What is the AIR (All-Inclusive Rate) in Healthcare?

The All-Inclusive Rate (AIR) is the cost-based reimbursement rate used by Medicare to pay Rural Health Clinics (RHCs) for covered services. Instead of billing each procedure separately, RHCs receive a single per-visit payment that includes both the professional and facility components of care. This payment structure ensures fair compensation for providers serving rural and medically underserved communities, where patient volume is often lower and costs are higher.

The AIR model was established under the Rural Health Clinic Services Act of 1977 and is administered by the Centers for Medicare & Medicaid Services (CMS). Each clinic’s AIR is based on its actual cost of delivering care, reported annually through the Medicare Cost Report (Form CMS-222-17). CMS also sets a national payment cap each year, adjusted by the Medicare Economic Index (MEI), to limit the maximum reimbursable rate per encounter.

In practice, the AIR provides predictable, encounter-based reimbursement that supports financial sustainability and access to care in underserved areas. It differs from the Medicare Physician Fee Schedule (MPFS), which reimburses providers based on Relative Value Units (RVUs) under the RBRVS system.

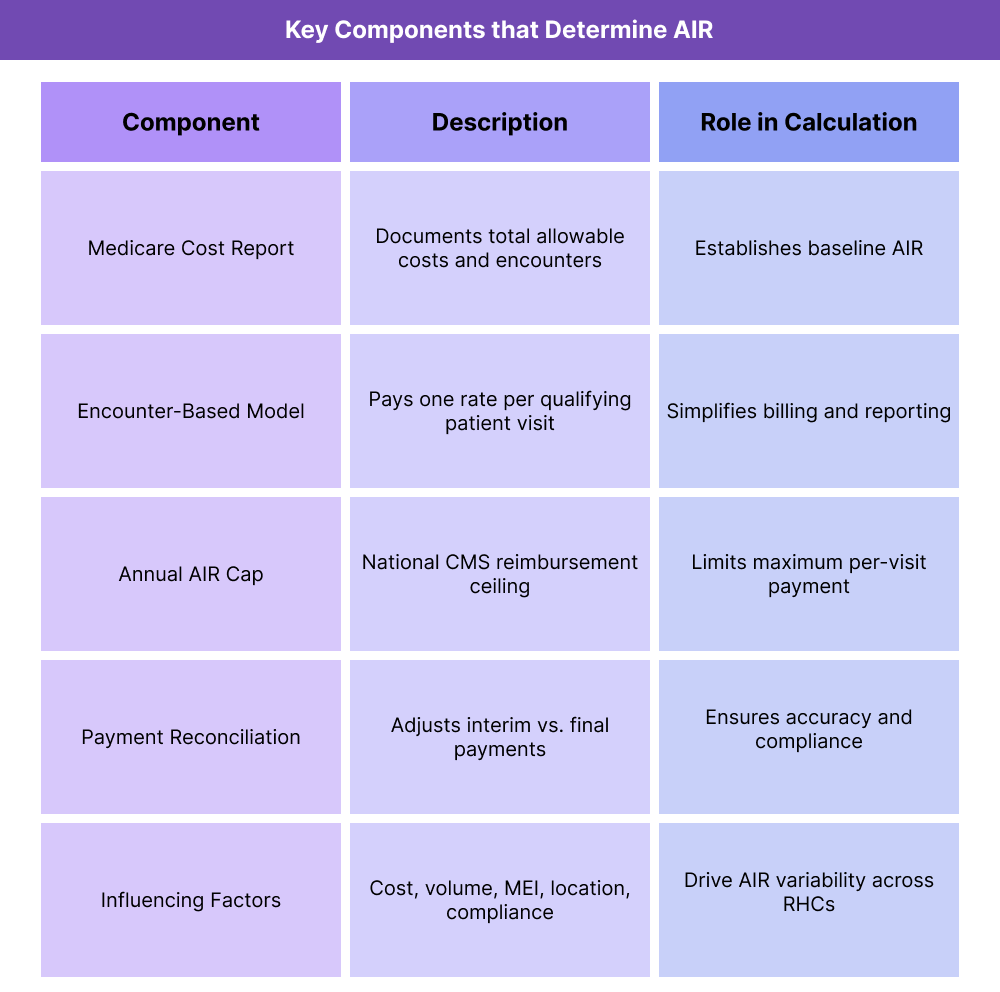

Key Components of the (AIR) All-Inclusive Rate

The All-Inclusive Rate (AIR) is the cornerstone of the Rural Health Clinic (RHC) reimbursement model. It determines how clinics are paid for patient encounters under Medicare Part B. The AIR is derived from cost-based reporting rather than the fee-for-service (FFS) model used in most outpatient settings.

Each RHC’s AIR is calculated from its annual cost report, adjusted by CMS to reflect real-world operating expenses and national economic trends.

1. Medicare Cost Report (Form CMS-222-17)

- Each RHC must file a Medicare Cost Report annually to document operating costs such as wages, supplies, utilities, and administrative expenses.

- The total allowable costs are divided by the number of billable encounters to establish a preliminary AIR.

- This process ensures the payment rate reflects the true cost of providing care in rural settings.

2. Encounter-Based Reimbursement

- The AIR represents the average cost per qualifying visit, regardless of how many services are performed during that encounter.

- Each encounter must meet CMS criteria — typically a face-to-face visit between a patient and a qualified provider (e.g., NP, PA, CNM, physician).

- Both independent and provider-based RHCs use AIR, though their cost-reporting structures differ slightly.

3. Annual AIR Cap

- CMS sets a national payment ceiling on the AIR each calendar year to control Medicare spending.

- Clinics with higher actual costs are capped at this amount, while those with lower costs receive their calculated rate.

- The cap is adjusted annually based on the Medicare Economic Index (MEI).

4. Interim and Final Payment Adjustments

- RHCs receive interim payments throughout the year based on their estimated AIR.

- Once the annual cost report is filed, CMS performs a reconciliation to finalize the actual AIR and adjust payments accordingly.

5. Factors That Influence AIR

- Operating expenses and staffing costs.

- Patient visit volume and encounter mix.

- Inflationary adjustments (MEI).

- Location (rural vs. provider-based designation).

- Compliance with CMS cost-reporting standards.

How the All-Inclusive Rate (AIR) Works in Practice

In a Rural Health Clinic (RHC), the All-Inclusive Rate (AIR) determines how Medicare reimburses the clinic for each patient encounter. Rather than billing line-by-line CPT codes as in traditional fee-for-service models, the RHC bills a single encounter that reflects all covered services provided during that visit.

The AIR workflow involves ongoing reporting, interim payment management, and annual reconciliation through the Medicare Cost Report process.

Step 1: Patient Encounter and Documentation

- A qualified provider (physician, NP, PA, or CNM) delivers a face-to-face patient encounter.

- All services provided during the visit — such as exams, lab tests, or preventive counseling — are documented in the EHR.

- RHCs track encounter volume carefully, since total visits determine their AIR calculation at year-end.

Step 2: Claim Submission

- Each qualifying encounter is billed as a single RHC claim under Type of Bill 71X, using the appropriate Revenue Code (0521–0529).

- CPT and HCPCS codes are still documented but are used for internal tracking and supporting documentation — not individual line-item reimbursement.

- Non-RHC services, such as lab-only tests or DME, are billed separately under Part B or Part A as appropriate.

Step 3: Interim Payment Process

- CMS pays RHCs throughout the year at their approved interim AIR, determined during certification or after the most recent cost report review.

- Payments are issued on a per-visit basis, providing predictable cash flow for rural clinics that depend on cost-based reimbursement.

Step 4: Cost Reporting and Reconciliation

- At the end of the fiscal year, the RHC submits its Medicare Cost Report (CMS-222-17) to document actual costs and total encounters.

- CMS uses this data to recalculate the final AIR and determine whether the clinic was overpaid or underpaid.

- Adjustments are made through settlement payments or recoupment, depending on the result.

Step 5: Ongoing Review and AIR Updates

- The clinic’s AIR may be revised annually to reflect operational changes such as staffing shifts, inflation (MEI), or expanded service offerings.

- RHCs often perform quarterly internal reviews to track cost trends and ensure financial alignment with their expected reimbursement.

AIR Billing, Reimbursement, and Program Limitations

The All-Inclusive Rate (AIR) is central to how Rural Health Clinics (RHCs) are reimbursed under Medicare Part B. While it provides a more equitable payment model for rural providers, it also introduces unique compliance, billing, and financial challenges. Understanding its limits and structure is critical for maintaining accurate cost-based reimbursement.

AIR Reimbursement Structure

- RHCs receive one encounter-level payment per qualifying visit, regardless of the number of services provided during that encounter.

- The AIR includes both the professional and facility components of care.

- Payments are made on an interim basis, then reconciled after the annual Medicare Cost Report review.

- The final AIR may differ from the interim rate, depending on actual cost and utilization data.

Annual Payment Cap

- CMS sets a national payment ceiling on AIR each year, known as the RHC Upper Payment Limit (UPL).

- As of 2025, this limit is adjusted annually based on the Medicare Economic Index (MEI).

- Clinics with actual costs above the cap can only be reimbursed up to the UPL, even if their documented cost per visit is higher.

- The cap is intended to promote consistency across RHCs, but it can disadvantage high-cost or low-volume clinics in remote areas.

Excluded and Separately Billable Services

- Certain services are not included in the AIR encounter rate and must be billed separately:

- Laboratory tests (technical-only).

- Durable Medical Equipment (DME).

- Hospital services performed outside the clinic.

- Outreach and preventive screenings not defined as RHC-covered services.

- These carve-outs can complicate billing workflows, especially for multi-service providers.

Compliance and Documentation Requirements

- RHCs must maintain encounter-level documentation that supports medical necessity, qualified provider involvement, and correct reporting of all costs.

- CMS and Medicare Administrative Contractors (MACs) routinely audit cost reports and AIR calculations for accuracy.

- Failure to properly allocate costs between RHC and non-RHC services can result in payment recoupment.

Operational Limitations and Challenges

- Administrative Burden: Preparing accurate cost reports requires specialized accounting expertise and ongoing reconciliation.

- Cash Flow Variability: Interim AIR adjustments and year-end settlements can disrupt predictable revenue streams.

- Workforce Costs: Increases in staff salaries or benefits may outpace MEI-based adjustments to AIR caps.

- Payer Alignment: Commercial payers may not follow CMS’s AIR methodology, requiring RHCs to manage multiple reimbursement models simultaneously.

AIR and Its Impact on Quality, Access, and Health Equity

The All-Inclusive Rate (AIR) plays a crucial role in promoting healthcare access and financial stability in rural America. By reimbursing Rural Health Clinics (RHCs) through a predictable, encounter-based payment model, AIR ensures that providers can continue offering essential services even when patient volume is low. However, while it enhances sustainability, the system also presents ongoing challenges for achieving equitable and high-quality care across regions.

Supporting Financial Stability and Access to Care

- The AIR model provides a steady reimbursement stream that helps clinics maintain operations in areas where volume-based payment models would be unsustainable.

- This predictability allows RHCs to invest in infrastructure, staff development, and preventive care initiatives.

- By reducing dependence on visit volume, AIR supports continuity of care for patients with chronic and complex conditions who might otherwise lose access.

Encouraging Consistent Quality of Care

- Because the AIR reimburses per encounter rather than per procedure, RHCs are incentivized to deliver comprehensive, patient-centered care during each visit.

- The model aligns with value-based care principles, emphasizing holistic treatment, care coordination, and prevention rather than high service volume.

- Documentation and cost reporting under AIR also increase transparency and accountability in rural health delivery.

Advancing Rural Health Equity

- AIR ensures that patients in rural and medically underserved areas can access the same scope of primary and preventive services as urban populations.

- It helps reduce disparities in Medicare access, provider availability, and continuity of care, particularly for older adults and low-income individuals.

- The model reinforces the public health safety net by sustaining small and independent practices that would otherwise face financial closure.

Challenges to Long-Term Equity and Quality

- Despite its strengths, AIR’s national payment cap may not fully reflect the actual cost of care in remote or high-expense regions.

- The Medicare Economic Index (MEI) adjustments often lag behind inflation, limiting the ability of clinics to recruit and retain staff.

- Some critics note that AIR’s per-encounter design does not fully reward care coordination and population health efforts performed outside traditional visits.

- Modernizing the AIR model to integrate value-based incentives and flexible regional adjustments remains an ongoing policy priority.

Frequently Asked Questions about the AIR

1. What is the All-Inclusive Rate (AIR) in healthcare?

The All-Inclusive Rate (AIR) is the cost-based reimbursement rate used by Medicare to pay Rural Health Clinics (RHCs) for each qualifying patient encounter. Instead of billing multiple CPT codes, clinics receive one flat payment per visit that covers both professional and facility services.

2. How is the AIR calculated?

The AIR is calculated using the Medicare Cost Report (Form CMS-222-17), which documents the clinic’s allowable operating costs and total number of billable encounters. The total cost is divided by encounters to produce an average cost per visit. CMS then applies the Medicare Economic Index (MEI) and the annual payment cap to finalize the AIR.

3. What is the AIR payment cap?

CMS sets a national upper payment limit (UPL) each year to control Medicare spending. Even if a clinic’s calculated cost per encounter exceeds the cap, reimbursement cannot exceed the maximum AIR limit. The cap is updated annually using MEI adjustments for inflation.

4. How often is the AIR updated?

Each RHC’s AIR is reviewed and potentially updated annually during the cost report reconciliation process. Revisions can also occur mid-year if there are major changes to the clinic’s operations, staffing, or scope of services.

5. What services are excluded from AIR reimbursement?

Certain services are not included in the encounter-based AIR and must be billed separately:

- Laboratory services (technical-only).

- Durable Medical Equipment (DME).

- Hospital and skilled nursing services.

- Non-RHC outreach or preventive screenings.

These exclusions prevent duplicate reimbursement under other Medicare benefit categories.

6. What is the difference between AIR and MPFS reimbursement?

- AIR (All-Inclusive Rate): Used by Rural Health Clinics; based on cost per encounter; includes both professional and facility components.

- MPFS (Medicare Physician Fee Schedule): Used in standard outpatient settings; based on Relative Value Units (RVUs) under the Resource-Based Relative Value Scale (RBRVS) system.

AIR supports rural cost recovery, while MPFS promotes consistency across broader provider types.

7. Why is the AIR model important for rural healthcare?

The AIR provides financial stability for clinics serving small, low-income, or geographically dispersed populations. It helps sustain rural access to primary care, reduces provider closures, and aligns with CMS’s goal of improving health equity and community-based care.