What is the MEI (Medicare Economic Index) in Healthcare?

The Medicare Economic Index (MEI) is a measure of inflation in the costs of operating a medical practice, used by the Centers for Medicare & Medicaid Services (CMS) to adjust physician payment rates under Medicare. It reflects changes in physician compensation, staff wages, rent, medical supplies, and other overhead expenses, ensuring that reimbursement levels remain aligned with economic conditions.

The MEI serves as the primary inflation adjustment factor for the Medicare Physician Fee Schedule (MPFS) and the All-Inclusive Rate (AIR) used in Rural Health Clinics (RHCs). When the cost of delivering care rises, the MEI determines how much CMS increases the Conversion Factor (for MPFS) or the payment cap (for AIR).

CMS calculates the MEI annually using data from the Bureau of Labor Statistics (BLS) and other federal cost indices. Each component of physician cost—such as staff salaries, equipment, or rent—is weighted according to its share of total practice expenses.

By maintaining a consistent measure of inflation across the healthcare sector, the MEI helps Medicare preserve payment fairness, fiscal stability, and access to care despite economic fluctuations.

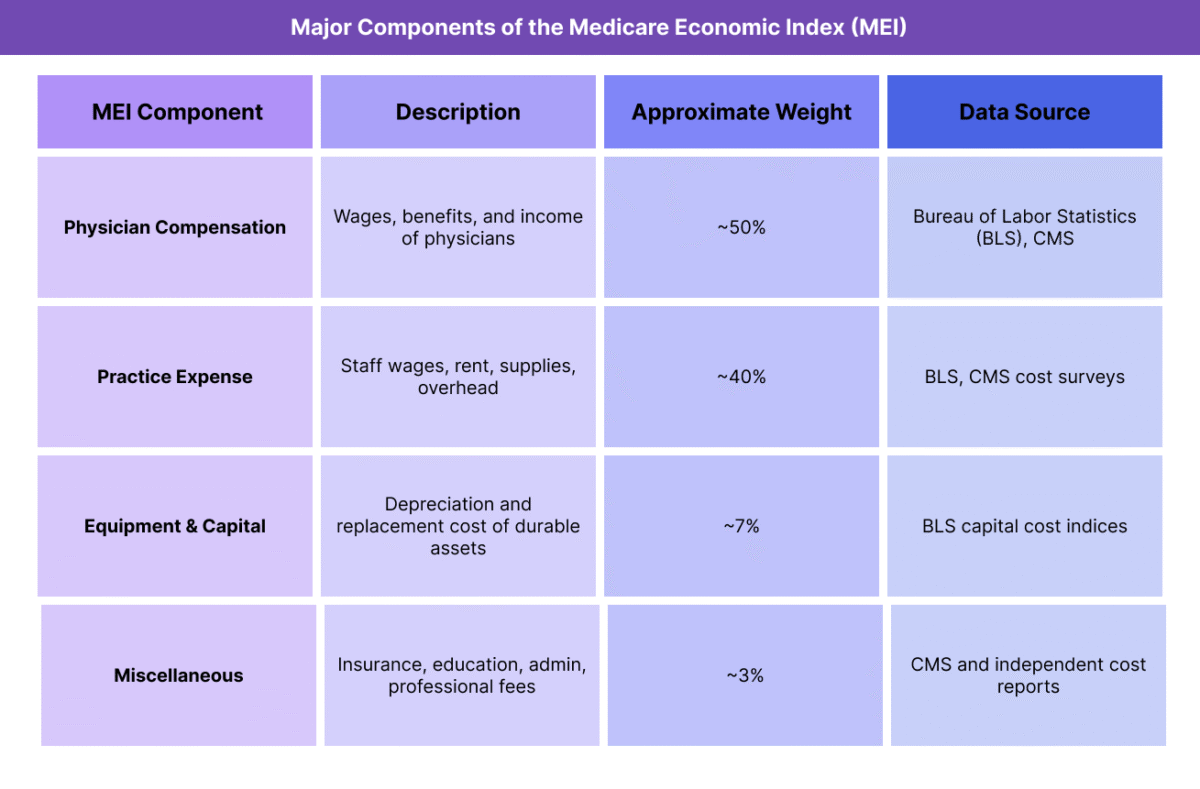

Key Components of the Medicare Economic Index (MEI)

The Medicare Economic Index (MEI) measures changes in the costs of operating a physician practice, functioning as Medicare’s official inflation adjustment tool for reimbursement. CMS updates the MEI annually using economic data to ensure that the Medicare Physician Fee Schedule (MPFS) and other payment systems reflect real-world cost trends.

The MEI is composed of weighted cost categories that represent the distribution of expenses in a typical physician practice. These components are derived from Bureau of Labor Statistics (BLS) data, CMS surveys, and industry cost indices.

1. Physician Compensation Component

- Represents the cost of physician labor — typically the largest portion of the MEI, accounting for roughly half of total expenses.

- Includes changes in wages, benefits, and self-employment income.

- Serves as the anchor for adjusting physician work-related payments under the MPFS.

2. Practice Expense Component

Captures the non-physician costs of operating a medical practice, such as:

- Staff salaries and benefits.

- Rent and utilities.

- Medical equipment and supplies.

- Professional fees (legal, accounting, billing).

These inputs collectively reflect changes in overhead costs that affect practice sustainability.

3. Equipment and Capital Component

- Measures the cost of durable assets and capital investments, including diagnostic equipment, information technology systems, and facility improvements.

- This category ensures that practices are compensated for inflation in long-term resource costs.

4. Miscellaneous Expenses and Adjustments

- Accounts for smaller categories such as insurance premiums, administrative costs, and continuing education.

- Adjusted periodically to reflect evolving practice structures and workforce trends.

How CMS Uses MEI in Reimbursement Calculations

- For the MPFS, MEI changes inform annual Conversion Factor (CF) updates to maintain parity with inflation.

- For RHCs, MEI determines the yearly increase to the All-Inclusive Rate (AIR) cap, ensuring clinics are reimbursed fairly as operational costs rise.

- CMS may apply partial MEI adjustments when budget neutrality rules or legislative constraints limit full inflation indexing.

How the Medicare Economic Index (MEI) Works in Practice

The Medicare Economic Index (MEI) serves as a key financial benchmark for CMS (Centers for Medicare & Medicaid Services), guiding annual payment updates under the Medicare Physician Fee Schedule (MPFS) and other Medicare reimbursement models such as the All-Inclusive Rate (AIR) for Rural Health Clinics (RHCs). It ensures that reimbursement rates reflect inflation and rising practice costs while maintaining long-term fiscal balance within Medicare.

The MEI influences payment policy through a structured annual process managed by CMS economists and published as part of the Federal Register rulemaking cycle.

Step 1: Data Collection and Cost Analysis

- CMS gathers national data on wages, rent, supplies, equipment, and insurance from sources like the Bureau of Labor Statistics (BLS) and Medicare cost reports.

- Each cost component is weighted according to its share of total practice expenses in the most recent CMS survey data.

- Economic changes, such as wage inflation or energy cost increases, are modeled to estimate year-over-year cost growth.

Step 2: MEI Calculation and Index Update

- CMS calculates the updated MEI percentage change for the upcoming fiscal year.

- The index represents the overall inflation rate for physician practice costs, typically expressed as an annual percentage (e.g., MEI = +2.6% for 2025).

- This figure is used as the baseline inflation adjustment for physician payment updates.

Step 3: Application to the Medicare Physician Fee Schedule (MPFS)

- The MEI directly affects the Conversion Factor (CF) used in the MPFS formula:

Payment = [(Work RVU × Work GPCI) + (PE RVU × PE GPCI) + (MP RVU × MP GPCI)] × Conversion Factor - The Conversion Factor is adjusted each year based partly on MEI data, though actual changes may be smaller if CMS applies budget neutrality or legislative caps.

- In effect, MEI determines how much Medicare physician payments increase (or remain flat) due to economic inflation.

Step 4: Application to Rural Health Clinic (RHC) AIR Caps

- For Rural Health Clinics, the MEI is used to update the All-Inclusive Rate (AIR) upper payment limit annually.

- This ensures cost-based payments for RHCs reflect inflationary increases in staffing, rent, and supplies.

- Even when Congress freezes MPFS adjustments, MEI-based AIR updates typically continue under statutory rules.

Step 5: Publication and Implementation

- The MEI is included in CMS’s annual Medicare Physician Fee Schedule Final Rule, published each November.

- Updated rates take effect on January 1, and CMS releases public documentation detailing each MEI component and weight.

- Providers and billing teams monitor MEI-driven changes to project revenue and update payer contract assumptions for the year ahead.

MEI Billing, Reimbursement, and System Limitations

The Medicare Economic Index (MEI) plays a crucial role in ensuring that Medicare’s payment systems reflect real-world economic conditions. It directly influences how physician payment rates and Rural Health Clinic caps are updated each year. However, while MEI is designed to maintain fairness, its impact is often limited by budget neutrality requirements, legislative caps, and delayed data cycles, creating a gap between actual cost growth and the rates physicians receive.

How MEI Affects Reimbursement

- The MEI serves as the core inflation metric used by CMS to update the Medicare Physician Fee Schedule (MPFS) and Rural Health Clinic (RHC) All-Inclusive Rate (AIR).

- For the MPFS, the MEI informs the Conversion Factor (CF) — the dollar amount applied to each CPT® or HCPCS code after RVU and GPCI adjustments.

- For RHCs, MEI determines the annual increase in the AIR payment cap, allowing for inflationary updates to cost-based reimbursement.

- The intent is to ensure payment adequacy and prevent erosion of provider income as practice costs rise over time.

Budget Neutrality and Congressional Limits

- By law, CMS must maintain budget neutrality in physician payment systems.

- This means that even if the MEI shows a significant cost increase (e.g., +3%), overall spending cannot rise without offsetting reductions elsewhere.

- As a result, MEI-based increases are often partially offset by cuts to the Conversion Factor or other payment adjustments.

- Congress can override MEI adjustments through temporary payment freezes or targeted relief acts (such as those passed during the pandemic).

- These political and fiscal controls frequently limit the MEI’s ability to fully adjust payments for inflation.

Lag in Data and Methodology

- The MEI is based on data from federal cost surveys and the Bureau of Labor Statistics (BLS), which often lags by 1–2 years behind real-time market conditions.

- This lag means physician payment updates may underestimate current inflation, particularly in periods of rapid cost growth.

- CMS periodically revises MEI methodologies to incorporate more current cost structures, but updates require formal rulemaking and often trail broader economic trends.

Impact on Providers and Practice Economics

- Rising Expenses vs. Static Rates: When MEI-based increases are constrained, provider revenue may fail to keep up with costs such as salaries, rent, or supplies.

- Specialty Variation: Procedural and cognitive specialties experience inflation differently, yet MEI applies uniformly across all services.

- Private Payer Implications: Because commercial insurers and Medicaid programs often benchmark rates to MPFS, MEI’s limited effect cascades into wider reimbursement stagnation.

- Equity Concerns: Smaller or rural practices, which operate with tighter margins, are disproportionately affected by delays or limits in MEI indexing.

Policy and Reform Challenges

- Reform advocates have called for direct MEI indexing of the Conversion Factor or partial inflation adjustments that bypass budget neutrality restrictions.

- CMS and Congress continue to explore hybrid solutions, such as combining MEI inflation tracking with value-based payment modifiers, to balance fiscal control and payment adequacy.

- Long-term sustainability of the Medicare payment system may depend on making the MEI more responsive to real-time cost pressures while maintaining fiscal responsibility.

MEI and Its Impact on Quality, Access, and Health Equity

The Medicare Economic Index (MEI) is more than a technical inflation metric — it directly affects the financial sustainability, care quality, and workforce distribution of the U.S. healthcare system. By determining whether physician payments keep pace with rising costs, MEI indirectly shapes provider availability, clinical investment, and equitable access to care, especially in rural and underserved areas.

Preserving Financial Stability and Practice Sustainability

- MEI-based payment updates help maintain economic viability for physician practices as operational expenses increase.

- When applied effectively, MEI adjustments prevent reimbursement erosion and ensure that providers can sustain staffing, equipment investments, and patient access.

- In years where budget neutrality or political constraints suppress MEI adjustments, practices face financial strain, forcing some to limit Medicare participation or consolidate into larger systems.

Influence on Care Quality and Delivery Models

- Adequate inflation indexing supports providers’ ability to deliver comprehensive, high-quality care without cutting corners or reducing service scope.

- When MEI lags behind actual cost growth, resource constraints can lead to reduced appointment availability, longer patient wait times, and lower preventive care utilization.

- CMS increasingly integrates MEI with value-based care incentives, tying inflation protection to performance outcomes to maintain a balance between fiscal control and clinical quality.

Supporting Rural and Underserved Communities

- MEI plays an indirect but critical role in Rural Health Clinic (RHC) funding through annual updates to the All-Inclusive Rate (AIR) cap.

- These adjustments help clinics in rural and medically underserved areas offset inflation-driven increases in wages, supplies, and facility costs.

- Without consistent MEI updates, small and independent practices are disproportionately vulnerable to payment shortfalls, risking closures in regions where healthcare access is already limited.

Equity Challenges and Policy Tensions

- Because MEI adjustments are often reduced by budget neutrality requirements, payment stagnation can deepen geographic and socioeconomic disparities.

- Urban practices may absorb slower updates more easily due to scale, while rural and low-income regions experience sharper access declines.

- Equity-focused reform proposals have suggested MEI floor adjustments or targeted inflation protections for small practices and safety-net providers.

Long-Term Role in Sustainable and Equitable Care

- The MEI remains a cornerstone of Medicare’s fiscal framework, ensuring that inflation data directly informs physician reimbursement.

- Modernizing the MEI to reflect real-time cost dynamics and integrating it with value-based payment principles could enhance both fairness and care quality.

- A more responsive and transparent MEI methodology is essential to advancing payment equity, workforce retention, and access to care across all provider settings.

Frequently Asked Questions about the MEI

1. What is the Medicare Economic Index (MEI)?

The Medicare Economic Index (MEI) is a measure of inflation in the costs of running a medical practice. It is used by the Centers for Medicare & Medicaid Services (CMS) to adjust physician payment rates under the Medicare Physician Fee Schedule (MPFS) and other programs. MEI tracks changes in expenses such as staff wages, rent, supplies, and equipment to ensure reimbursement reflects real-world cost growth.

2. How is the MEI calculated?

The MEI is derived from weighted cost components that represent typical physician practice expenses. CMS uses data from the Bureau of Labor Statistics (BLS) and other economic indices to measure annual changes in:

- Physician compensation

- Practice expenses (staff, rent, supplies)

- Equipment and capital costs

Each category is weighted by its share of total practice costs, and the combined percentage change becomes the MEI for that year.

3. How does the MEI affect Medicare reimbursement?

- The MEI is the inflation adjustment factor applied to physician payment systems. It influences:

- The Conversion Factor (CF) in the Medicare Physician Fee Schedule (MPFS), which converts RVUs into dollar amounts.

- The All-Inclusive Rate (AIR) payment cap for Rural Health Clinics (RHCs), ensuring cost-based reimbursement keeps pace with inflation.

In short, MEI determines how much Medicare payment rates rise or stay flat each year.

4. What is the relationship between MEI and the Conversion Factor (CF)?

The Conversion Factor is updated annually by CMS based on the MEI. If the MEI shows a 2.5% increase in costs, the Conversion Factor would ideally rise by the same amount — but budget neutrality rules often reduce or offset that increase. As a result, MEI-driven inflation adjustments are sometimes only partially reflected in final payment rates.

5. Why doesn’t the MEI always keep up with actual inflation?

MEI data lags by one to two years because it relies on federal cost surveys and BLS indices. In addition, CMS is legally required to maintain budget neutrality, so increases in one area (such as new code valuations) must be offset by cuts elsewhere. This combination often leads to under-adjustment relative to current inflation levels.

6. How does MEI support Rural Health Clinics (RHCs)?

For RHCs, the MEI determines the annual adjustment to the AIR (All-Inclusive Rate) upper payment limit. This ensures rural clinics receive inflation-aligned reimbursement for each encounter. Without MEI-based updates, RHCs would face declining payment adequacy as labor and supply costs rise.

7. Why is MEI important for healthcare equity and sustainability?

The MEI protects provider payment levels against inflation, helping maintain access to care across both urban and rural settings. When MEI adjustments are limited or delayed, smaller and rural practices are disproportionately affected — leading to provider shortages, access gaps, and financial instability. Accurate and timely MEI updates are essential for sustaining equitable, high-quality care delivery.