What is the QPP (Quality Payment Program)?

The Quality Payment Program (QPP) is a federal initiative created by the Centers for Medicare & Medicaid Services (CMS) under the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA). Its goal is to shift Medicare away from traditional fee-for-service billing toward value-based care, where providers are rewarded for delivering high-quality, cost-efficient care.

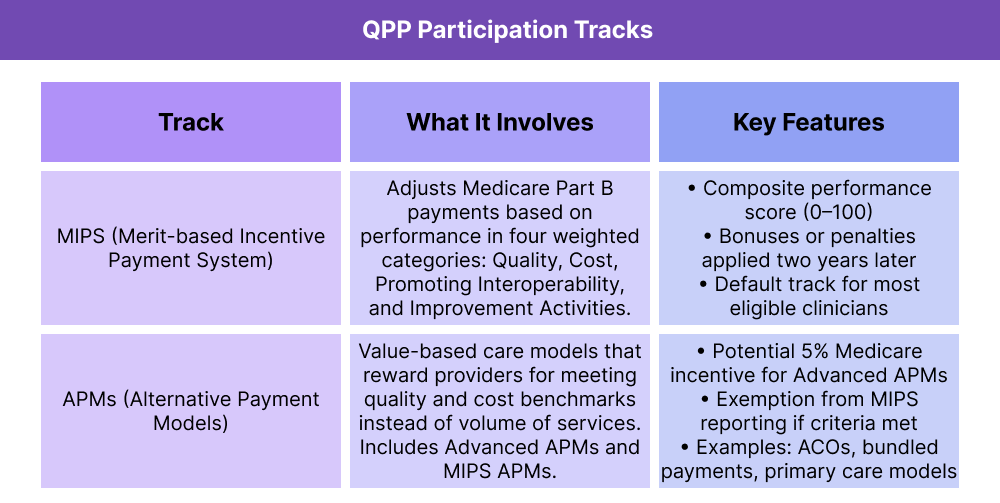

Clinicians participating in QPP can follow one of two tracks:

By participating in QPP, providers may earn incentives for strong performance or face payment adjustments if they fail to meet program standards. The program also supports interoperability, patient safety, and care coordination by requiring use of certified EHR technology and data-sharing practices.

Key Components of the QPP

The Quality Payment Program (QPP) was designed to improve care quality, patient outcomes, and cost efficiency across Medicare. It has two main participation tracks, plus a set of core goals that guide its structure.

Core Goals of QPP

- Reward Value Over Volume: Shift Medicare toward value-based care.

- Encourage Interoperability: Require certified EHR technology and secure health data exchange.

- Improve Patient Outcomes: Link reimbursement to quality, safety, and coordinated care.

- Promote Flexibility: Offer multiple pathways (MIPS or APMs) so providers can participate based on practice type and readiness.

How the Quality Payment Program Works in Practice

The Quality Payment Program (QPP) runs on an annual reporting cycle. Eligible clinicians must choose a participation track, submit data, and receive payment adjustments from CMS based on performance.

Step 1 — Determine Eligibility and Track

CMS notifies clinicians each year whether they are required to participate. Eligible providers must either report through MIPS or qualify for participation in an APM.

Step 2 — Collect and Submit Data

Throughout the year, clinicians record performance data.

- MIPS participants submit data in categories such as Quality, Cost, Promoting Interoperability, and Improvement Activities.

- APM participants follow model-specific reporting rules, often tied to quality benchmarks and cost measures.

Data is submitted through the QPP portal, a registry, or an EHR vendor.

Step 3 — CMS Evaluates Performance

CMS calculates either:

- A MIPS composite score (0–100 points), or

- APM model results based on shared savings, quality measures, and cost benchmarks.

Step 4 — Payment Adjustments

- MIPS track: Scores above the threshold earn bonuses; below the threshold, penalties apply.

- Advanced APMs: Qualifying participants earn a 5% Medicare incentive and are exempt from MIPS reporting.

Adjustments are applied two years after the performance year (e.g., 2025 data affects 2027 payments).

Step 5 — Annual Updates

QPP requirements — including thresholds, measures, and APM options — are updated yearly. Clinicians must check CMS rules each cycle to remain compliant.

QPP and its Impact on Billing and Reimbursement

The Quality Payment Program (QPP) directly affects how clinicians are reimbursed for Medicare Part B services. Payment adjustments are based on whether a provider participates in MIPS or in an APM, and on how well they perform against CMS standards.

MIPS Pathway

- Providers earn a composite performance score (0–100 points).

- CMS applies positive, neutral, or negative payment adjustments based on this score.

- Adjustments are applied two years later (e.g., 2025 reporting impacts 2027 payments).

- Clinicians who fail to report receive an automatic penalty at the maximum negative adjustment for that year.

APM Pathway

- Providers in MIPS APMs continue to be scored under MIPS rules, but often with streamlined reporting.

- Providers in Advanced APMs who meet participation thresholds:

- Earn a 5% Medicare incentive payment on Part B claims

- Become exempt from MIPS reporting

- Those who don’t meet thresholds may be placed back into the MIPS track.

Why It Matters

- QPP shifts Medicare from volume-based reimbursement (fee-for-service) toward value-based care.

- Strong performance in QPP can increase revenue, while poor reporting or low scores can result in significant payment reductions.

- By aligning payment with quality, efficiency, and interoperability, QPP incentivizes long-term improvements in patient outcomes and health system costs.

Frequently Asked Questions About QPP

1. What is the Quality Payment Program (QPP)?

The Quality Payment Program (QPP) is a CMS initiative that rewards clinicians for providing high-quality, cost-efficient care. It was created under the MACRA law of 2015 to replace the Sustainable Growth Rate formula and shift Medicare away from fee-for-service toward value-based reimbursement.

2. Who participates in QPP?

QPP generally applies to clinicians who bill more than $90,000 annually in Medicare Part B charges, see 200 or more beneficiaries, and deliver 200 or more covered services per year. Participation can occur through either the MIPS track or an APM track. Some clinicians may qualify for exemptions based on practice size, location, or specialty.

3. What are the two tracks of QPP?

QPP has two participation pathways:

- MIPS (Merit-based Incentive Payment System): Adjusts payments based on a composite performance score across categories such as Quality, Cost, Promoting Interoperability, and Improvement Activities.

- APMs (Alternative Payment Models): Value-based care models like Accountable Care Organizations (ACOs), bundled payments, or primary care initiatives. Some Advanced APMs offer a 5% incentive and exemption from MIPS.

4. How does QPP affect Medicare reimbursement?

QPP directly impacts Medicare Part B payments:

- MIPS participants may receive bonuses, neutral adjustments, or penalties depending on their composite performance score.

- Advanced APM participants who meet thresholds earn a 5% Medicare bonus and are exempt from MIPS reporting.

- Payment adjustments are applied two years after the reporting year.

5. What is the difference between QPP and MIPS?

QPP is the umbrella program created by CMS to drive value-based care. MIPS is one of the tracks under QPP. While MIPS is the default for most clinicians, those in qualifying APMs can participate through the APM track instead.

6. What is the deadline for QPP reporting?

QPP data must usually be submitted by March 31 of the year following the performance year. For example, data from 2025 must be submitted by March 31, 2026. Missing the deadline can result in an automatic negative payment adjustment.