What is ERA (Electronic Remittance Advice) and the 835 Transaction in Medical Billing?

Electronic Remittance Advice (ERA) is the digital version of an Explanation of Benefits (EOB). It is a standardized electronic document that insurers send to providers to explain how a healthcare claim was processed — including the payment amount, Claim Adjustment Reason Codes (CARCs), Remittance Advice Remark Codes (RARCs), and the patient’s responsibility.

The ERA is transmitted in the HIPAA 835 transaction format, often referred to simply as an 835 file. In practice, the terms ERA and 835 are often used interchangeably. The ERA/835 includes all the details providers need to post payments electronically, reconcile claims, and track denials.

For providers and billing teams, ERAs eliminate manual posting from paper EOBs, reduce errors, and accelerate the revenue cycle management (RCM) process. They are essential for organizations seeking to automate claim reconciliation and denial management at scale.

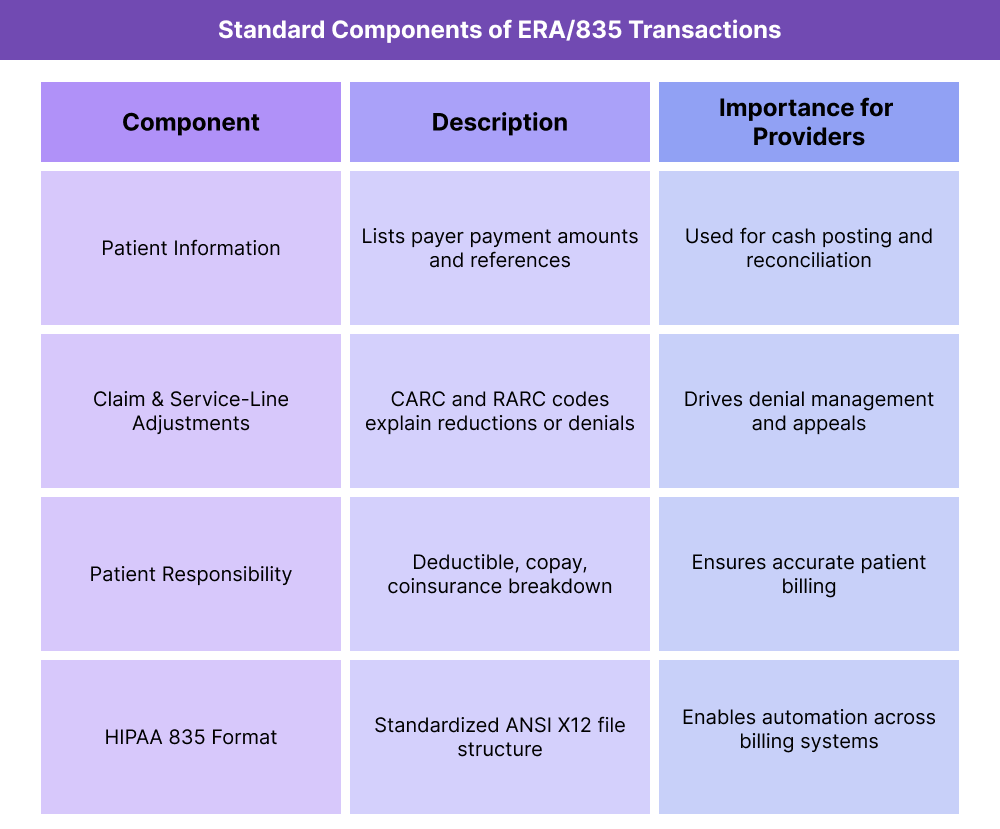

Key Components of ERA and 835 Transactions

An ERA (Electronic Remittance Advice) is more than just an electronic “bill explanation.” It is a structured dataset that follows the HIPAA 835 transaction standard, designed to support automation in payment posting, denial management, and reconciliation. Each ERA contains details that allow providers to match payer payments against billed services and identify variances quickly.

For billing teams, understanding the components of an ERA/835 is critical, since each section drives a specific part of the revenue cycle workflow — from reconciling payments to resolving denials.

Payment Information

- Lists the amount paid by the payer and ties it to specific claims and service lines.

- Provides check or EFT reference numbers for cash posting.

- Claim-Level and Service-Line Adjustments

- Includes CARC codes to explain financial adjustments (e.g., contractual obligations, coverage issues).

- Includes RARC codes to give additional narrative context.

Patient Responsibility

- Identifies the portion of the charges applied to deductible, copay, or coinsurance.

- Ensures providers bill patients only for amounts not covered by insurance.

- Technical Format: HIPAA 835 Transaction

- The 835 is the ANSI X12 file format that standardizes ERAs across payers.

- It ensures interoperability so that practice management systems can automatically read and post data.

How ERA and 835 Transactions Are Used in Healthcare Workflows

ERAs, transmitted in the 835 format, are built into the daily revenue cycle management (RCM) process. They streamline how providers reconcile payments, resolve denials, and post balances to patient accounts.

Step 1: Claim Adjudication by the Payer

- The provider submits a claim to the payer.

- The payer adjudicates the claim, applying benefits, contractual rules, and adjustments.

Step 2: ERA / 835 File Generated

- Instead of sending only a paper EOB, the payer creates an ERA in 835 format.

- The ERA includes payment information, adjustments (CARCs), remarks (RARCs), and patient responsibility.

Step 3: Transmission to Provider Systems

- The 835 file is transmitted electronically, often through a clearinghouse or direct payer-provider connection.

- The ERA integrates with the provider’s practice management system or EHR.

Step 4: Automated Payment Posting

- The ERA allows automated posting of payments to patient accounts.

- Adjustments and denials are recorded instantly, reducing manual keying errors.

Step 5: Denial Identification and Management

- Billing teams use CARC and RARC codes in the ERA to identify denials.

- Claims are routed to denial management workflows for appeals, corrections, or write-offs.

Step 6: Reconciliation and Reporting

- The ERA is used to reconcile payer deposits with claim-level payments.

- Data from ERAs feeds into KPI dashboards (denial rates, AR days, payment variances).

- Revenue cycle leaders use this reporting for compliance audits and payer contract reviews.

ERA and 835 in Billing, Reimbursement, and Revenue Cycle Management

The ERA/835 transaction is one of the most important tools for modern revenue cycle operations. By standardizing how remittance details are delivered, ERAs accelerate reimbursement, reduce manual errors, and give providers clearer visibility into payer decisions. However, like all systems, they come with limitations that providers must manage.

Direct Role in Reimbursement

- The ERA/835 communicates the payer’s final decision on a claim, including payment, adjustments, and patient responsibility.

- Providers use this data to post payments directly into their practice management or EHR systems.

- Because it is standardized, ERA/835 reduces delays caused by manual processing of paper EOBs.

Automation Benefits

- ERAs enable auto-posting of payments, drastically reducing staff time spent on manual entry.

- When paired with denial management software, ERAs help route claims to the correct workflow team automatically.

- Electronic reconciliation against bank deposits improves cash flow visibility.

Limitations and Challenges

- Payer Variability: Not all payers provide complete or consistent ERA/835 files, which can lead to mismatches.

- System Integration: Smaller practices may lack systems capable of fully ingesting ERA/835 data, forcing partial manual posting.

- Complexity: Denial codes (CARCs and RARCs) still require trained staff to interpret, even when delivered electronically.

- Transition Issues: Providers relying on paper EOBs face a learning curve when moving to full electronic workflows.

ERA and 835: Impact on Data Quality, Compliance, and Equity

The ERA/835 transaction improves not only reimbursement speed but also the accuracy, transparency, and fairness of the billing process. By replacing manual EOB posting with structured electronic data, it strengthens provider-payer relationships and supports compliance with regulatory standards.

Improving Data Quality and Auditability

- ERA/835 transactions create a consistent, machine-readable record of payments and adjustments.

- This standardization reduces posting errors and improves reporting accuracy across claims and payers.

- Audit trails generated from ERA/835 files allow providers to prove compliance during payer or CMS reviews.

Enhancing Transparency in the Revenue Cycle

- ERAs clearly outline payer logic using CARC and RARC codes, making adjustments easier to interpret.

- Providers gain real-time visibility into underpayments, denials, and patient responsibility.

- Patients benefit indirectly, since more accurate posting results in cleaner, less confusing statements.

Supporting Compliance and Regulatory Mandates

- The HIPAA 835 standard ensures all payers transmit remittance information consistently.

- Compliance staff use ERA/835 records to confirm payer adherence to federal transaction requirements.

- The files also support Medicare and Medicaid billing audits, reducing regulatory risk.

Equity and Access Considerations

- Smaller practices benefit from ERAs by reducing administrative burden, leveling the playing field with larger health systems.

- Faster and more accurate payment posting improves financial stability, which indirectly supports access to care in underserved communities.

- As payers continue to move toward electronic-only remittance, ensuring all providers — regardless of size — have access to ERA/835 tools is critical for equitable participation in value-based care.

ERA and 835 Frequently Asked Questions

1. What is ERA in medical billing?

ERA (Electronic Remittance Advice) is the digital version of an Explanation of Benefits (EOB). It explains how claims were paid, adjusted, or denied, and is delivered in the HIPAA 835 transaction format.

2. What is the 835 transaction in healthcare?

The 835 is the ANSI X12 HIPAA transaction standard used to transmit ERA files. It ensures all payers and providers use the same electronic format for remittance details.

3. What is the difference between ERA and 835?

- ERA: The content — an electronic explanation of benefits.

- 835: The standardized file format (ANSI X12) that transmits ERA data.

In practice, the terms are often used interchangeably.

4. How does ERA differ from an EOB?

An EOB (Explanation of Benefits) is a paper or PDF statement given to patients. An ERA is the electronic version of the same information, designed for provider billing systems to process automatically.

5. What information does an ERA/835 include?

ERAs include payer payment amounts, adjustments (CARCs), remarks (RARCs), and patient responsibility (copays, deductibles, coinsurance).

6. How do providers use ERA/835 files?

Providers import ERA/835 files into their billing or practice management systems to auto-post payments, reconcile deposits, and identify denials.

7. Why are ERA and 835 important for revenue cycle management?

ERAs reduce manual posting, speed up cash flow, and improve denial tracking. They are essential for providers seeking automation, compliance, and transparency in reimbursement.