What is MMIS (Medicaid Management Information System)?

The Medicaid Management Information System (MMIS) is the core technology platform states use to administer Medicaid programs. MMIS supports claims processing, provider enrollment, eligibility verification, payment, reporting, and program oversight across fee-for-service and managed care environments.

From an operational standpoint, MMIS is the backbone of Medicaid. Every Medicaid claim, encounter, eligibility check, and payment ultimately flows through or is reconciled against MMIS. For healthcare organizations, managed care plans, and vendors, understanding MMIS is essential because it determines how data is validated, how payments are released, and how compliance is enforced at the state level.

MMIS is not a single, uniform system nationwide. Each state operates its own MMIS—often with customized modules and vendor configurations—while still adhering to federal requirements. As a result, MMIS shapes how programs like PRC, FFP-funded initiatives, and SPA-driven policy changes are implemented in practice.

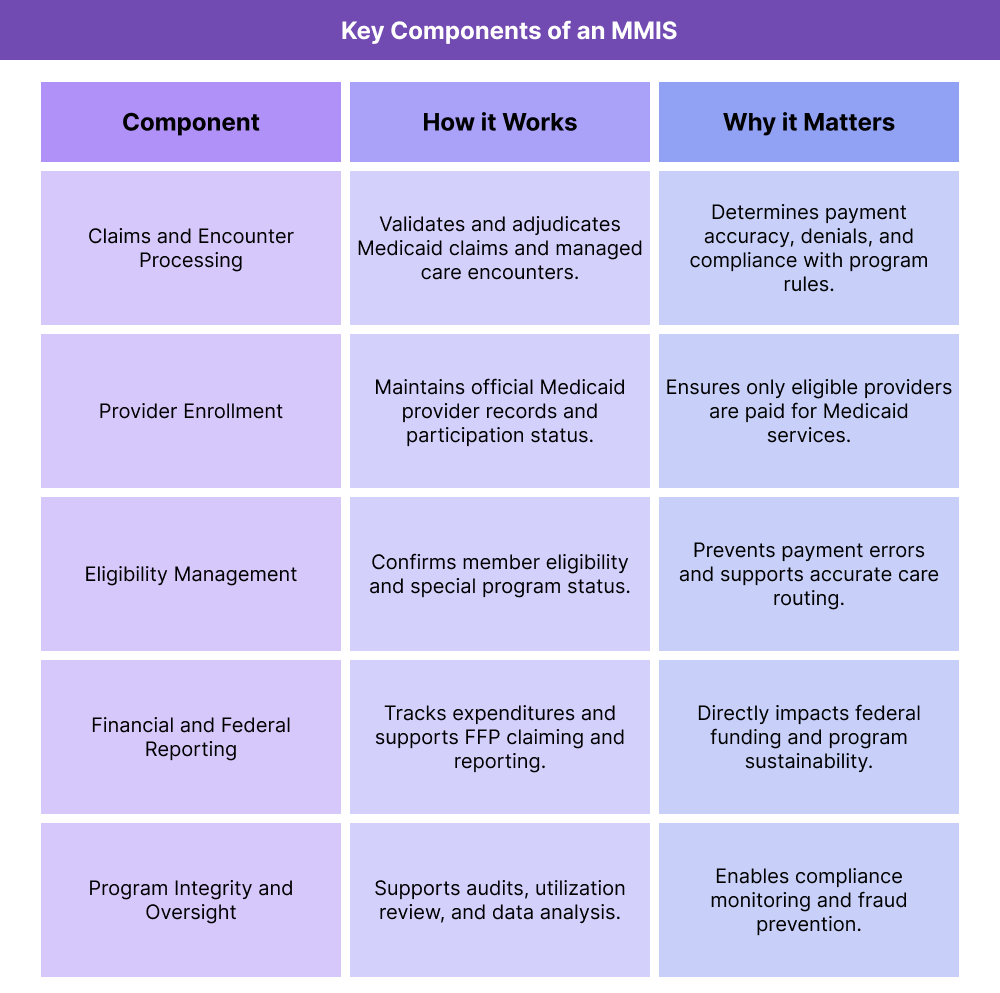

Key Components of a Medicaid Management Information System (MMIS)

While MMIS is often described as a claims system, it is more accurately a collection of tightly integrated modules that support the full lifecycle of Medicaid administration. Each component plays a role in ensuring payments are accurate, services are authorized, and federal funding requirements are met.

Medicaid Claims and Encounter Processing in MMIS

At its core, MMIS processes Medicaid claims and managed care encounters. It validates submitted data against eligibility rules, provider enrollment records, coverage policies, and billing logic before determining whether a claim should be paid, denied, or pended.

For providers and plans, this is where many operational realities emerge: claims edits, denials tied to missing data, PRC-related restrictions, and encounter validation rules all surface at the MMIS layer.

Provider Enrollment and Credentialing in MMIS

MMIS maintains the authoritative record of Medicaid providers, including enrollment status, specialties, service locations, and participation eligibility. Claims submitted by providers not properly enrolled or credentialed in MMIS are typically denied, regardless of clinical appropriateness.

This makes MMIS enrollment workflows tightly linked to compliance topics like OIG exclusion screening and ongoing provider monitoring.

Eligibility Verification and Member Data

MMIS houses eligibility and enrollment information used to confirm whether a member is eligible for Medicaid services on a given date. Eligibility data also supports special program flags, such as PRC enrollment, dual eligibility status, or participation in waiver programs.

Accurate eligibility data is critical for front-end workflows, as errors often result in downstream denials and rework.

Financial Management and Federal Reporting

MMIS plays a central role in tracking Medicaid expenditures and supporting federal reporting tied to Federal Financial Participation (FFP). States rely on MMIS data to substantiate claims for federal match, allocate costs correctly, and demonstrate compliance with approved Medicaid plans and amendments.

Because of this, MMIS configuration directly affects a state’s ability to claim federal funds—and indirectly affects how providers and vendors are paid.

Oversight, Audits, and Program Integrity Functions

MMIS supports program integrity by enabling audits, utilization reviews, and data analysis. States use MMIS data to identify outliers, monitor billing trends, and support investigations related to fraud, waste, and abuse.

This data often feeds into oversight activities associated with OIG reviews, Medicaid Integrity Contractors, and state-level compliance programs.

How the Medicaid Management Information System (MMIS) Works in Practice

The Medicaid Management Information System (MMIS) operates as the system of record for Medicaid administration at the state level. While providers and care teams interact primarily with EHRs, clearinghouses, and care management platforms, MMIS is where Medicaid rules are ultimately enforced, validated, and reconciled.

In practice, MMIS connects policy, operations, billing, and federal funding into a single execution layer. Understanding how that plays out day to day helps explain why Medicaid workflows can feel rigid—and why small errors often have outsized financial impact.

Step 1: Medicaid Policy Is Translated Into MMIS Configuration

Every major Medicaid policy decision eventually becomes MMIS logic.

Coverage rules, billing requirements, payment methodologies, and special program rules—often introduced through State Plan Amendments (SPAs) or waiver approvals—must be encoded into MMIS before they can be enforced consistently. This includes:

- Which services are covered and under what conditions

- Which provider types are eligible to bill

- Whether a service is paid fee-for-service, encounter-based, or through managed care

- Program-specific flags such as PRC enrollment or eligibility restrictions

This translation step is one of the most fragile points in the system. When policy intent and MMIS configuration are misaligned, providers experience denials that feel arbitrary, and states face pressure to reconcile operational behavior with federal requirements tied to FFP.

Step 2: Eligibility and Program Status Are Checked at the Front End

When a Medicaid member seeks care, eligibility and program status are verified using MMIS data—or through systems that pull directly from MMIS. This includes not just basic eligibility, but participation in special programs that affect care routing and billing.

Examples include:

- PRC enrollment, which restricts which providers and pharmacies can be used

- Dual eligibility indicators for Medicare–Medicaid members

- Enrollment in waiver programs or targeted benefit groups

If eligibility data is inaccurate or out of sync, the impact often doesn’t appear until after services are delivered—when claims are denied or recouped. For this reason, MMIS accuracy at the eligibility layer is critical to both access and revenue integrity.

Step 3: Services Are Delivered Outside MMIS—but Validated Inside It

Clinical care does not happen in MMIS. It happens in clinics, hospitals, community settings, and care management programs. However, every Medicaid-covered service must eventually be represented in a format MMIS can validate.

This is where operational systems intersect with MMIS logic:

- EHRs generate claims and encounter data

- Care management platforms track non-clinical activities tied to programs like MAC or PRC

- Clearinghouses format and route transactions

MMIS then applies its rules to that data, checking for:

- Provider enrollment and eligibility

- Member eligibility on the date of service

- Coding accuracy and service compatibility

- Program-specific restrictions and edits

Even when care is appropriate, failure to meet MMIS formatting or rule requirements can result in denial.

Step 4: Claims, Encounters, and Payments Are Reconciled

For fee-for-service Medicaid, MMIS directly adjudicates claims and releases payment. For managed care, MMIS validates encounter data that supports capitation payments and federal reporting.

At this stage, MMIS data feeds:

- Provider reimbursement

- Managed care oversight

- State financial reporting

- Federal match calculations tied to FFP

This is also where errors become expensive. Inaccurate encounter data can affect not just provider payment, but a state’s ability to claim federal funds—creating downstream pressure on providers and vendors to correct issues retroactively.

Step 5: Oversight, Audits, and Adjustments Happen Continuously

MMIS is not a static system. States continuously analyze MMIS data to support:

- Program integrity reviews

- Utilization monitoring

- OIG-related audits and investigations

- Policy refinements and system updates

Findings at this stage often lead to new edits, tighter documentation standards, or revised workflows—sometimes months after services were originally delivered. This lag is why Medicaid organizations place so much emphasis on audit readiness and traceable documentation.

Why This Matters for Providers, Plans, and Vendors

From a business standpoint, MMIS is the enforcement point for Medicaid policy and funding. It is where:

- PRC rules are applied

- FFP eligibility is substantiated

- MAC activities are validated

- AIR and encounter-based models are enforced

Organizations that understand MMIS as a governing system—not just a claims processor—are better positioned to design workflows that hold up under scrutiny and avoid costly rework.

MMIS in Billing, Reimbursement, and System Limitations

The Medicaid Management Information System (MMIS) has a direct and unavoidable impact on how Medicaid services are billed, reimbursed, and audited. Even though many providers never log into MMIS itself, its rules ultimately determine whether claims are paid, denied, delayed, or later reviewed for compliance.

From a revenue-cycle perspective, MMIS is not just a back-end system — it is the final authority on Medicaid payment logic.

How MMIS Affects Medicaid Billing and Reimbursement

MMIS enforces the technical and policy rules that govern Medicaid billing. These include:

- Provider enrollment and credentialing status

- Member eligibility on the date of service

- Covered service definitions and limits

- Coding, modifier, and rendering provider rules

- Program-specific edits (such as PRC restrictions or waiver requirements)

If a claim or encounter fails any of these checks, MMIS may deny it outright or pend it for additional review. This is true even when the service was clinically appropriate and properly documented at the point of care.

Because MMIS logic varies by state, organizations operating in multiple Medicaid markets must manage state-specific billing workflows, even when clinical care looks identical.

MMIS and Encounter-Based and Managed Care Payment Models

MMIS plays a critical role in encounter-based and managed care arrangements, even when payment does not occur through traditional fee-for-service claims.

Examples include:

- Encounter-based models such as All-Inclusive Rates (AIR), where MMIS validates whether a visit qualifies as an encounter

- Managed care encounters, where plans submit data to MMIS to support capitation payments and federal reporting

- Care management and administrative activities, where MMIS data supports Medicaid Administrative Claiming (MAC) and FFP reporting

In all of these models, incomplete or inaccurate encounter data can create downstream financial risk — not just for providers, but for states attempting to substantiate federal match.

MMIS, Federal Financial Participation, and Audit Exposure

MMIS data underpins Federal Financial Participation (FFP) claims. States rely on MMIS to demonstrate that Medicaid expenditures were:

- Eligible under the approved Medicaid plan

- Properly documented

- Accurately categorized

- Allocated correctly between federal and non-federal shares

When MMIS data is inconsistent or incomplete, states may face disallowances or repayment demands. That risk often flows downstream, increasing scrutiny on providers, managed care organizations, and vendors.

This is also where MMIS intersects with OIG oversight. OIG audits frequently rely on MMIS data extracts to identify billing patterns, documentation gaps, and program integrity risks.

System Limitations and Common MMIS Pain Points

Despite its central role, MMIS has structural limitations that create operational friction:

- Delayed system updates: Policy changes approved through SPAs or waivers may take months to be fully implemented in MMIS

- Opaque denial logic: Providers often receive limited insight into why claims failed MMIS edits

- Fragmented integrations: EHRs, clearinghouses, and care management platforms may not align cleanly with MMIS requirements

- Data latency: Eligibility and program flags may lag behind real-world changes

- One-size-fits-all edits: MMIS rules may not account for clinical nuance or complex patient circumstances

These limitations make proactive workflow design essential. Organizations that rely on post-denial fixes often incur higher administrative costs and compliance risk.

How MMIS Influences Quality, Access, and Equity in Healthcare

Although MMIS is primarily an administrative system, its design and implementation have meaningful effects on care delivery, patient experience, and equity — particularly in Medicaid-heavy environments.

MMIS and Access to Medicaid-Covered Care

MMIS affects access at several points in the care journey:

- Eligibility errors can delay or block care

- Program flags (such as PRC enrollment) can restrict where care is received

- Provider enrollment issues can reduce network availability

- System delays can slow referrals, prescriptions, and follow-up services

For patients, these issues often feel like access barriers rather than administrative problems. For providers, they translate into cancelled visits, rescheduled care, and unreimbursed services.

Access challenges are especially pronounced for populations with unstable coverage, frequent eligibility changes, or complex care needs.

MMIS and Healthcare Quality Measurement

MMIS data feeds many Medicaid quality measurement and reporting programs. Accurate claims and encounters are essential for:

- Reflecting actual care delivered

- Measuring preventive services and chronic condition management

- Evaluating care coordination and transitions

- Supporting value-based and quality improvement initiatives

When MMIS data is incomplete or misaligned with clinical reality, quality performance may be understated — affecting program evaluation, funding decisions, and public reporting.

This creates a strong incentive for organizations to align documentation, billing, and reporting workflows across clinical and administrative teams.

Equity Implications of MMIS Design and Implementation

MMIS complexity does not affect all organizations equally.

Smaller clinics, rural providers, Tribal health systems, and safety-net organizations often face greater challenges due to:

- Limited administrative staffing

- Less flexible technology infrastructure

- Higher patient complexity

- Greater reliance on Medicaid funding

When MMIS rules are difficult to interpret or systems are slow to adapt, these organizations may experience higher denial rates, delayed payments, and increased administrative burden — widening existing inequities.

Conversely, when MMIS is implemented with flexibility, transparency, and strong support, it can enable more equitable access by ensuring consistent eligibility, payment, and oversight across diverse provider settings.

MMIS as a Lever for System-Wide Improvement

At its best, MMIS serves as a coordination layer that aligns policy intent with operational execution. When states invest in clear rules, timely updates, and strong integrations, MMIS can support:

- More reliable access to care

- More accurate quality measurement

- Stronger accountability for public funds

- More equitable participation in Medicaid programs

For providers and vendors, success depends on recognizing MMIS not as a black box, but as a system whose logic must be anticipated and supported throughout the care and billing lifecycle.

Frequently Asked Questions about MMIS

1. What is MMIS (Medicaid Management Information System)?

The Medicaid Management Information System (MMIS) is the state-operated system used to administer Medicaid programs. MMIS supports claims processing, provider enrollment, eligibility verification, payments, reporting, and oversight for Medicaid services.

2. How does MMIS work in Medicaid programs?

MMIS works by applying Medicaid policy rules to claims and encounter data submitted by providers and managed care plans. It validates eligibility, provider enrollment, coding, and program rules before approving payment or recording encounters for reporting and federal funding purposes.

3. Is MMIS the same system in every state?

No. Each state operates its own MMIS with different vendors, configurations, and workflows. While all MMIS platforms must meet federal requirements, the specific rules, edits, and processes vary significantly by state.

4. How does MMIS affect Medicaid billing and reimbursement?

MMIS determines whether Medicaid claims are paid, denied, or delayed. Even if services are clinically appropriate, claims that do not meet MMIS eligibility, enrollment, or coding rules may be denied, creating downstream revenue-cycle challenges for providers.

5. How does MMIS support Federal Financial Participation (FFP)?

MMIS data is used to support Federal Financial Participation by tracking Medicaid expenditures, validating eligible services, and producing reports used to claim federal matching funds. Inaccurate MMIS data can put federal funding at risk.

6. How does MMIS interact with managed care and encounter data?

In managed care environments, MMIS validates encounter data submitted by health plans. While providers may be paid through capitation, encounter data must still meet MMIS standards to support oversight, quality reporting, and federal funding.

7. What role does MMIS play in program integrity and compliance?

MMIS supports audits, utilization reviews, and program integrity activities by providing data used to identify outliers, improper billing, and compliance risks. This data is often used in reviews related to OIG oversight and Medicaid integrity initiatives.

8. Why is MMIS important for health IT vendors and care management platforms?

Health IT and care management systems must align with MMIS rules to ensure accurate data flow, clean claims, valid encounters, and audit-ready documentation. Systems that do not account for MMIS requirements can unintentionally increase denial rates and compliance risk.