payments and fraud.

- They perform data analytics and medical reviews to identify billing patterns that deviate from national norms.

- When issues arise, MACs issue demand letters or initiate overpayment recovery actions under CMS oversight.

Step 7: Digital Integration and Future Role

- MACs are increasingly central to CMS’s digital modernization strategy, including expanded use of:

- APIs and portal access for real-time claim status tracking.

- AI-assisted review tools to streamline audits and coverage determinations.

- Interoperability pilots to support data exchange across CMS systems and EHR platforms.

- Their evolution ensures Medicare payment operations remain efficient, secure, and scalable.

Summary Insight

MACs are not policymaking entities but executional agents—the link that turns federal reimbursement rules into consistent, timely provider payments. Their performance directly affects cash flow, compliance risk, and provider satisfaction across the healthcare ecosystem.

MACs in Billing, Reimbursement, and System Limitations

Medicare Administrative Contractors (MACs) are the operational gatekeepers of the Medicare payment system. They manage the flow of claims, apply CMS rules, and release billions of dollars in reimbursements each year. For healthcare organizations, MAC efficiency directly affects cash flow, audit exposure, and payment predictability.

While MACs create uniformity in processing and compliance, they also introduce regional and procedural variation that can challenge providers navigating multi-state operations or complex billing structures.

How MACs Affect Billing and Reimbursement

- MACs implement CMS payment rules by applying the Medicare Physician Fee Schedule (MPFS), Conversion Factor (CF), and coverage determinations to each claim.

- They ensure budget neutrality and payment consistency across their jurisdiction, aligning reimbursement with federal guidelines.

- Accurate MAC performance supports:

- Timely adjudication of claims (typically within 14–30 days).

- Correct application of code edits, modifiers, and bundling rules.

- Fair interpretation of Local Coverage Determinations (LCDs) and national CMS policy.

- Any delay or inconsistency in MAC processes directly impacts provider revenue cycles and accounts receivable timelines.

Regional and Operational Variation

- Although MACs follow uniform CMS rules, jurisdictional differences exist in operational execution, LCD interpretation, and communication practices.

- Providers operating in multiple states often must navigate different LCDs, appeal portals, and customer-service procedures for each MAC region.

- These inconsistencies can result in payment disparities, even for identical services billed under the same federal codes.

- CMS monitors MAC performance through accuracy and timeliness benchmarks, but differences persist due to volume, staffing, and system variations.

Technology and System Limitations

- Some MAC IT infrastructures are based on legacy systems that may lack full interoperability with EHR and clearinghouse platforms.

- Electronic Remittance Advice (ERA) formats and claim-status response systems vary slightly across MACs, requiring custom configuration for each jurisdiction.

- MAC portals may have limited real-time tracking, leading to inefficiencies in claims monitoring and appeals management.

- These technology constraints can increase administrative burden, especially for multi-jurisdictional billing teams and national provider networks.

Coverage and Policy Interpretation Challenges

- MACs issue Local Coverage Determinations (LCDs) to clarify national CMS rules for specific services.

- While LCDs provide regional flexibility, they can also create variability in reimbursement, particularly for newer procedures or diagnostics.

- Providers must stay current with each MAC’s LCD library to avoid inadvertent non-coverage or documentation denials.

- Conflicting or outdated LCD guidance can delay claim resolution and contribute to higher appeal rates.

Payment Delays and Audit Exposure

- MACs occasionally issue mass denials or payment holds when system edits, policy updates, or error trends are identified.

- Routine audits, such as Targeted Probe and Educate (TPE) reviews, can temporarily suspend payment on certain claims.

- While these processes protect Medicare program integrity, they can create short-term liquidity challenges for providers reliant on steady cash flow.

Policy and Reform Considerations

- CMS continues to modernize MAC operations through:

- Digital transformation initiatives (API-based submissions, real-time eligibility checks).

- Cross-jurisdictional consistency programs to align LCD and appeal processes.

- Performance-based contracting, where MAC renewal depends on metrics for timeliness, accuracy, and provider satisfaction.

- Despite these efforts, providers still call for greater transparency, uniformity, and interoperability across MAC systems.

Key Takeaway

MACs remain indispensable to the Medicare ecosystem but also represent a bottleneck risk when systems, staffing, or guidance lag behind policy. Their modernization and standardization are crucial to ensuring accurate, equitable, and efficient reimbursement for all providers.

How MACs Influence Quality, Access, and Equity in Medicare Administration

Although Medicare Administrative Contractors (MACs) function primarily as payment processors, their performance and decision-making directly influence care quality, provider access, and reimbursement equity across the Medicare system. As CMS’s regional administrators, MACs shape how consistently policies are applied—and how fairly providers are reimbursed—at the operational level.

Ensuring Consistency and Quality in Claims Administration

- MACs are responsible for applying CMS coverage and payment rules uniformly across all providers in their jurisdiction.

- High-performing MACs maintain low claim-error rates and short turnaround times, helping ensure that reimbursement is both timely and accurate.

- Consistency in claims adjudication promotes provider confidence and participation, which ultimately supports continuity and quality of patient care.

- When MAC performance varies across jurisdictions, disparities emerge—affecting provider trust and regional payment stability.

Impact on Provider Access and Participation

- Timely, predictable reimbursement is essential for provider retention in the Medicare program.

- Inconsistent MAC processes, delayed payments, or unclear coverage rules can discourage small practices and rural providers from maintaining participation.

- MACs that excel in provider outreach and education help improve participation rates by ensuring billing teams understand evolving policies and documentation requirements.

- By contrast, administrative bottlenecks or opaque audit processes can erode confidence and contribute to provider attrition, especially in underserved areas.

Regional Equity and Administrative Fairness

- CMS’s reliance on multiple MACs introduces regional variation in how policies and coverage determinations (LCDs) are interpreted.

- In some cases, identical procedures may be reimbursed differently depending on jurisdiction, challenging the goal of uniform national policy enforcement.

- These discrepancies can reinforce existing geographic inequities, particularly for newer or emerging procedures awaiting consistent national guidance.

- CMS continuously monitors MACs for compliance consistency and adjusts contract renewal terms to mitigate inequitable implementation.

MACs and Health Equity Objectives

- MACs play a critical operational role in advancing CMS’s health equity framework, which focuses on equitable access to care and consistent payment application.

- Through claims data analysis and regional performance reports, MACs help identify patterns of underutilization, denial disparities, or access barriers among vulnerable populations.

- Improved collaboration between MACs and Office of Minority Health (OMH) initiatives enables CMS to track inequities tied to geographic, socioeconomic, or demographic factors.

- Transparent reporting and uniform policy execution are key to ensuring that Medicare benefits are applied equitably across all regions and populations.

Modernization and Quality Improvement Initiatives

- CMS is modernizing MAC operations to enhance both efficiency and fairness by implementing:

- AI-assisted audit and fraud detection tools to improve accuracy without overburdening providers.

- Standardized data-sharing platforms for claims and appeals tracking across jurisdictions.

- Performance-based contracting tied to metrics like provider satisfaction, adjudication accuracy, and timeliness.

- These reforms aim to minimize administrative friction while maintaining program integrity—ultimately improving quality of service and equity in payment operations.

The Equity Imperative for MAC Operations

- As CMS advances toward value-based care, administrative equity has become as important as payment fairness.

- Efficient, transparent MAC operations ensure that all providers—regardless of size or location—can access timely, accurate reimbursement without unnecessary administrative barriers.

- By reducing variation and improving accountability, MAC modernization directly contributes to a more equitable and sustainable Medicare payment system.

Frequently Asked Questions about Medicare Administrative Contractors (MACs)

1. What are Medicare Administrative Contractors (MACs)?

Medicare Administrative Contractors (MACs) are regional private organizations contracted by the Centers for Medicare & Medicaid Services (CMS) to manage Medicare operations. They process and pay claims, handle provider enrollment, conduct medical reviews, and ensure compliance with CMS rules for Medicare Part A and Part B services.

2. What do MACs do for Medicare providers?

MACs handle nearly all operational aspects of Medicare’s fee-for-service (FFS) system, including:

- Claims processing and payment under the Medicare Physician Fee Schedule (MPFS).

- Provider enrollment and credentialing through PECOS.

- Coverage guidance via Local Coverage Determinations (LCDs).

- Appeals management, audit coordination, and education outreach.

Their performance directly impacts claim accuracy, payment timeliness, and provider satisfaction.

3. How are MAC regions divided?

CMS divides the U.S. into 12 primary Part A/B MAC jurisdictions and 4 DME (Durable Medical Equipment) MAC regions. Each jurisdiction covers multiple states or territories and is managed by a contracted MAC organization (e.g., Noridian, WPS, NGS, Palmetto GBA). Jurisdiction assignments are published by CMS and updated as contracts are re-competed or consolidated.

4. How do MACs interact with CMS?

MACs act as CMS’s operational arm, implementing policies, fee schedules, and coverage determinations. CMS sets the national rules; MACs execute them regionally by applying the Conversion Factor (CF), Geographic Practice Cost Index (GPCI), and relevant coverage policies to adjudicate claims. MACs also report performance metrics and audit data back to CMS for oversight and compliance tracking.

5. What is the difference between a MAC and CMS?

- CMS: Establishes policy, reimbursement rates, and program rules.

- MACs: Implement those policies, process claims, and manage provider relationships.

In short, CMS designs the framework; MACs operate the system.

6. How do MACs affect provider payments?

MACs determine whether a claim meets coverage criteria and apply current MPFS rates to calculate payment. Delays, denials, or local coverage discrepancies can directly influence provider cash flow. High-performing MACs maintain efficient claim cycles and transparent communication to ensure timely and accurate reimbursement.

7. Why are MACs important for equity and program integrity?

MACs ensure consistent rule enforcement across regions and help detect improper billing or fraud through data analysis and audits. They also play an essential role in advancing CMS’s health equity goals by monitoring regional variation in coverage decisions and access barriers. Efficient, equitable MAC performance supports both financial fairness and patient access across the Medicare system.