What is Electronic Data Interchange (EDI)?

Electronic Data Interchange (EDI) is the standardized digital framework used across the healthcare industry to securely exchange administrative and financial data between providers, payers, clearinghouses, and government agencies.

In Medicare, EDI is the foundation for electronic claims submission, eligibility verification, payment remittance, and claim status updates, enabling providers to transmit HIPAA-compliant transaction files directly to Medicare Administrative Contractors (MACs).

EDI replaces manual, paper-based workflows with structured electronic messages—most notably the 837 claim and 835 Electronic Remittance Advice (ERA)—reducing processing time, improving accuracy, and supporting automated revenue cycle operations.

These transactions follow strict HIPAA X12 standards, ensuring that all payers interpret and process the data uniformly.

Providers must complete EDI enrollment with their MAC or commercial payer (either directly or through a clearinghouse) before transmitting claims. Once enrolled, organizations use EDI to:

- Submit professional and institutional claims

- Receive payment remittance files

- Check claim status

- Verify beneficiary eligibility

- Exchange secondary and crossover claim information

EDI is essential for compliant Medicare billing, supporting secure data transfer, automated front-end error detection, and consistent integration with practice management systems, EHRs, and clearinghouses.

Key Components of Targeted Probe and Educate (TPE)

Electronic Data Interchange (EDI) enables healthcare organizations to exchange standardized administrative and financial data with Medicare, commercial payers, and clearinghouses.

Its structure, rules, and transaction formats are governed by HIPAA X12 standards, ensuring consistent interpretation across all systems involved in claims and payment operations.

1. HIPAA X12 Transaction Standards

- EDI transactions follow the federally mandated HIPAA X12 formatting rules, which define:

- Required data segments

- Standardized field structures

- Accepted codes, qualifiers, and delimiters

- Validation criteria for file acceptance

- These standards ensure every payer—including Medicare Administrative Contractors (MACs)—can process data consistently, regardless of vendor or software system.

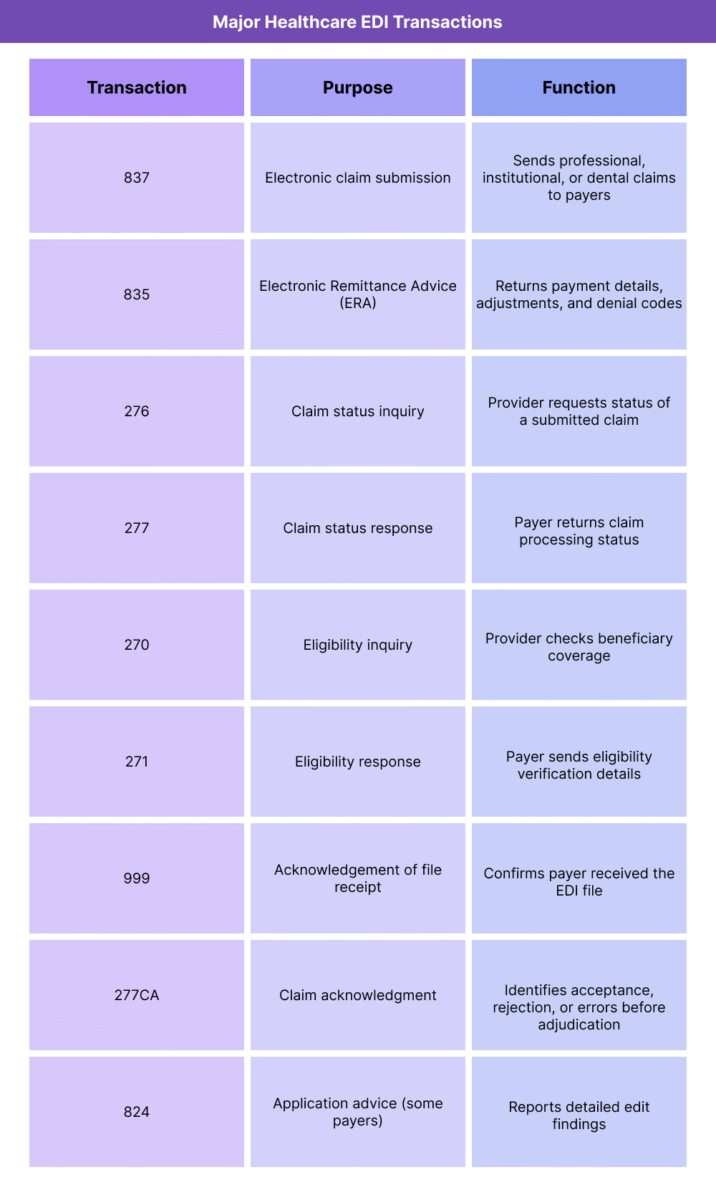

2. Core EDI Claim and Payment Transactions

- The most widely used EDI files in Medicare billing include:

- 837 – Electronic claims (professional, institutional, dental)

- 835 – Electronic Remittance Advice (ERA)

- 276/277 – Claim status inquiry and response

- 270/271 – Eligibility inquiry and response

- These transactions support the full lifecycle of revenue cycle management, from claim submission to final adjudication.

3. EDI Enrollment and Connectivity

- Before transmitting EDI transactions, providers must complete:

- EDI enrollment with their MAC or commercial payer

- EFT enrollment for electronic payments

- Clearinghouse setup (if not sending directly)

- Testing and validation to confirm compliance with payer specifications

- Enrollment ensures the provider’s NPI, PTAN, TIN, and submitter ID are properly authorized for EDI exchange.

4. Clearinghouse and Gateway Functions

- Clearinghouses serve as intermediaries that:

- Validate EDI files against payer rules

- Apply format checks and error detection

- Convert vendor-specific formats into HIPAA-compliant X12 files

- Route claims to the appropriate MAC or commercial payer

- Return acknowledgement reports and rejection messages

- Many organizations rely on clearinghouses to manage front-end edits before files reach Medicare.

5. Front-End Edits and Validation

- EDI submissions undergo multiple layers of validation:

- Technical edits: structural formatting and segment accuracy

- HIPAA edits: compliance with X12 standards

- Payer-specific edits: MAC policy rules, LCD/NCD indicators

- Clearinghouse edits: code validation, duplicate checks, NPI verification

- Claims that fail these edits are rejected before processing, reducing downstream denials.

6. Integration With EHR, PMS, and RCM Systems

- EDI is the backbone of electronic billing infrastructure, allowing systems to:

- Auto-generate 837 claims

- Automatically import 835 ERAs for posting

- Conduct real-time eligibility checks

- Automate claim follow-up with 276/277 data

- Track payer responses and processing timelines

- This integration enables end-to-end automation across the revenue cycle.

7. Compliance, Security, and Audit Requirements

- EDI transactions must meet strict requirements for:

- Data encryption

- Secure transmission protocols

- Authentication and access control

- HIPAA Privacy and Security Rule compliance

- Audit logging and traceability

- These measures ensure patient data remains secure throughout the exchange process.

How Electronic Data Interchange (EDI) Works in Practice

Electronic Data Interchange (EDI) is the operational backbone of modern Medicare billing.

Every claim submitted to a Medicare Administrative Contractor (MAC)—whether directly or through a clearinghouse—flows through an EDI pipeline that validates formatting, checks policy compliance, and routes files for adjudication.

From claim creation to payment posting, EDI enables automated, high-volume communication that reduces manual work and accelerates reimbursement.

Below is how EDI functions across real-world revenue cycle operations.

Step 1: Claim Creation in the EHR or Practice Management System

- The EDI workflow begins when a provider submits a claim through their:

- EHR (integrated billing module)

- Practice Management System (PMS)

- RCM platform

- The system automatically assembles an 837 file using structured data fields (diagnosis codes, procedure codes, NPI, charge amounts, dates of service, modifiers, place of service, etc.).

- For Medicare, this is typically:

- 837P – Professional claim

- 837I – Institutional claim

- The file is then queued for transmission.

Step 2: Clearinghouse Pre-Submission Review (Front-End Edits)

- Most providers route their EDI files through a clearinghouse before sending them to Medicare.

- The clearinghouse performs:

- HIPAA X12 compliance checks

- Code validation (CPT®, HCPCS, ICD-10)

- LCD/NCD-based edits (when rules are configured)

- Eligibility validations

- Formatting and structural checks

- Duplicate detection

- NPI/TIN/submitter ID verification

- If errors are found, the clearinghouse returns:

- 999 Acknowledgement – technical acceptance/rejection

- 277CA – claim-level acceptance/rejection with edit codes

- Providers must correct and resubmit before the claim reaches Medicare.

Step 3: Transmission to the MAC EDI Gateway

- Once cleared, the file is transmitted to the MAC’s EDI Front-End System, where Medicare performs its own set of checks:

- Syntax validation

- HIPAA X12 structural edits

- Payer-specific rule edits

- Medicare edits (e.g., invalid modifiers)

- Provider enrollment verification

- Medicare benefit category rules

- Claims failing MAC edits are rejected before adjudication—these do not become official Medicare denials.

Step 4: EDI Claim Acceptance and Entry Into Adjudication

If the EDI file passes all front-end edits, the MAC issues an electronic acknowledgment and loads the claim into the Medicare claims processing system.

From here:

- Covered charges are applied using the Medicare Physician Fee Schedule (MPFS)

- LCD/NCD rules are applied

- Bundling edits and CCI rules run

- Medical necessity is validated

- Claims may be sent to TPE or prepayment review (rare for clean EDI submissions)

- The EDI pathway ensures clean, structured data feeds the MAC’s adjudication engine.

Step 5: ERA (835) Delivery and Payment Posting

- When Medicare completes adjudication, the MAC transmits an 835 ERA (Electronic Remittance Advice) to the provider or clearinghouse, containing:

- Payment amounts

- Deductibles and coinsurance

- CARC/RARC denial codes

- Adjustment codes

- Crossovers to secondary payers

- Claim-level and line-level outcomes

- Practice management systems automatically:

- Import the 835

- Post payments

- Flag denials for follow-up

- Reconcile payer adjustments

- This automation dramatically reduces manual posting workload.

Step 6: Claim Status and Eligibility Transactions

- EDI also supports real-time administrative workflows:

- 276/277 – Claim status inquiry and response

- 270/271 – Eligibility inquiry and response

- These transactions help revenue cycle teams:

- Verify coverage before the visit

- Confirm deductible/coinsurance amounts

- Identify claim delays

- Track MAC processing stages

- Resolve rejections or denials efficiently

- EDI enables visibility across the lifecycle of every Medicare claim.

Step 7: Integration With Compliance, Audit, and RCM Workflows

- EDI transactions support:

- Denial management workflows (based on ERA codes)

- Audit preparedness (consistent coding and claim structure)

- TPE and RAC follow-up (easy record retrieval for reviewed claims)

- Reporting and analytics (ERA trend reports, rejection rate KPIs)

- Cash flow forecasting (predictable remittance cycles)

- Because EDI standardizes every data exchange, it becomes the backbone of audit defensibility and compliance tracing.

Step 8: Long-Term Optimization and Error Reduction

- Organizations enhance EDI performance by:

- Routing MAC edits into denial analytics

- Updating EHR templates to reduce rejected fields

- Configuring LCD/NCD-driven prompts

- Running monthly EDI error trend reports

- Using clearinghouse analytics for proactive correction

- Training staff on CARC/RARC interpretation

- Streamlining eligibility workflows with automated 270/271 checks

- Mature EDI programs drive higher first-pass acceptance and faster reimbursement.

EDI in Medicaid Billing, Reimbursement, and System Limitations

Electronic Data Interchange (EDI) is essential for accurate, timely Medicare reimbursement.

It ensures claims follow standardized submission rules and reach Medicare Administrative Contractors (MACs) in a format suitable for automated adjudication.

However, because EDI sits at the front of the billing workflow, any breakdown in formatting, transmission, or validation can create significant downstream delays that affect cash flow and denial rates.

EDI improves efficiency, but it also introduces technical dependencies and system limitations that revenue cycle leaders must navigate carefully.

How EDI Supports Billing and Reimbursement Accuracy

- EDI reduces administrative burden and enhances payment performance by:

- Eliminating manual claim entry

- Automating the 837 submission process

- Providing structured ERA files for automatic payment posting

- Standardizing payer communication

- Reducing coding and demographic errors through automated validation

- Supporting quick identification of claim acceptance or rejection

- When well-configured, EDI increases first-pass acceptance and accelerates the overall revenue cycle.

Common EDI Rejection and Error Patterns

- EDI rejections occur before adjudication and are typically caused by:

- Invalid or missing required data elements

- Incorrect NPI, TIN, or PTAN information

- Mismatched patient identifiers or DOB

- ICD-10 or CPT® coding errors

- Improper delimiter or segment formatting

- Claim-level structural errors

- Invalid MAC-specific rules (e.g., modifier requirements)

- Provider not enrolled for EDI or not authorized for specific claim types

- Because EDI rejects claims before processing, all associated reimbursement is delayed until corrections are made.

Impact on Cash Flow and Payment Timelines

- EDI delays can create major cash-flow disruptions:

- Front-end rejections halt payment entirely until corrected

- Rejected files cause batch delays for all claims within the transmission

- Incorrect enrollment or connectivity misconfigurations can block all claims to a payer

- Transmission failures may delay ERAs, slowing payment posting

- Clearinghouse routing issues can cause large-scale delays for multiple providers simultaneously

- Effective EDI workflows are directly tied to financial stability.

System Limitations and Technical Challenges

- Despite its standardization, EDI has inherent limitations:

- Legacy MAC systems may not support full real-time processing

- Some payers use outdated X12 versions or proprietary edits

Clearinghouse interpretations of EDI standards vary

- EHR/PMS software updates can break established EDI connections

- Segmentation errors can be difficult for staff to diagnose

- Complex benefit categories (e.g., DME, home health) may require additional or unique EDI fields

- Some MACs have limited support for attachments, requiring manual processing for documentation-heavy claims

- Because EDI is highly technical, small misconfigurations can cascade into large operational problems.

- Clearinghouse and MAC Variation

- Though EDI standards are national, real-world execution varies:

- Clearinghouses may apply different front-end edits

- MACs may require additional payer-specific fields

- ERA formats may vary in granularity or adjustment details

- Claim status response (277) detail levels vary by contractor

- This inconsistency increases complexity, especially for multi-state providers.

Interoperability Gaps

- EDI is highly standardized—but not truly interoperable. Challenges include:

- Limited support for clinical data exchange

- No direct linkage between documentation and claim fields

- Attachments often require separate portals or faxing

- Real-time connectivity is limited to specific transaction types (270/271, some 276/277)

- EDI does not reflect nuances of medical necessity beyond coded criteria

- These gaps mean that EDI alone cannot ensure documentation sufficiency or clinical completeness.

Security and Compliance Constraints

- EDI must comply with:

- HIPAA Privacy and Security Rules

- Encryption requirements for PHI transmission

- Audit trail and log retention policies

- Role-based access controls

- Timely breach detection and reporting

- While these safeguards protect patient data, they also increase operational complexity and IT burden.

Key Takeaway

EDI is indispensable for Medicare billing—but it also introduces technical dependencies, interoperability gaps, and front-end vulnerabilities that directly impact reimbursement.

Strong EDI governance, robust clearinghouse partnerships, and well-trained billing teams are essential to reducing rejects, maintaining cash flow, and ensuring compliance with MAC and CMS requirements.

How EDI Influences Quality, Access, and Equity in Medicaid Financing

Electronic Data Interchange (EDI) plays a critical role in shaping how equitably and efficiently Medicare claims are processed across the United States.

By standardizing communication between providers and payers, EDI helps reduce human error, improve documentation accuracy, and support consistent adjudication.

However, its reliance on technical infrastructure, IT resources, and specialized knowledge can create uneven administrative burdens, particularly for smaller or rural providers.

EDI’s influence on quality and equity extends beyond billing—it impacts access, administrative fairness, and the integrity of Medicare’s national payment system.

Improving Claims Quality Through Standardization

- EDI elevates quality by:

- Ensuring uniform claim structure across all providers

- Reducing errors caused by manual data entry

- Enforcing standardized CPT®, HCPCS, and ICD-10 coding

- Applying consistent HIPAA X12 validation rules

- Supporting clean claim submission through automated front-end edits

- This standardization leads to higher first-pass acceptance rates, more accurate adjudication, and fewer administrative delays.

Reducing Variability and Supporting National Consistency

- EDI ensures that Medicare claims:

- Follow the same structural rules nationwide

- Are evaluated based on consistent technical criteria

- Move through standardized MAC front-end validation

- Produce predictable 835 ERA outputs for payment posting

- Are easier to reconcile and audit due to uniform formatting

- This promotes equitable processing regardless of region, contractor, or provider size.

Enhancing Transparency Across the Revenue Cycle

- EDI transactions provide a clear and traceable audit trail:

- Automatic timestamps

- Detailed acknowledgement files (999, 277CA)

- Structured denial codes

- Standardized payment adjustment codes (CARC/RARC)

- Real-time eligibility confirmation

- This transparency strengthens both provider-level compliance and CMS’s national oversight.

Supporting Program Integrity and Reducing Improper Payments

- EDI supports program integrity efforts by:

- Flagging invalid claims before adjudication

- Detecting inconsistent coding or eligibility mismatches

- Preventing duplicate submissions

- Reducing manual-touch opportunities for error

- Providing structured data for RAC, CERT, UPIC, and TPE targeting algorithms

- Cleaner EDI data directly improves accuracy in improper payment measurement and audit targeting.

Equity Challenges: Resource Disparities Among Providers

- While EDI improves standardization, its technical demands can disproportionately burden smaller or underserved providers:

- Limited IT infrastructure

- Outdated EHR or PMS systems

- Lack of dedicated billing or compliance teams

- Reliance on manual workflows

- Higher risk of EDI rejections due to resource constraints

- These disparities can lead to:

- Longer reimbursement delays

- Higher denial and rejection rates

- Increased administrative workload

- Reduced stability for safety-net and rural practices

- In this context, EDI may unintentionally amplify administrative inequity within the Medicare ecosystem.

Interoperability Gaps and Workflow Burden

- EDI is highly structured but not fully interoperable:

- Attachments (documentation, images, reports) often require manual submission

- No direct integration with clinical data in EHRs

- No standardized method for transmitting NCD/LCD-specific documentation

- Limited ability to support real-time medical review workflows

- These gaps mean that EDI alone cannot ensure quality unless paired with strong internal documentation and compliance processes.

Balancing Automation With Provider Burden

- While EDI reduces manual work overall, its benefits are maximized when organizations have:

- Robust claim-scrubbing logic

- Up-to-date clearinghouse rules

- Skilled billing and IT teams

- Reliable internet and system infrastructure

- Training to interpret technical rejection codes

- Providers lacking these capabilities may find EDI more burdensome than empowering.

Key Insight

EDI is foundational to a fair, transparent, and efficient Medicare payment system.

It strengthens claims quality, supports nationwide consistency, and enhances program integrity.

However, the administrative and technical complexity of EDI can challenge smaller or resource-limited providers, making equitable access to digital infrastructure and billing support essential to achieving true administrative fairness across Medicare.

Frequently Asked Questions about EDI

1. What is Electronic Data Interchange (EDI) in healthcare?

EDI is the standardized digital system used to exchange administrative and financial healthcare data between providers, Medicare Administrative Contractors (MACs), payers, and clearinghouses.

It enables electronic claims (837), remittances (835), eligibility checks, and claim status inquiries using HIPAA-compliant X12 formats.

2. What is the purpose of EDI in Medicare billing?

EDI allows Medicare claims to be transmitted electronically, ensuring:

- Faster submission and adjudication

- Fewer manual errors

- Standardized claim formats

- Secure data exchange

- Automated remittance posting via 835 ERA files

Without EDI, Medicare billing would rely on slow, error-prone manual processes.

3. What EDI transactions are required for Medicare claims?

The core Medicare EDI transactions include:

- 837 – Claim submission

- 835 – Electronic Remittance Advice

- 276/277 – Claim status inquiry/response

- 270/271 – Eligibility inquiry/response

- 999 – Acknowledgement of file receipt

- 277CA – Claim acknowledgment with front-end edit results

These form the backbone of automated revenue cycle workflows.

4. Do providers need to enroll for EDI with Medicare?

Yes. Providers must complete:

- EDI enrollment with their MAC

- EFT enrollment for payments

- Clearinghouse setup (if applicable)

- Submitter ID registration

- Testing/validation before live transmission

Without enrollment, Medicare cannot accept or return EDI files.

5. What causes EDI rejections?

Common rejection reasons include:

- Invalid NPI, TIN, or PTAN

- Missing required segments or data elements

- Incorrect CPT®, HCPCS, or ICD-10 coding

- Structural formatting errors

- MAC-specific front-end edits

- Eligibility mismatches

- Delimiter or segment issues

- Invalid claim type or benefit category

EDI rejections occur before adjudication, delaying all payment until corrected.

6. What is the difference between an EDI rejection and a denial?

- EDI Rejection:

Happens before Medicare accepts the claim. The claim never enters adjudication.

Must be corrected and resubmitted. - Denial:

Occurs after the claim is processed and adjudicated based on medical necessity, LCD/NCD rules, or coverage criteria.

Can be appealed.

Understanding this distinction is essential for accurate denial management.

7. Why do claims still get denied if they passed EDI validation?

EDI checks technical correctness, not medical necessity.

A claim may pass EDI edits but still be denied due to:

- LCD/NCD requirements

- Missing documentation

- Incorrect diagnosis coding

- Frequency limitations

- Medical necessity issues

- Provider enrollment restrictions

EDI removes formatting errors—but clinical and policy-based errors still drive denials.

8. Do all providers need a clearinghouse for EDI?

Not always. Options include:

- Direct-to-MAC submission (common for hospitals and large systems)

- Clearinghouse submission (common for small to mid-size practices)

Clearinghouses offer additional scrubbing, routing, and analytics capabilities that improve first-pass acceptance rates.

9. How does EDI support eligibility and claim status workflows?

EDI enables:

- 270/271 – Real-time eligibility verification

- 276/277 – Claim status checks

These reduce manual follow-up and support automated workflows within RCM platforms.

10. Is EDI required under HIPAA?

Yes—HIPAA mandates the use of standardized X12 EDI formats for:

- Claims

- Remittance advice

- Eligibility verification

- Claim status inquiries

Paper and non-standard electronic formats are not compliant for Medicare FFS billing.