What is an Independent Practice Association? (IPA)

An Independent Practice Association (IPA) is a network of independently owned healthcare providers—typically primary care physicians and specialists—who join together to contract collectively with insurance companies, employers, or other payers.

Unlike hospital-owned practices or integrated health systems, IPA members maintain ownership of their private practices but benefit from shared services like billing infrastructure, credentialing, negotiation power, and care coordination frameworks.

IPAs are most commonly found in markets where value-based care and capitated payment models are prevalent, such as with Medicare Advantage or certain Medicaid plans.

Key Components of an Independent Practice Association

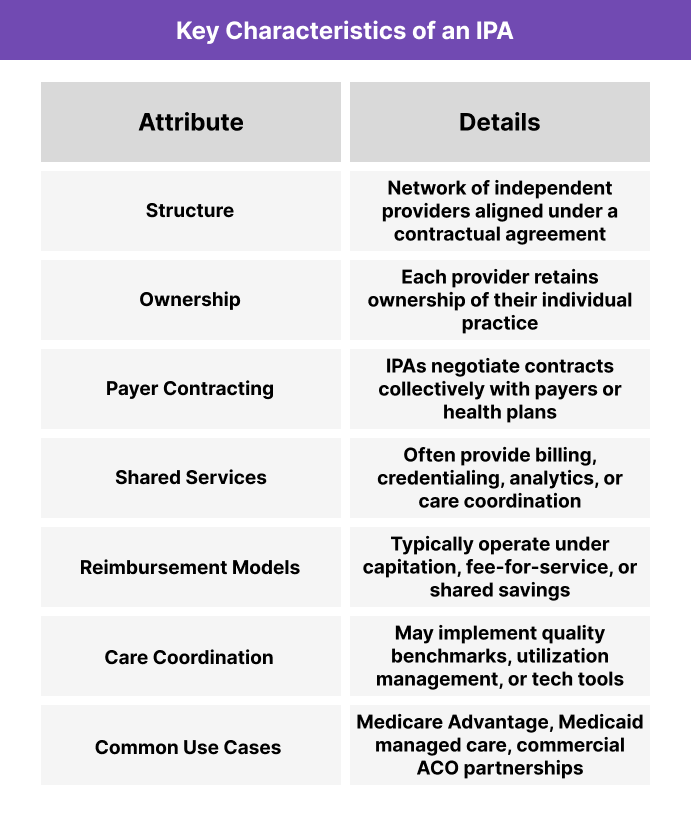

Independent Practice Associations (IPAs) bring together physicians and other healthcare providers to collaborate on payer contracting and care delivery—without giving up ownership of their practices. While each provider remains independent, the IPA offers a shared infrastructure to support financial alignment, operational efficiency, and quality improvement.

The following table outlines the core characteristics that define most IPA structures.

How Independent Practice Associations Work in Practice

In a typical IPA model, independent providers sign participation agreements that allow the association to represent them collectively when negotiating contracts with payers. This gives solo and small-group practices access to larger patient panels, better reimbursement rates, and shared risk arrangements—without having to join a hospital-owned system.

Key operational elements may include:

- Centralized Contracting: The IPA enters into agreements with health plans on behalf of its members.

- Delegated Services: The IPA may manage administrative functions like credentialing, claims processing, and data reporting.

- Performance Benchmarks: Some IPAs monitor member performance on cost, quality, or utilization metrics, distributing incentives or penalties accordingly.

- Technology Enablement: Many IPAs invest in shared EHR systems, population health tools, or care management software to support coordination.

While each member practice retains day-to-day clinical control, the IPA sets the rules for participation, reimbursement distribution, and quality management.

Benefits and Challenges of Independent Practice Associations (IPA)

Benefits of IPAs

- Preserve Independence: Providers retain ownership and autonomy while accessing shared administrative support.

- Improved Contract Leverage: Collective negotiation power leads to better rates and access to value-based contracts.

- Lower Administrative Overhead: IPAs often provide billing, credentialing, and compliance services that reduce burden on small practices.

- Enhanced Data Access: Many IPAs offer population health tools, dashboards, and EHR integration.

- Pathway to Risk Models: IPAs allow smaller practices to participate in capitation or shared savings without assuming full risk alone.

Challenges of IPAs

- Variation in Structure: Some IPAs function like true clinical networks; others offer minimal support beyond contracting.

- Limited Standardization: Without tightly aligned protocols, performance and outcomes may vary across member practices.

- Revenue Sharing Disputes: How funds or bonuses are distributed can become a source of friction.

- Market Competition: In highly consolidated regions, IPAs may struggle to compete with large health systems or IDNs.

How Do IPAs Get Paid?

Independent Practice Associations do not directly bill patients or insurers. Instead, they serve as contracting and administrative intermediaries between providers and payers.

Common IPA payment models include:

- Capitated Contracts: The IPA receives a fixed per-member-per-month (PMPM) payment from a payer and distributes funds to participating providers.

- Fee-for-Service Aggregation: Each member bills independently, but the IPA negotiates higher reimbursement rates or bonuses for collective performance.

- Shared Savings Programs: In value-based arrangements, the IPA earns a portion of savings generated by reducing costs or improving quality—and then shares those funds with members.

- Administrative Fees: Some IPAs charge member practices a monthly fee or percentage of revenue in exchange for services like credentialing, analytics, and contract management.

The exact model depends on the payer contracts and how the IPA is structured—some are more clinically integrated than others.

Frequently Asked Questions about Independent Practice Associations

1. What is an Independent Practice Association?

An IPA, or Independent Practice Association, is a group of independent healthcare providers who join together to negotiate payer contracts and share administrative services while maintaining ownership of their individual practices.

2. What is the purpose of an Independent Practice Association?

IPAs help independent providers work together to secure payer contracts, reduce administrative burden, and participate in value-based care—without merging their practices.

3. How does an IPA differ from a CIN or an ACO?

An IPA is primarily a contractual and administrative network. A CIN (Clinically Integrated Network) requires clinical alignment and shared protocols, while an ACO (Accountable Care Organization) assumes responsibility for patient outcomes and cost control.

4. Can specialists join an IPA?

Yes. While many IPAs are anchored by primary care, specialists such as cardiologists, dermatologists, or behavioral health providers often participate to expand service offerings and improve care coordination.

5. Do IPAs employ providers?

No. IPA members maintain independent ownership of their practices. The IPA itself does not typically hire or manage clinicians directly.

6. Are IPAs still relevant in today's healthcare landscape?

Yes. As value-based care expands, IPAs offer small practices a scalable way to engage in payer contracts, population health, and shared savings models without joining a hospital system.