What is a CHOW (Change of Ownership) in Healthcare?

A Change of Ownership (CHOW) is a Medicare and payer enrollment event that occurs when the ownership or controlling entity of a healthcare provider or supplier changes. CHOW matters because Medicare provider agreements and billing privileges are tied to the legal owner of the organization. When ownership changes, CMS requires the provider to report the CHOW so enrollment records, payment permissions, and compliance responsibility transfer correctly.

CHOW can involve a full sale, merger, consolidation, or other transaction that shifts who legally owns or controls the provider entity. Depending on the deal structure, CMS may treat the change as a full CHOW requiring a new or updated Medicare provider agreement, or as a more limited ownership update that still must be reported through enrollment systems. Either way, CHOW is a high-risk moment for billing continuity because claims, certifications, and payer contracts depend on accurate ownership records.

In practice, providers report CHOW through Medicare enrollment channels such as PECOS and their Medicare Administrative Contractor (MAC). Timely, accurate CHOW reporting helps prevent interruptions in billing, avoids survey and certification complications, and ensures the correct legal entity is accountable for compliance and quality oversight after the transaction closes.

Key Components of CHOW in Healthcare

A CHOW is designed to ensure that Medicare and other payers always have an accurate record of who owns and controls a provider entity. Because billing privileges and provider agreements are legally tied to ownership, CMS expects providers to report changes in a structured way that reflects the real transaction.

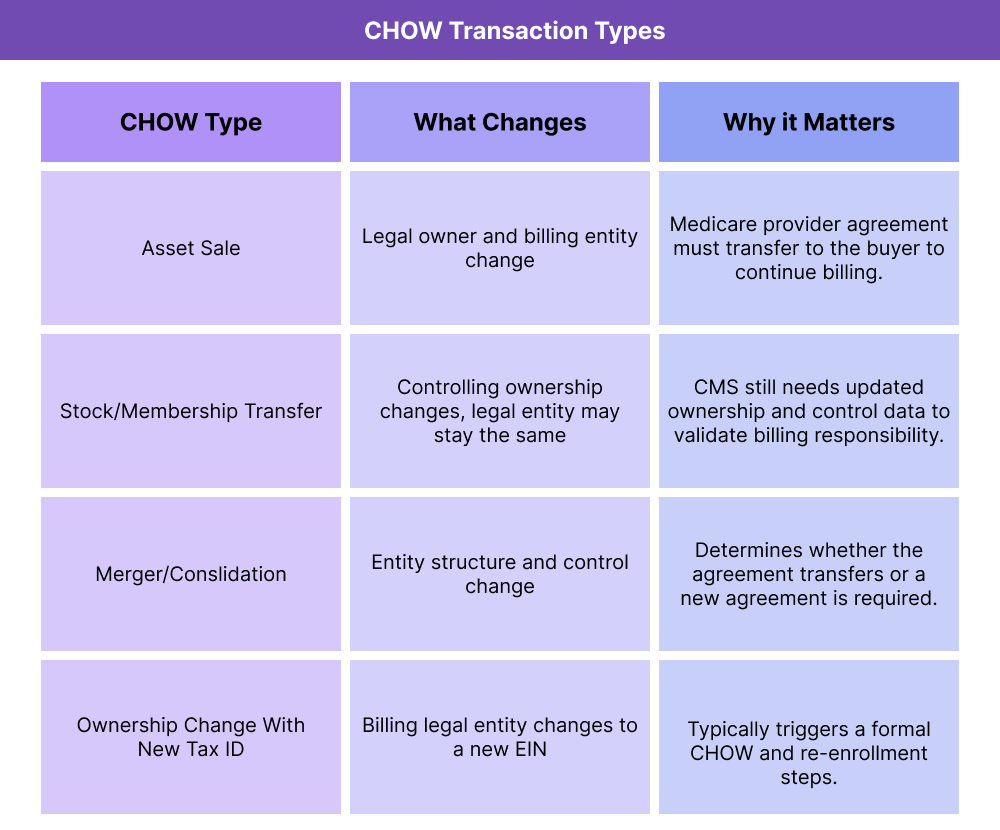

Not every ownership change triggers the same requirements. CMS distinguishes CHOW types based on how the transaction is structured and whether the legal entity billing Medicare is changing.

Asset Sale CHOW

An asset sale CHOW occurs when one owner sells the provider’s assets (such as the practice, facility, or operating components) to another owner, and the buyer assumes the Medicare provider agreement. In these cases, the legal ownership tied to billing usually changes, and CMS requires a formal CHOW submission.

Stock Transfer or Membership Interest Change

A stock transfer CHOW happens when ownership shifts through the transfer of stock or membership interests, but the legal entity itself stays the same. CMS may still consider this a CHOW if controlling interest changes hands, even if the provider’s name and NPI do not change.

Merger or Consolidation CHOW

A merger or consolidation CHOW occurs when two entities combine into one ownership structure. Depending on whether a new legal entity is formed or one entity survives, CMS may require a new provider agreement or a transfer of the existing one.

CHOW Effective Date and Reporting Window

CHOW reporting must align with the effective date of ownership change, not simply the contract signing date. CMS expects CHOW submissions to be filed promptly so enrollment and billing permissions track to the correct owner without interruption.

How CHOW Works in Practice

CHOW reporting follows a defined operational path because CMS needs to confirm that billing privileges and compliance responsibility move to the correct legal owner without creating gaps in patient care or reimbursement. The exact steps vary by provider type and transaction structure, but the workflow is consistent across Medicare-participating organizations.

Step 1: Determine Whether the Transaction Is a CHOW

Before reporting, the organization must determine whether CMS considers the ownership change a CHOW. Transactions that change the legal entity responsible for billing Medicare, transfer a provider agreement, or shift controlling interest typically qualify. This distinction matters because CHOW submissions require a different enrollment pathway than routine demographic updates.

Step 2: Submit the CHOW Through PECOS or the MAC

Most providers report a CHOW through PECOS or by submitting enrollment forms directly to their Medicare Administrative Contractor (MAC). The submission includes updated ownership and control documentation, effective dates, tax ID information when applicable, and signatures from authorized officials representing both the seller and buyer.

Step 3: CMS / MAC Review and Agreement Transfer

The MAC reviews the CHOW submission to confirm the new ownership structure and determine whether the Medicare provider agreement can transfer. In many transactions, the buyer assumes the existing agreement so billing can continue without a break. If the legal entity changes in a way CMS cannot reconcile, a new enrollment record and agreement may be required.

Step 4: Update Downstream Enrollment and Billing Systems

After CMS recognizes the CHOW, providers typically need to align commercial payer enrollments, credentialing files, and internal billing systems. This step is operationally critical because payer and vendor systems depend on the same ownership and identifier data recorded in Medicare enrollment.

Step 5: Maintain Documentation for Audit Readiness

CHOW events are common audit triggers. Organizations should keep transaction documents, enrollment confirmations, and updated ownership records available in case surveyors or payers request validation.

CHOW in Billing, Reimbursement, and System Limitations

A CHOW is one of the highest-risk enrollment events for billing continuity because Medicare billing privileges and provider agreements are legally tied to ownership. If a CHOW is not reported correctly, CMS or the Medicare Administrative Contractor (MAC) may pause or reject claims until enrollment records reflect the new owner.

How CHOW Affects Medicare Billing Privileges

When CMS recognizes a CHOW, it determines whether the buyer can assume the existing Medicare provider agreement or must enroll under a new one. This decision impacts how quickly billing can resume and whether claims can be submitted under the same identifiers.

Common reimbursement risks during CHOW include:

- Claims denial due to ownership mismatch on file

- Billing holds while the MAC reviews CHOW documentation

- Delays in adding or updating practice locations and service lines

- Revalidation issues if enrollment data is incomplete post-transaction

Even when the CHOW is approved, payer systems often take time to sync. Operational teams should plan for a transition period where data alignment is still stabilizing.

CHOW and PECOS Enrollment Dependencies

Although a CHOW is reported through PECOS, PECOS is not the source of provider identity—it relies on upstream records such as the National Plan and Provider Enumeration System (NPPES). If NPPES data is outdated during a CHOW, PECOS submissions often require rework, which extends billing disruption risk.

Because CHOW workflows are enrollment-dependent, providers should verify that:

- Ownership and authorized official records are current in PECOS

- Practice locations match what payers have on file

- NPIs and taxonomy reflect the post-transaction structure

- System Limitations and Operational Watch-Outs

CHOW reporting is often slowed by system and process limitations, including:

- PECOS processing timelines that do not match deal-close timelines

- MAC documentation requirements that vary by provider type

- Payer-side enrollment systems that update later than Medicare records

- Transactions structured to avoid CHOW being later reclassified by CMS

For healthcare SaaS buyers, the takeaway is that CHOW requires coordinated data governance. Systems can support tracking and documentation, but ownership accuracy must be managed proactively to protect reimbursement.

How CHOW Influences Quality, Access, and Equity in Healthcare

CHOW events affect more than who gets paid—they can disrupt care delivery if operational and clinical systems are not stabilized quickly after ownership changes. Because CHOW touches staffing, workflows, payer participation, and compliance responsibility, it has real downstream effects on quality and patient access.

How CHOW Can Affect Care Quality During Transitions

Ownership change often introduces new leadership, policies, or clinical processes. Without structured oversight, these shifts can increase variation in care delivery and weaken safety controls during the transition period.

Organizations that manage CHOW well typically prioritize:

- Continuity of clinical protocols

- Clear accountability for quality oversight post-close

- Rapid stabilization of documentation and escalation workflows

This is especially important in settings where survey performance and certification are closely tied to Medicare participation.

How CHOW Impacts Patient Access and Network Stability

CHOW can temporarily affect whether patients can access covered care, particularly when payer enrollments lag behind the transaction timeline. If payer records are not updated promptly, patients may see:

- Delayed scheduling or referrals

- Confusion about in-network status

- Disrupted continuity with established care teams

For provider organizations, maintaining accurate CHOW reporting helps reduce gaps in network participation and patient access.

Equity Considerations During Ownership Change

Access disruptions from CHOW can have a larger impact on vulnerable populations who already face fewer care options. When transitions lead to billing pauses, staffing instability, or directory errors, patients in rural or underserved communities may experience outsized delays in receiving care.

Treating CHOW as a quality and access event—not only a billing event—helps organizations reduce unintended disparities during transitions.

Frequently Asked Questions about CHOW

1. What is a CHOW in healthcare?

A CHOW (Change of Ownership) is an enrollment and compliance event that occurs when the legal ownership or controlling interest of a Medicare-participating provider or supplier changes. CMS requires CHOW reporting so billing privileges and provider agreements transfer to the correct owner.

2. What types of transactions count as a CHOW?

Transactions that shift the legal owner responsible for billing Medicare or transfer controlling interest typically count as a CHOW. Common examples include asset sales, stock or membership interest transfers with a change of control, and mergers or consolidations.

3. How is a CHOW reported to CMS?

CHOW is reported through PECOS or by submitting Medicare enrollment forms to the Medicare Administrative Contractor (MAC). The submission includes ownership documentation, effective dates, and authorized signatures from the parties involved in the transaction.

4. Does a CHOW require a new Medicare provider agreement?

Not always. CMS may allow the buyer to assume the existing Medicare provider agreement, depending on the transaction structure. If the legal billing entity changes in a way CMS cannot reconcile, a new agreement and enrollment may be required.

5. How does CHOW affect claims and reimbursement?

If CHOW is not reported accurately or on time, claims can be denied or placed on hold because billing privileges are tied to the owner on file. Even after approval, payer systems may take time to sync to the updated ownership record.

6. What is the difference between a CHOW and a demographic update?

A demographic update changes surface-level provider details like addresses or phone numbers. A CHOW changes who legally owns or controls the billing entity, which can affect the Medicare provider agreement and billing privileges.

7. Why is CHOW considered a high-risk compliance event?

CHOW is high-risk because it triggers enrollment review, ownership validation, and sometimes survey or certification attention. Errors can interrupt billing, create audit exposure, or delay payer participation if records don’t match the post-transaction reality.