What is a Managed Care Organization (MCO)?

A Managed Care Organization (MCO) is a healthcare entity that contracts with providers and payers to deliver medical services to enrolled members under a fixed or capitated payment model. MCOs are designed to control costs, improve care coordination, and ensure quality outcomes by managing how care is accessed and reimbursed.

MCOs typically operate within Medicaid, Medicare Advantage, and commercial insurance markets, often serving as intermediaries between state agencies or insurers and provider networks. Unlike traditional fee-for-service systems, managed care emphasizes preventive services, network efficiency, and utilization oversight.

Key Components of a Managed Care Organization

1. Provider Network: Contracted physicians, hospitals, specialists, and ancillary services that deliver care to members within defined coverage parameters.

2. Health Plan Administration: Handles enrollment, eligibility verification, member services, and claims processing. Often includes call centers and digital self-service tools.

3. Care Management Programs: Structured support services targeting high-risk or high-cost populations, including chronic care management, behavioral health coordination, and utilization review.

4. Medical Management Team: Includes nurses, care coordinators, and medical directors responsible for prior authorizations, case management, and care pathway development.

5. Quality and Compliance Infrastructure: Monitors clinical performance, HEDIS metrics, grievance resolution, and adherence to CMS, NCQA, or state guidelines.

6. Risk Adjustment and Actuarial Analysis: Forecasts patient needs and adjusts payments based on health status, demographics, and social determinants of health.

How Managed Care Organizations Work in Practice

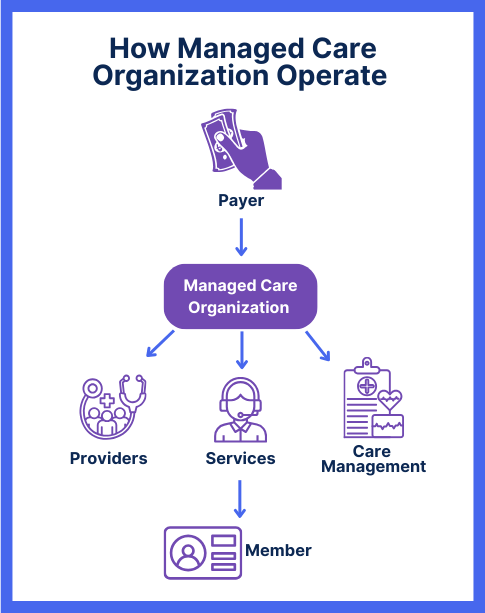

MCOs serve as intermediaries between payers (such as state Medicaid agencies or commercial insurers) and provider networks. They receive a fixed monthly payment—known as a capitation rate—for each enrolled member, regardless of how many services that member uses.

In practice, this means:

- Enrollment: Members are assigned or choose an MCO plan through Medicaid, Medicare Advantage, or employer-sponsored insurance.

- Network Access: Patients receive care from providers within the MCO’s contracted network. Out-of-network care is often limited or subject to prior approval.

- Care Management: MCOs deploy teams to identify high-risk members and coordinate preventive services, behavioral health, and chronic condition support.

- Utilization Oversight: Medical directors and review teams assess whether services are medically necessary and cost-effective.

- Payment and Incentives: MCOs pay providers through fee schedules, bundled payments, or performance bonuses, while managing their own margins under capitation.

This approach allows MCOs to manage both cost containment and clinical quality—a dual mandate that shapes how they interact with both patients and providers.

Benefits and Challenges of Managed Care Organizations

Benefits of MCOs

- Cost Control: Capitated payment models incentivize preventive care and reduced unnecessary utilization.

- Coordinated Services: MCOs often provide centralized care management for chronic, behavioral, and complex needs.

- Predictable Budgets: Payers (like state Medicaid agencies) benefit from fixed per-member-per-month payments.

- Incentives for Quality: Some MCOs offer provider bonuses for meeting HEDIS, CAHPS, or state-defined benchmarks.

- Member Support Services: Many MCOs offer enhanced services like transportation, health education, or social needs referrals.

Challenges of MCOs

- Network Limitations: Patients may face restrictions when accessing out-of-network care.

- Administrative Complexity: Providers must navigate varying authorization rules, documentation standards, and reimbursement terms.

- Variable Oversight: State and federal regulation of MCO performance can vary widely, leading to inconsistency in member experience.

- Health Equity Gaps: While MCOs aim to serve vulnerable populations, addressing SDOH effectively remains uneven across plans.

Managed Care Reimbursement Models

Most Managed Care Organizations are reimbursed through capitation, a payment model in which the payer (such as Medicaid or a commercial insurer) pays a fixed amount per enrolled member each month. This amount is paid regardless of how many services the member uses.

MCO reimbursement is influenced by:

- Population Risk Profiles: Capitation rates are often adjusted based on age, health status, and disability indicators to account for higher care needs.

- Performance Metrics: Some MCO contracts include pay-for-performance bonuses tied to quality indicators, such as immunization rates, hospital readmission reduction, or member satisfaction scores.

- Rate Setting and Actuarial Review: Capitation rates are negotiated or approved by state regulators (in Medicaid) or CMS (for Medicare Advantage) and are subject to annual recalibration.

This model aligns MCO financial incentives with preventive care and efficient service delivery—but also places responsibility on the MCO to manage total cost of care.

Frequently Asked Questions about MCOs

1. What is a Managed Care Organization (MCO)?

A Managed Care Organization is a health plan that coordinates medical services through a network of contracted providers. MCOs receive fixed payments to manage care and control costs for enrolled members.

2. Are MCOs the same as insurance companies?

Not exactly. MCOs often operate like insurers, but many are separate entities contracted by state Medicaid programs or Medicare Advantage to manage care and administer benefits.

3. What types of MCOs exist?

Common types include Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), and Medicaid MCOs. Each varies in network flexibility, authorization rules, and payment models.

4. How do MCOs affect providers?

Providers working with MCOs must follow specific guidelines, including prior authorization protocols and documentation requirements. However, they may receive incentives for meeting quality benchmarks.

5. Do MCOs limit patient choice?

MCOs often require members to use in-network providers and may require referrals or prior approvals for certain services. However, some plans offer limited out-of-network benefits depending on type and state.