What is VBID (Value-Based Insurance Design)?

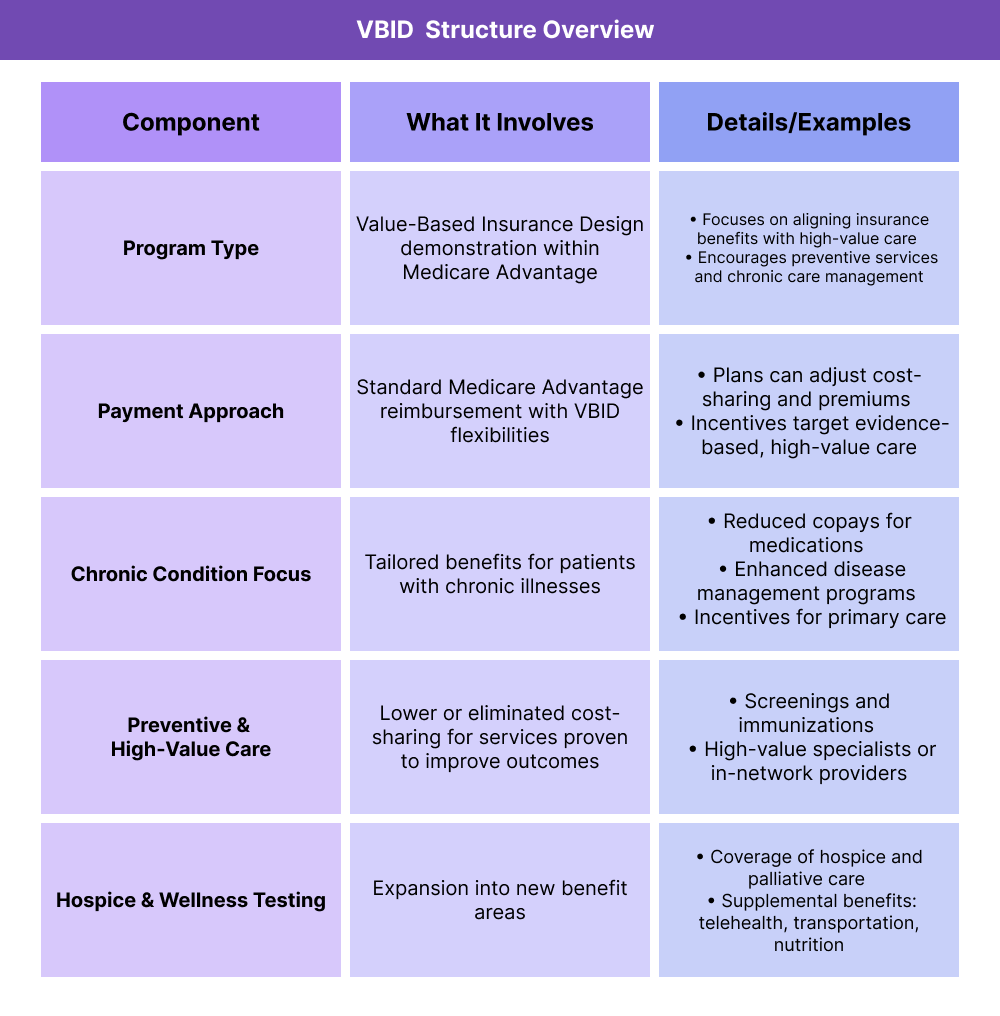

VBID (Value-Based Insurance Design) is a healthcare payment model developed by the Centers for Medicare & Medicaid Services (CMS) to encourage high-value care. Launched as a demonstration within Medicare Advantage (MA) plans, VBID adjusts cost-sharing and benefits to make preventive services, chronic condition management, and high-quality providers more affordable for patients. The goal is to improve outcomes while reducing unnecessary spending.

VBID is part of CMS’s broader move toward value-based care (VBC), complementing programs like Accountable Care Organizations (ACOs) that focus on provider accountability. By aligning insurance benefits with evidence-based, high-value care, VBID aims to create stronger incentives for patients to seek the right care at the right time.

Key Components of VBID

How VBID Works

VBID changes how insurance benefits are structured. Instead of uniform cost-sharing, it lowers or removes patient costs for services and treatments that are proven to deliver high value.

- Reduced or eliminated copays for preventive services and screenings

- Lower cost-sharing for medications that manage chronic conditions

- Incentives to use high-quality or in-network providers

How Payment and Reimbursement Are Structured

VBID is primarily implemented through Medicare Advantage plans. CMS allows participating plans to vary benefits and cost-sharing to encourage appropriate care.

- Plans may reduce premiums or copays for targeted services

- Insurers are reimbursed through the standard MA payment process, with VBID flexibility layered in

- VBID does not change overall MA benchmarks, but shifts incentives inside the benefit design

How Chronic Condition Incentives Work

VBID includes special provisions for patients with chronic illnesses, giving them tailored benefit designs to improve adherence and care management.

- Targeted cost-sharing reductions for essential medications

- Access to enhanced disease management programs

- Encouragement of ongoing primary care visits and coordination

How Hospice and Wellness Benefits Are Tested

In recent years, VBID demonstrations have expanded to include hospice benefits and supplemental wellness services.

- Testing coverage of palliative and hospice care within Medicare Advantage

- Adding benefits such as transportation, telehealth, and nutrition programs to improve access and outcomes

How the VBID Model Works in Practice

The Value-Based Insurance Design (VBID) model changes how Medicare Advantage (MA) plans structure benefits, aiming to align cost-sharing with high-value care.

Step 1 — Plans Apply to Participate

Medicare Advantage organizations submit applications to CMS to join the VBID demonstration. Approved plans gain flexibility to modify benefit designs.

Step 2 — Target Populations Identified

Plans choose specific beneficiary groups to target with redesigned benefits.

- Enrollees with chronic conditions

- Beneficiaries who would benefit from preventive services

- Underserved populations needing improved access

Step 3 — Benefit Design Adjusted

Plans vary cost-sharing or provide supplemental benefits to encourage appropriate care.

- Reduced copays for preventive screenings

- Lower costs for medications managing chronic conditions

- Added benefits such as transportation, nutrition, or telehealth

Step 4 — Care Delivered Under New Structure

Beneficiaries receive care with altered incentives that reduce barriers to high-value services and encourage disease management participation.

Step 5 — CMS Evaluation and Oversight

CMS evaluates the impact of VBID on cost, quality, and patient outcomes. Performance is reviewed annually, with adjustments made to the demonstration.

Billing and Reimbursement in VBID

How Payments Flow in VBID

VBID operates within the existing Medicare Advantage (MA) payment system. Plans continue to receive capitated payments from CMS, but they have added flexibility to redesign cost-sharing and supplemental benefits.

- CMS pays MA plans a fixed per-member, per-month (PMPM) rate based on benchmarks and risk adjustment.

- Plans use VBID flexibilities to modify benefit structures without changing the underlying MA reimbursement formula.

- Savings or added costs from VBID design choices are absorbed at the plan level.

How VBID Affects Beneficiaries

While provider billing processes remain unchanged, beneficiaries experience different cost-sharing structures at the point of care.

- Lower copays or no-cost services for preventive screenings and chronic condition management

- Reduced cost-sharing for medications tied to evidence-based care

- New supplemental benefits such as telehealth, transportation, or nutrition programs

Reconciliation and Oversight under VBID

CMS requires participating MA plans to submit data showing how VBID benefit designs affect utilization, cost, and patient outcomes.

- Annual reports ensure designs meet program goals

- Adjustments may be made to ensure equitable access and quality safeguards

- Plans must remain compliant with CMS rules on nondiscrimination and beneficiary protections

VBID vs Standard MA Reimbursement

- Standard MA: Uniform cost-sharing and benefit design, with limited flexibility to vary benefits across populations.

- VBID: Maintains the same CMS capitated payments but allows targeted benefit design changes to incentivize high-value care and improve outcomes.

Quality & Equity Requirements in VBID

Quality Measures

VBID participation requires plans to maintain or improve quality while testing new benefit designs. CMS monitors:

- Preventive care utilization (e.g., screenings, vaccinations)

- Chronic condition management outcomes (e.g., adherence to medication regimens)

- Member experience and satisfaction surveys

- Overall healthcare utilization patterns

Equity Requirements

The VBID model incorporates an explicit Health Equity Incubation track, requiring plans to:

- Identify underserved populations within their service area

- Offer targeted benefit designs to reduce disparities

- Collect data on demographics, social risk factors, and access barriers

- Report outcomes annually to CMS

Safeguards for Beneficiaries

To protect patients, CMS enforces:

- Non-discrimination rules for all benefit designs

- Transparency in communicating benefit differences

- Oversight to ensure cost-sharing reductions do not compromise quality or limit access

Frequently Asked Questions about VBID

1. What is VBID?

VBID (Value-Based Insurance Design) is a CMS demonstration that allows Medicare Advantage plans to vary benefits and cost-sharing to encourage high-value care, such as preventive services, chronic disease management, and the use of high-quality providers.

2. Who can participate in VBID?

Medicare Advantage organizations can apply to participate in VBID. Approved plans gain flexibility to redesign cost-sharing and supplemental benefits for targeted beneficiary groups.

3. How does VBID affect beneficiaries?

Beneficiaries may pay lower copays for high-value services, receive enhanced chronic care benefits, or gain access to supplemental services like telehealth, nutrition support, or transportation, depending on their plan’s VBID design.

4. What conditions or populations does VBID focus on?

VBID often targets patients with chronic illnesses, underserved populations, or beneficiaries who benefit most from preventive care. Plans tailor benefit designs to improve access and outcomes for these groups.

5. How does VBID differ from standard Medicare Advantage plans?

In standard MA, cost-sharing and benefits are uniform across enrollees. In VBID, plans can offer variable benefit designs that reduce barriers to high-value care, while still operating under the same capitated payment structure.

6. How does CMS ensure quality and equity in VBID?

CMS requires participating plans to collect data, report outcomes, and implement safeguards. Plans must demonstrate that redesigned benefits improve care quality and reduce disparities without restricting access or discriminating against certain populations.