What is FMAP (Federal Medical Assistance Percentage)?

The Federal Medical Assistance Percentage (FMAP) is the statutory formula used to determine how much the federal government contributes toward each state’s Medicaid program costs. FMAP sets the federal matching rate for most Medicaid services, meaning that for every dollar a state spends on covered Medicaid benefits, the federal government reimburses a defined share based on that state’s FMAP.

FMAP is calculated annually using a state’s per-capita income relative to the national average. States with lower per-capita income receive higher federal matching rates, while higher-income states receive lower matches. This structure is intended to balance fiscal capacity across states and support consistent access to Medicaid coverage regardless of local economic conditions.

From a financing and policy perspective, FMAP is one of the most important levers in Medicaid design. It directly affects state budgeting, program expansion decisions, and the sustainability of optional benefits. FMAP also serves as the baseline for enhanced matching arrangements—such as higher rates for certain populations, services, or temporary federal policy initiatives—making it central to how Medicaid funding flows through federal-state partnerships.

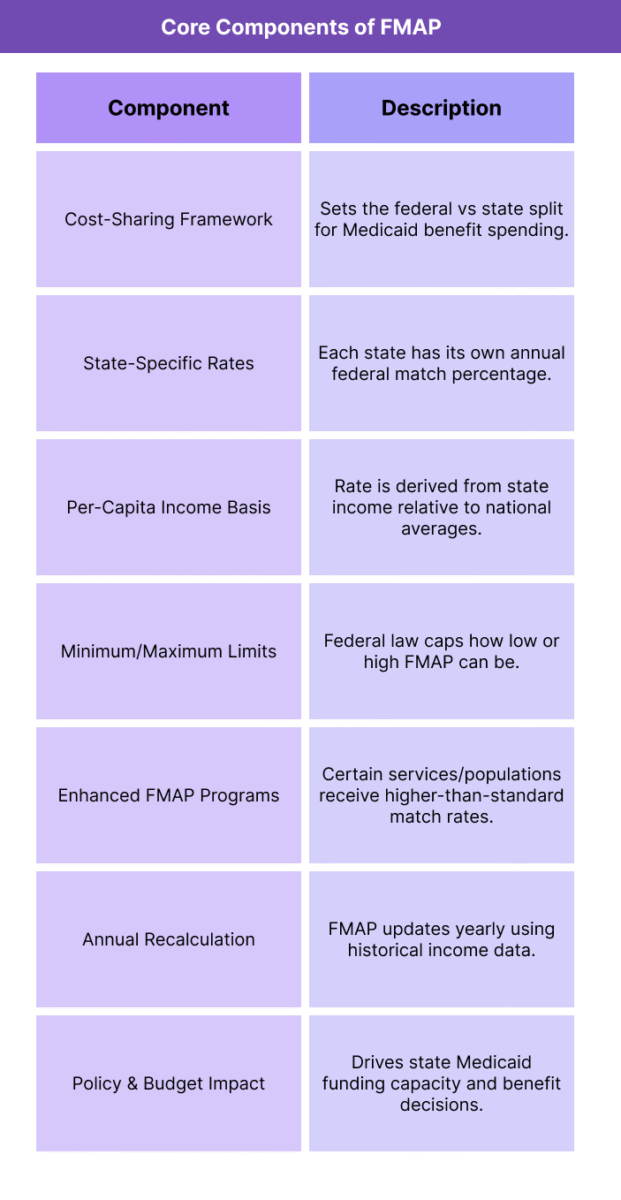

Key Components of FMAP

FMAP functions as the core Medicaid financing mechanism that determines how costs are shared between the federal government and states. While the formula itself is straightforward, its operational impact depends on several structural components that shape how matching funds are calculated, applied, and adjusted over time.

FMAP rules also interact with enhanced matching programs, state budgeting cycles, and benefit design decisions, making the concept foundational for anyone evaluating Medicaid policy or reimbursement strategy.

Federal–State Cost-Sharing Structure

FMAP establishes the percentage split for Medicaid benefit spending between the federal government and each state. The federal share automatically adjusts to the state’s FMAP, and the state is responsible for financing the remainder.

State-Specific Matching Rates

Each state receives its own FMAP rate, recalculated annually. The rate applies broadly to most Medicaid services and populations unless a statutory exception or enhanced match overrides it.

Per-Capita Income Formula

FMAP is based on a state’s per-capita income compared to the national per-capita income average. Lower-income states receive a higher match, while higher-income states receive a lower match.

Statutory Minimum and Maximum Bounds

FMAP rates cannot fall below a federal minimum or exceed a federal maximum. These bounds prevent very high-income states from being overly penalized and ensure that the federal share remains meaningful in all states.

Enhanced FMAP (eFMAP) Categories

Certain Medicaid services or populations receive enhanced matching rates that are higher than the state’s standard FMAP. These enhanced rates are tied to specific statutory programs such as CHIP, certain preventive services, family planning, or temporary federal initiatives.

Annual Recalculation and Timing Lag

FMAP is recalculated once per year using multi-year income data, meaning rates may reflect economic conditions from previous years rather than current real-time shifts. This lag can affect state fiscal planning during economic volatility.

Budgeting and Program Design Influence

Because FMAP determines the federal share of Medicaid spending, it directly influences how states design benefits, decide on optional coverage expansions, or respond to federal policy changes that alter matching rules.

How FMAP Works in Practice

FMAP operates as the practical engine behind Medicaid funding, determining in real time how much of a state’s Medicaid benefit spending is reimbursed by the federal government. Because every Medicaid claim ultimately flows through a federal–state cost-sharing arrangement, FMAP influences everything from annual budgets to day-to-day reimbursement strategy.

1. CMS Sets Each State’s FMAP Rate Annually

Each year, the federal government calculates a matching rate for every state based on the statutory per-capita income formula. These rates are published ahead of the new fiscal year so states can plan budgets and benefit structures accordingly.

2. States Spend First, Then Receive Federal Matching Funds

Medicaid is not pre-funded by the federal government. States pay Medicaid claims as they occur, and then the federal share is reimbursed based on the applicable FMAP rate. The state finances the remainder.

3. Standard FMAP Applies to Most Medicaid Services

For routine eligibility groups and covered services, the federal government reimburses the state using the regular FMAP. This includes most medical, behavioral health, outpatient, and inpatient Medicaid benefits.

4. Enhanced FMAP Applies When Statutes Require It

Certain services, populations, or programs qualify for enhanced matching rates above the standard FMAP. When a claim falls under an enhanced category (for example, CHIP-related costs or specific mandated preventive services), the federal reimbursement uses that higher enhanced rate instead.

5. FMAP Shapes State Policy Decisions

Because the federal share scales with FMAP, higher-FMAP states can expand optional benefits or eligibility categories with relatively less state spending per dollar of service. Lower-FMAP states face higher state cost burden for the same expansion, which affects program design.

6. FMAP Becomes Critical During Economic or Policy Shifts

During recessions or public health emergencies, Congress may temporarily raise FMAP to stabilize state Medicaid budgets. In practice, these temporary increases can preserve coverage, prevent provider payment reductions, and support rapid eligibility growth.

7. Providers Feel FMAP Indirectly Through State Reimbursement Capacity

FMAP doesn’t set provider rates directly, but it influences how much financial room a state has to increase reimbursement, add benefits, or extend managed-care contracts. States with fiscal strain and low match capacity may be slower to adopt expanded services or payment enhancements.

FMAP in Billing, Reimbursement, and System Limitations

FMAP is not a billing code or claims-processing rule, but it directly shapes Medicaid reimbursement by determining the federal share of every covered Medicaid dollar. Because FMAP drives how much of a program’s cost the federal government absorbs, it influences how states structure benefits, set provider payment rates, and decide whether optional services are financially sustainable.

How FMAP Affects Medicaid Reimbursement

States finance Medicaid claims upfront and receive federal reimbursement afterward based on the applicable FMAP rate. The higher a state’s FMAP, the more federal funding flows back for the same volume of services. This affects the state’s ability to maintain or increase provider payments, expand eligibility, or add optional benefits without exceeding state budget constraints.

FMAP and Enhanced Matching Categories

Some services and populations qualify for enhanced FMAP, meaning the federal government pays a higher percentage than the standard state match. In practice, enhanced matching is a major incentive tool. It makes certain policy choices cheaper for states to implement, such as expanding coverage for children, promoting preventive services, or adopting federally encouraged delivery reforms.

Budget Pressure and State Payment Capacity

Because states must cover the non-federal share, FMAP sets the baseline fiscal burden of Medicaid participation. Lower-FMAP states pay a larger share of every claim, which can create downward pressure on provider reimbursement levels, narrow benefit coverage, or slow adoption of optional programs. Higher-FMAP states have more financial flexibility to support reimbursement enhancements.

Timing Lag and Economic Mismatch

FMAP is calculated using multi-year historical income data, which means rates may not reflect current economic conditions. During sudden downturns, states can face rising Medicaid enrollment and costs while still operating under pre-recession FMAP levels, creating short-term fiscal strain until federal adjustments occur.

Operational Limitations for Policy Planning

FMAP provides a consistent funding structure but does not adjust dynamically to state-level healthcare cost variation, demographic shifts, or real-time program utilization changes. This creates planning challenges, especially for states experiencing rapid growth in high-need populations or care costs that outpace the assumptions behind their matching rate.

How FMAP Influences Quality, Access, and Equity

FMAP affects quality and equity indirectly by shaping state Medicaid capacity. Since Medicaid reimbursement levels and benefit breadth are closely tied to state budgets, the federal match rate influences how robustly states can support care access and provider participation.

FMAP and Access to Care

States with higher FMAP rates receive more federal support per Medicaid dollar spent, which can help stabilize coverage and maintain broader service access. Lower-FMAP states face higher state cost exposure, which may limit benefit expansions or constrain provider payment levels, potentially narrowing access in some regions.

Provider Participation and Network Stability

FMAP affects how competitive a state can make Medicaid reimbursement. When fiscal room is limited, states may struggle to raise rates to attract providers, leading to thinner networks, longer wait times, or geographic access gaps. Stronger match capacity can support more stable provider participation.

Equity Across State Economies

FMAP’s income-based design is intended to advance equity by directing higher federal support to states with lower fiscal capacity. This helps reduce the risk that low-income states provide materially weaker Medicaid programs simply because they cannot afford the same state share.

Risk of Within-State Disparities

Even with equitable federal-state matching, FMAP does not automatically eliminate inequities within a state. Rural or underserved communities may still face provider shortages or limited service availability if reimbursement remains low or administrative barriers persist.

Role During Public Health and Economic Shocks

Temporary FMAP increases during emergencies can preserve access and continuity of care when enrollment spikes. These increases help prevent cuts to benefits or provider rates that would disproportionately affect high-need and underserved populations.

Frequently Asked Questions about FMAP

1. What is FMAP?

FMAP is the Federal Medical Assistance Percentage—the formula Medicare uses to determine how much the federal government matches each state’s Medicaid spending. It sets the federal share of most Medicaid benefit costs.

2. How is FMAP calculated?

FMAP is calculated annually using a state’s per-capita income compared to the national average. States with lower per-capita income receive higher FMAP rates; higher-income states receive lower rates.

3. What does FMAP pay for?

FMAP applies to most Medicaid-covered services and populations. It determines how much the federal government reimburses the state for allowable Medicaid benefit spending.

4. What is the minimum and maximum FMAP a state can receive?

Federal law sets a minimum FMAP floor so that no state receives too low a match, and a maximum cap so that no state receives a match above the allowed limit. This keeps the cost-sharing structure stable nationwide.

5. What is enhanced FMAP (eFMAP)?

Enhanced FMAP refers to higher-than-standard federal matching rates applied to specific services or populations, such as CHIP, certain preventive services, family planning, or federally incentivized program expansions.

6. How is FMAP different from eFMAP?

FMAP is a state’s standard Medicaid matching rate. eFMAP is an elevated rate applied only to defined categories. A state can have multiple matching rates depending on what is being funded.

7. Why does FMAP matter for state Medicaid budgets?

FMAP determines the size of the federal contribution. Higher FMAP means the state pays less per Medicaid dollar, giving more budget flexibility. Lower FMAP increases the state cost burden and can limit benefit or payment expansions.

8. Does FMAP affect provider reimbursement rates?

Not directly. States set provider rates, but FMAP influences what states can afford. Higher match capacity can support stronger reimbursement, while lower match capacity can constrain rate increases.

9. How often does FMAP change?

FMAP is recalculated once per year and applies to the upcoming fiscal year. It can also be temporarily adjusted by Congress during economic downturns or public health emergencies.

10. Why is there a lag in FMAP updates?

FMAP uses multi-year historical income data, so a state’s rate may reflect earlier economic conditions rather than current shifts. This lag can create short-term mismatch during rapid economic change.

11. What happens when FMAP increases temporarily?

Temporary FMAP increases boost federal reimbursement, helping states maintain coverage and provider payments during periods of high Medicaid enrollment or fiscal stress.

12. Is FMAP only used in Medicaid?

Yes. FMAP is specific to Medicaid and related programs. Medicare is federally funded and does not use a state matching formula.