What is TIN (Tax Identification Number)?

A Tax Identification Number (TIN) is the federal tax ID used to identify the business entity that bills for healthcare services and receives payment from payers. In most healthcare settings, the TIN is an Employer Identification Number (EIN) assigned by the IRS to a practice, clinic, health system, or supplier. The TIN represents the legal billing organization, not the individual clinician.

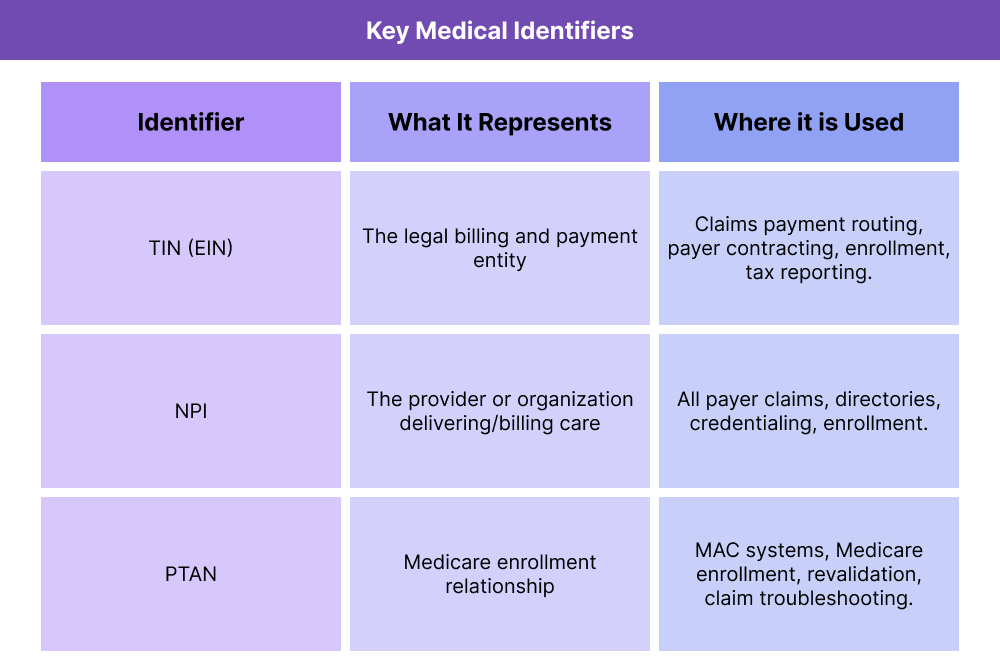

In reimbursement workflows, the TIN is paired with a National Provider Identifier (NPI) to define who is billing and under what business entity. The NPI identifies the individual or organization clinically, while the TIN identifies where the payment should be routed for tax and contracting purposes. This pairing is used across Medicare enrollment, commercial payer credentialing, and claims processing.

In practice, TIN accuracy is essential for stable billing. If the TIN on a claim does not match the enrolled billing entity on file, claims can deny or payments can be delayed. TINs also become central during organizational changes—like mergers or a Change of Ownership (CHOW)—because a new legal entity may require a new TIN and updated enrollment before billing continues.

Key Components of a TIN

A TIN functions as the financial and legal identifier that payers use to recognize the billing entity behind a claim. While clinicians deliver care and are identified by NPIs, the TIN defines which organization is contracting with the payer, submitting charges, and receiving reimbursement.

TIN as the Billing Entity Identifier

Healthcare claims typically include both an NPI and a TIN. The NPI identifies the rendering or billing provider, and the TIN identifies the tax entity responsible for the claim. This allows payers to route payment to the correct organization and attribute billing activity to the right legal business unit.

TINs Are Usually EINs for Practices and Facilities

In most cases, a TIN is an Employer Identification Number (EIN) assigned to a business by the IRS. Group practices, clinics, hospitals, and suppliers bill under their EIN-based TIN. Individual clinicians may also bill under a TIN if they operate as a sole proprietorship or professional entity, but the TIN still represents the business structure.

TIN and Provider Enrollment Alignment

Payers require TIN alignment during enrollment and credentialing. Medicare and commercial plans use the TIN to validate who is participating, what services they are eligible to bill for, and where payment should be delivered. If the enrolled TIN does not match the TIN used on claims, reimbursement issues follow.

TIN Changes During Organizational Transitions

TINs often change when the legal billing entity changes. This happens in scenarios such as mergers, acquisitions, or a Change of Ownership (CHOW). When a new TIN is created, payers require updated enrollment before claims can be paid under that entity.

TIN Use in Tax Reporting and Contracting

Beyond claims, TINs are used for tax reporting, payer contracting, and compliance tracking. They define the business unit responsible for revenue, reporting, and legal accountability.

How TINs Work in Practice

TINs show up in everyday billing and enrollment workflows as the organizational “anchor” that tells payers which business entity is responsible for the claim. Because healthcare billing often involves multiple clinicians working under a single organization, the TIN is essential for keeping claims, contracts, and payment attribution aligned.

Step 1: TIN Is Established for the Billing Entity

A healthcare organization first obtains a TIN (typically an EIN) from the IRS when it is created or when a new legal entity is formed. This TIN becomes the official tax and payment identifier for the practice, clinic, or facility.

Step 2: The Organization Enrolls With Payers Using the TIN

During payer enrollment, the organization submits its TIN alongside its organizational NPI and ownership documentation. Medicare and commercial payers use the TIN to build the billing relationship that determines where claims payments will be routed.

For clinicians who bill under a group practice, their individual NPIs are enrolled and reassigned to the group’s TIN-based billing entity.

Step 3: Claims Are Submitted With NPI + TIN Together

When services are billed, the claim includes:

- The rendering provider NPI (who delivered care)

- The billing provider NPI (often the organization)

- The TIN (the tax/payment entity receiving reimbursement)

Payers validate that the TIN on the claim matches the enrolled billing entity on file. If not, claims may deny or pend for manual review.

Step 4: TIN Changes Trigger Enrollment and Billing Updates

If a practice undergoes a Change of Ownership (CHOW), merger, or other legal restructuring that creates a new billing entity, the TIN may change. When that happens, payers generally require:

- New or updated enrollment under the new TIN

- Reassignment updates for clinicians attached to that billing entity

- Claims system updates so billing routes correctly

Until those pieces align, reimbursement interruptions are common.

TINs in Billing, Reimbursement, and System Limitations

TINs are central to claims payment because they define the legal entity that is enrolled with a payer and eligible to receive reimbursement. Even when the clinical service is correctly documented and coded, a claim can still deny if the TIN does not match the payer’s enrolled billing record.

How TINs Affect Claims Processing and Payment

Most payers validate three things together on a claim:

- Who rendered the service (rendering NPI)

- Who is billing (billing NPI)

- Which legal entity is receiving payment (TIN)

If the TIN on the claim is not the one associated with the billing NPI in the payer’s enrollment file, common outcomes include:

- Claims rejection for billing entity mismatch

- Payment delays while enrollment is corrected

- Reassignment issues when clinicians are linked to the wrong TIN

- Directory or network attribution errors

This is why TIN accuracy is treated as a prerequisite for stable reimbursement.

TIN Changes and Medicare / Commercial Enrollment

A TIN change is not a simple demographic update. It usually indicates a change in legal billing structure, which payers interpret as a new billing entity. Common triggers include:

- Change of Ownership (CHOW)

- New corporate structure or tax status

- Acquisition or merger creating a new legal entity

- Splitting locations into separate billing units

When this happens, payers require re-enrollment or enrollment updates before they will pay claims under the new TIN, even if the NPIs remain the same.

System Limitations and Operational Watch-Outs

Because TINs are organization-level identifiers, they create a few predictable complexity points:

- Multiple TINs across one brand (e.g., different locations or subsidiaries) can confuse billing unless clearly mapped.

- Clinician reassignment may lag behind a TIN update, causing mismatched claims.

- Payer systems don’t sync at the same speed, so claims may deny temporarily after a TIN change even if enrollment is in progress.

- Front-end billing tools often hide the TIN, so teams miss TIN-related errors until denials surface.

Operationally, any TIN change should be treated like a high-risk billing transition with structured tracking and verification.

How TINs Influence Quality, Access, and Equity in Healthcare

TINs are administrative identifiers, but they affect real care outcomes indirectly because billing continuity influences whether services remain available and sustainable.

Quality and Continuity Effects

When TIN enrollment is clean, providers experience fewer billing interruptions, which supports consistent staffing, reliable care processes, and stable follow-up workflows. When TIN alignment breaks—especially after ownership or organizational change—billing instability can trigger operational strain that affects care delivery and documentation quality.

Access Implications

TIN-related enrollment delays can slow service start dates for new clinics or reorganized practices. If claims are not payable under the correct TIN, organizations may pause scheduling, delay onboarding, or limit Medicare/payer participation until enrollment stabilizes. That can create temporary access gaps for patients.

Equity Considerations

Administrative billing friction tends to impact access more in settings with fewer alternatives—such as rural communities, safety-net practices, or high-Medicare populations. When TIN transitions interrupt reimbursement, these communities may feel the effects fastest through longer waits or reduced local availability.

Strong TIN management supports equitable access by reducing avoidable billing disruption.

Frequently Asked Questions about TINs

1. What is a TIN (Tax Identification Number)?

A TIN is the federal tax ID used to identify the legal business entity that bills for healthcare services and receives payment from payers. In most cases, a TIN is the organization’s EIN.

2. Is a TIN the same as an EIN?

In healthcare billing, yes in most cases. EIN is the specific IRS-issued tax number businesses use, and it functions as the TIN on payer enrollment and claims.

3. How is a TIN used on a medical claim?

Claims include both an NPI and a TIN. The NPI identifies who delivered or billed the service, and the TIN identifies which legal entity should be paid.

4. What is the difference between a TIN and an NPI?

A TIN identifies the billing business for tax and payment purposes. An NPI identifies the provider or organization clinically and is used across all payers.

5. Can a practice have more than one TIN?

Yes. Organizations with multiple legal entities or subsidiaries may operate under multiple TINs. Each TIN represents a separate enrolled billing entity.

6. What happens if the TIN on a claim doesn’t match payer enrollment?

Claims often deny or payment is delayed because the payer cannot validate that the billing entity is enrolled under that TIN.

7. Does a TIN change require re-enrollment?

Usually yes. A TIN change typically signals a new legal billing entity, so Medicare and commercial payers require updated enrollment before paying claims under the new TIN.