What is Durable Medical Equipment (DME)?

Durable Medical Equipment (DME) refers to medically necessary, physician-ordered equipment that supports a Medicare beneficiary’s health, mobility, safety, or functional independence in the home.

To qualify as DME under Medicare guidelines, an item must be:

- Durable (able to withstand repeated use)

- Medically necessary for a diagnosed condition

- Primarily used for a medical purpose

- Not generally useful in the absence of illness or injury

- Appropriate for home use rather than institutional care

Common examples include wheelchairs, walkers, CPAP devices, oxygen supplies, hospital beds, commode chairs, and certain orthotics or prosthetic items.

Most DME is billed using HCPCS Level II codes, and Medicare coverage is administered by specialized DME Medicare Administrative Contractors (DME MACs) responsible for claims processing, policy enforcement, and supplier oversight.

Medicare imposes strict requirements for:

- Face-to-face examinations

- Detailed written orders

- Medical necessity documentation

- Proof of delivery (POD)

- Ongoing use and compliance (e.g., sleep apnea devices)

- Prior authorization for certain high-cost or high-utilization DME categories

Because DME is frequently targeted for improper payments, audits, and program integrity reviews, suppliers must adhere to federal DMEPOS Supplier Standards, maintain accurate records, and follow CMS billing rules closely.

Durable Medical Equipment plays a critical role in supporting chronic disease management, mobility, safety, and home-based care—making it central to Medicare beneficiaries’ long-term functioning and independence.

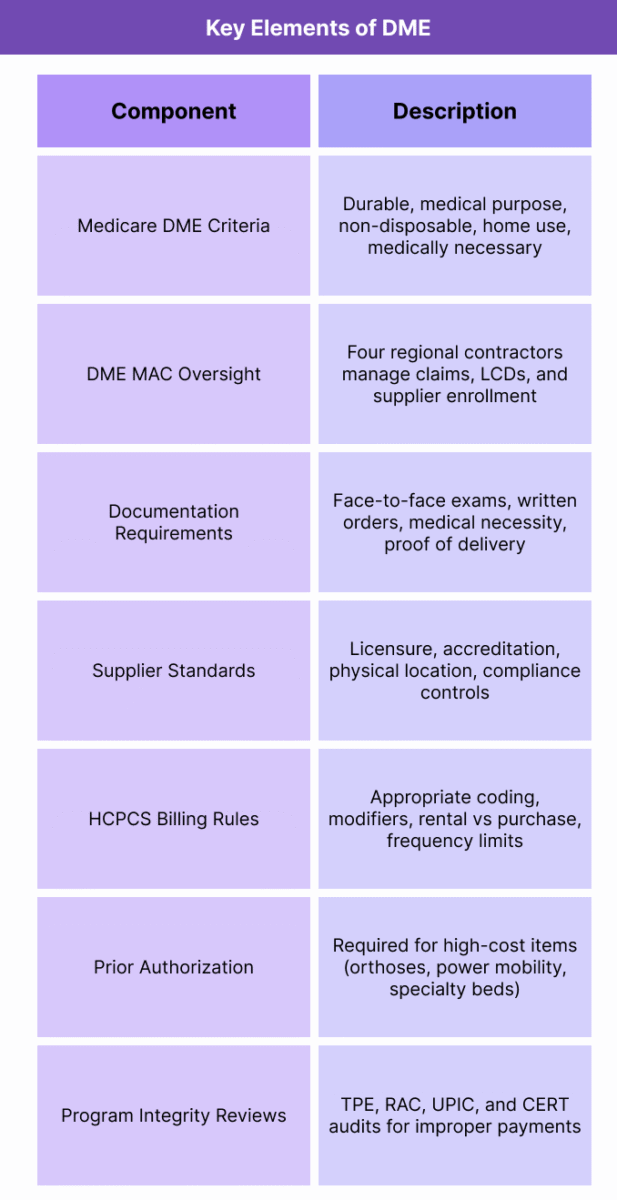

Key Components of Durable Medical Equipment (DME)

Durable Medical Equipment (DME) is governed by a structured set of Medicare rules that define product categories, medical necessity requirements, supplier obligations, documentation standards, and oversight mechanisms.

Because DME is highly regulated and prone to improper payment risk, CMS enforces rigorous compliance expectations through DME MACs, DMEPOS Supplier Standards, and detailed policy manuals.

Below are the foundational elements that determine how DME is covered, billed, documented, and supplied under Medicare.

1. Medicare Definition and Eligibility Criteria

- Medicare covers an item as DME only if it meets all five criteria:

- Durable: Withstands repeated use.

- Medical Purpose: Primarily serves a medical function.

- Non-Disposable: Not useful to a person without illness or injury.

- Home Use: Appropriate for use in the beneficiary’s home.

- Medically Necessary: Ordered by a qualified provider for a diagnosed condition.

- Failure to meet any criterion results in non-coverage.

2. DME MAC Jurisdiction and Policy Oversight

- DME claims are processed and administered by four regional DME MAC jurisdictions (A–D).

- Their responsibilities include:

- Claims adjudication

- Coverage policy interpretation

- Supplier enrollment and enforcement

- Medical review and audits

- Local policy updates (LCDs for DME)

- These contractors ensure consistent application of CMS rules across states.

3. Coverage Rules and Product Categories

- DME includes a wide range of equipment:

- Mobility devices: Wheelchairs, walkers, scooters

- Respiratory devices: CPAP/BiPAP, oxygen supplies

- Home safety equipment: Hospital beds, commode chairs

- Orthotics and prosthetics: Braces, artificial limbs

- Monitoring/support devices: Blood glucose monitors, nebulizers

- Each category has unique HCPCS codes, documentation standards, and evidence requirements.

4. Documentation Requirements

- DME is documentation-intensive.

- Common requirements include:

- Face-to-face evaluation prior to ordering the item

- Detailed written order (DWO) or Standard Written Order (SWO)

- Medical necessity documentation in the medical record

- Supporting test results, diagnoses, and clinical findings

- Proof of delivery (POD) showing the beneficiary received the equipment

- Incomplete documentation is the leading cause of DME denials.

5. DMEPOS Supplier Standards

- DME items must be furnished by suppliers who meet CMS’s DMEPOS Supplier Standards, which require:

- State licensure

- Accreditation by an approved organization

- Physical business location requirements

- Complaint and record-keeping processes

- Customer service, repair, and replacement protocols

- Fraud prevention controls

- Suppliers that fail to uphold these standards may lose billing privileges.

6. Billing Rules and HCPCS Coding

- DME billing relies heavily on:

- HCPCS Level II codes

- Applicable modifiers (e.g., NU = new, RR = rental, MS = multi-function device)

- Rental vs. purchase rules (many items must be rented first)

- Frequency limits and replacement cycles

- Prior authorization (for select high-cost items)

- Capped rental categories with recurring monthly billing

- Correct coding determines payment accuracy and compliance.

7. Prior Authorization and Utilization Controls

- CMS requires prior authorization for certain DME categories, including:

- Orthoses

- Power mobility devices

- Certain hospital beds

- Some pressure-reducing support surfaces

- Prior authorization helps prevent:

- Improper utilization

- Duplicate or non-medically necessary orders

- Beneficiary harm due to inappropriate equipment

8. Program Integrity and Audit Exposure

- DME faces high scrutiny from:

- DME MACs

- UPICs

- RACs

- CERT audits

- TPE (Targeted Probe and Educate)

- Common audit triggers include:

- Missing face-to-face documentation

- Invalid medical necessity

- Missing proof of delivery

- Incorrect modifiers or HCPCS codes

- Excessive utilization patterns

- DME suppliers must maintain strict internal controls to avoid recoupments and penalties.

How Durable Medical Equipment (DME) Works in Practice

The real-world lifecycle of Durable Medical Equipment (DME) involves coordinated clinical, administrative, and billing activities across the ordering provider, DME supplier, clearinghouse, and DME MAC.

Because Medicare imposes strict documentation and supplier requirements, each step must be executed precisely to avoid denials, audits, or delays in beneficiary access.

Below is the full operational workflow from clinical evaluation through claim adjudication and ongoing compliance.

Step 1: Clinical Evaluation and Medical Necessity Determination

- The process begins with a provider assessing the Medicare beneficiary’s medical condition and determining whether DME is clinically appropriate.

- Typical requirements include:

- Face-to-face evaluation with documentation of functional limitations, diagnoses, and therapeutic rationale

- Assessment of mobility, respiratory status, or home safety needs

- Confirmation that alternatives (e.g., medication adjustments, physical therapy) have been considered

- Medicare requires this documentation before the order is written.

Step 2: Creating the DME Order

- Once medical necessity is established, the provider must issue a Standard Written Order (SWO) or, if applicable, a Detailed Written Order (DWO) that includes:

- Beneficiary information

- Ordering provider NPI

- DME item description (HCPCS code or narrative)

- Quantity

- Frequency and duration (if applicable)

- Signature and date

- Certain items require additional clinical documentation (e.g., polysomnogram results for CPAP devices).

Step 3: Supplier Intake and Documentation Review

- The Medicare-enrolled DME supplier receives the order and:

- Verifies patient identity and Medicare eligibility

- Confirms the provider’s Medicare enrollment status

- Reviews documentation for medical necessity criteria

- Requests missing clinical notes, test results, or forms

- Ensures compliance with DMEPOS Supplier Standards

- High-risk items undergo additional internal compliance checks due to audit exposure.

Step 4: Prior Authorization (If Required)

- For items subject to DME Prior Authorization, the supplier must submit:

- The order

- Clinical records

- Supporting test results

- Supplier documentation

- Required forms or medical justification templates

- The DME MAC issues:

- Affirmed decision – item can be supplied and billed

- Non-affirmed decision – supplier must correct documentation before delivery

- Prior authorization protects beneficiaries and reduces improper payments.

Step 5: Delivery, Setup, and beneficiary Education

- Once approved, the supplier:

- Delivers the DME to the beneficiary’s home

- Provides setup, fitting, or installation (if required)

- Educates the beneficiary on safe use, cleaning, maintenance, and replacement rules

- Collects Proof of Delivery (POD) with beneficiary signature and date

- POD is mandatory for Medicare billing and frequently audited.

Step 6: Claim Submission to the DME MAC

- The supplier submits a claim to the DME MAC using:

- HIPAA X12 837 electronic format

- Appropriate HCPCS Level II codes

- Required modifiers (e.g., NU, RR, MS, KX)

- Diagnosis codes supporting medical necessity

- Pricing, rental indicators, or capped rental sequences

- Prior authorization tracking number, if applicable

- Claims flow through clearinghouse and MAC EDI edits before adjudication.

Step 7: Payment, ERA Posting, and Follow-Up

- Once adjudicated, the DME MAC returns an 835 ERA detailing:

- Allowed amounts

- Coinsurance and deductible

- CARC/RARC denial codes

- Rental cycle progression

- Competitive bidding adjustments (if applicable)

- Suppliers then:

- Post payments

- Correct and resubmit rejected claims

- Track rental periods (up to 13 months for capped rentals)

- Manage patient cost-sharing and replacement intervals

Step 8: Ongoing Compliance and Equipment Monitoring

- Depending on the item, Medicare may require long-term monitoring, including:

- Compliance tracking (e.g., CPAP usage hours)

- Re-certification of medical necessity

- Maintenance logs

- Replacement justification for lost, stolen, or irreparably damaged equipment

- Failure to meet follow-up rules may terminate coverage for ongoing rentals.

Step 9: Audit Vulnerabilities and Documentation Management

- DME is a high-risk category for improper payments, making suppliers subject to:

- TPE audits

- UPIC reviews

- RAC post-payment audits

- CERT error sampling

- Common findings include:

- Missing or late face-to-face documentation

- Incomplete or incorrect orders

- Missing POD

- Insufficient medical necessity

- Incorrect HCPCS coding or modifiers

- To mitigate exposure, suppliers maintain robust documentation, internal checklists, and compliance workflows.

DME in Medicaid Billing, Reimbursement, and System Limitations

Durable Medical Equipment (DME) reimbursement is governed by some of the most complex and restrictive rules in the Medicare program.

Because DME is prone to improper payments, Medicare uses strict documentation, rental cycles, supplier standards, and audit controls—all of which influence how claims are paid and how frequently denials occur.

These rules help maintain program integrity but also create reimbursement vulnerabilities for providers, suppliers, and revenue cycle teams.

How Medicare Pays for DME

- Medicare reimburses most DME under Part B using:

- HCPCS Level II codes

- Fee schedule rates established by CMS

- Modifiers indicating new equipment (NU), rentals (RR), repairs, or special circumstances

- Capped rental rules for many items

- Competitive bidding rates in certain geographic areas

- Prior authorization for select categories

- Payment is typically made to the supplier, not the ordering provider.

Rental vs. Purchase Rules

- Medicare categorizes DME into:

- Capped Rental Items

Most DME falls under capped rental rules (e.g., wheelchairs, oxygen, hospital beds).

Medicare pays suppliers monthly for up to 13 months, after which ownership may transfer to the beneficiary. - Inexpensive or Routinely Purchased Items

Purchased outright on the first claim (e.g., canes, walkers). - Oxygen and Respiratory Equipment

Paid under a separate 36-month rental period, with an additional maintenance period. - Frequent & Substantial Servicing Items

Paid continuously on a rental basis due to maintenance requirements (rare category).

- Capped Rental Items

- Rental rules often create:

- Billing complexity

- Patient confusion about ownership

- Tracking burdens for suppliers

- Increased error risk in month-to-month claims

Common DME Denial and Reimbursement Challenges

- DME denials typically arise from:

- Missing or invalid face-to-face documentation

- Incomplete or incorrect orders

- Failure to meet local coverage determination (LCD) criteria

- Missing or invalid proof of delivery (POD)

- Incorrect, outdated, or mismatched HCPCS codes

- Missing modifiers (e.g., KX, NU, RR)

- Prior authorization not obtained

- Beneficiary non-compliance (e.g., CPAP usage requirements)

- Frequency or replacement limits not met

- Competitive bidding restrictions

- These denials often result in overpayment recoupment or full non-coverage.

Competitive Bidding and Geographic Pricing

- Medicare’s DME Competitive Bidding Program (CBP) significantly affects reimbursement:

- Only selected contract suppliers may furnish certain equipment in competitive bidding areas.

- Fee schedule amounts are based on bid pricing, not standard national rates.

- Non-contract suppliers may not bill Medicare for bid items unless an exemption applies.

- This creates:

- Regional payment variation

- Limited supplier choice for beneficiaries

- Operational challenges for national suppliers

- Not all DME categories or regions are currently under active bidding, but pricing remains influenced by prior bidding cycles.

Documentation Complexity and Medical Necessity Burden

- DME is one of Medicare’s most documentation-heavy categories.

- Suppliers must maintain complete files that include:

- Physician/NPP progress notes

- Face-to-face visit documentation

- Detailed written orders

- Objective test results (e.g., sleep studies)

- Continued need/continued use documentation for rentals

- Signed POD forms

- Any gap—no matter how minor—can invalidate payment.

System Limitations Affecting Reimbursement

- DME reimbursement relies on older administrative infrastructure that introduces limitations:

- DME MACs often have older adjudication systems, making claims sensitive to structural errors.

- Limited interoperability prevents direct submission of attachments with claims.

- Suppliers must use multiple portals for documentation uploads, prior authorization, and claim corrections.

- ERA detail levels vary by region, complicating denial analysis.

- Manual interventions are often required for oxygen, orthotics, and multi-component mobility devices.

- Coordination between suppliers, physicians, and Medicare can be slow, resulting in delays.

- Audit Exposure and Program Integrity Controls

DME is a top target for:

- UPIC investigations

- RAC post-payment audits

- TPE (Targeted Probe and Educate) cycles

- CERT error rate sampling

- Contractor prepayment reviews

- High-risk triggers include:

- High utilization patterns

- Inadequate medical necessity documentation

- Missing POD

- Suppliers with prior error trends

- Mobility device ordering patterns

- Oxygen recertification gaps

- Audit outcomes may include recoupments, education cycles, payment holds, or revocation of supplier billing privileges.

Key Takeaway

Medicare’s DME reimbursement framework is intentionally stringent.

While the system protects program integrity and patient safety, it also creates complex operational requirements that demand precise documentation, coding accuracy, and compliant supplier practices.

Even small deviations can result in non-payment, recoupments, or long-term audit exposure

How DME Influences Quality, Access, and Equity in Medicaid Financing

Durable Medical Equipment (DME) plays a foundational role in maintaining mobility, independence, and safety for millions of Medicare beneficiaries.

Because DME often supports chronic conditions, respiratory stability, post-acute recovery, and home-based care, equitable access is directly tied to overall quality of life and long-term outcomes.

However, variability in supplier availability, geographic pricing, documentation complexity, and beneficiary affordability creates meaningful equity challenges—particularly for rural, low-income, and medically complex populations.

Supporting Clinical Quality and Patient Independence

- When appropriately prescribed and supplied, DME:

- Reduces hospitalizations and ED visits

- Prevents falls and injuries

- Supports chronic disease management (e.g., CPAP for sleep apnea)

- Improves mobility and functional independence

- Enables home-based recovery and long-term care

- Enhances respiratory and mobility outcomes

- Quality improves significantly when beneficiaries can access safe, properly fitted, medically necessary equipment in a timely manner.

Barriers to DME Access for Medicare Beneficiaries

- Despite its clinical importance, patients face persistent access challenges:

- Supplier shortages in rural and underserved regions

- Long wait times due to documentation requirements

- Limited availability of contract suppliers in competitive bidding areas

- Higher out-of-pocket costs for non-assigned claims

- Difficulties navigating complex rental and replacement rules

- Insufficient beneficiary education on equipment use and maintenance

- These barriers disproportionately impact older adults with mobility limitations or chronic respiratory conditions.

Equity Challenges Linked to Competitive Bidding

- The DME Competitive Bidding Program (CBP) was designed to reduce fraud and lower Medicare costs, but it also affected equity:

- Many small suppliers exited the market, reducing local availability

- Beneficiaries in rural/non-bid areas experienced pricing differentials

- Contract suppliers may not stock certain niche or specialty items

- Geographic price variation can result in unequal access or delivery delays

- CMS has acknowledged these issues and implemented reforms, but the effects persist in many regions.

Administrative Burden on Providers and Suppliers

- The extensive documentation and compliance requirements create disparities between well-resourced organizations and smaller practices or suppliers:

- Smaller suppliers may struggle with prior authorization, multiple portals, or onerous audit cycles

- Providers with limited staffing may fail to produce timely face-to-face or clinical documentation

- Lower-resourced communities experience more frequent delays, rejections, or non-coverage decisions

- These operational inequities translate into real patient access challenges.

Beneficiary Affordability and Cost-Sharing Considerations

- Medicare beneficiaries often face:

- 20% coinsurance on DME

- Potentially high rental accumulations over time

- Costs for repairs, replacements, or upgrades

- Cost-sharing disparities between assigned and non-assigned suppliers

- Low-income beneficiaries may delay or forgo needed DME due to cost barriers, affecting clinical stability and safety.

Program Integrity vs. Equity Balance

- DME is heavily audited due to historical improper payment rates.

- While these controls safeguard Medicare funds, they also contribute to:

- Delays in delivery

- Increased documentation burden

- Higher denial rates for minor technical issues

- Variability in supplier willingness to serve high-complexity patients

- Balancing fraud prevention with equitable access remains an active CMS priority.

Key Insight

DME is essential to functional independence and chronic care management.

Equity challenges arise not from the equipment itself but from the administrative, financial, and market structures surrounding it.

Improving supplier availability, reducing documentation burden, and modernizing competitive bidding are central to ensuring all Medicare beneficiaries—regardless of geography or income—can receive safe, timely, medically necessary equipment.

Frequently Asked Questions about DME

1. What qualifies as Durable Medical Equipment under Medicare?

Medicare defines DME as equipment that is durable, medically necessary, primarily medical in purpose, not useful without illness or injury, and appropriate for home use.

Examples include walkers, wheelchairs, CPAP devices, oxygen supplies, hospital beds, braces, and certain prosthetic items.

2. How does Medicare pay for DME?

Medicare Part B reimburses DME using:

- HCPCS Level II codes

- Fee schedule rates

- Modifiers (NU, RR, KX, etc.)

- Rental vs. purchase rules

- Competitive bidding pricing in select areas

Many items fall under capped rental, where Medicare pays monthly for up to 13 months.

3. What documentation is required for DME claims?

Key requirements include:

- Face-to-face evaluation documenting medical necessity

- Standard Written Order (SWO) or Detailed Written Order

- Clinical notes supporting the diagnosis and functional need

- Objective test results when required (e.g., sleep study)

- Proof of delivery (POD) after the item is supplied

Missing documentation is the most common cause of denials.

4. What is a DME MAC?

A DME MAC (Durable Medical Equipment Medicare Administrative Contractor) is a specialized regional Medicare contractor responsible for:

- Processing DME claims

- Interpreting coverage rules

- Managing supplier enrollment

- Conducting medical review and audits

There are four DME MAC jurisdictions covering the U.S.

5. Does DME require prior authorization?

Yes—for certain high-cost or frequently scrutinized items, including:

- Power mobility devices

- Some orthoses

- Certain hospital beds

- Pressure-reducing support surfaces

A claim will be denied if prior authorization is required and not obtained.

6. Why do DME claims get denied?

Common reasons include:

- Missing or incomplete face-to-face documentation

- Missing or incorrect written orders

- Insufficient medical necessity support

- Missing proof of delivery

- Incorrect HCPCS coding or modifiers

- Failure to meet LCD requirements

- Prior authorization not obtained

- Beneficiary non-compliance (e.g., CPAP usage)

7. What is proof of delivery (POD) and why is it important?

Proof of delivery verifies that the beneficiary received the equipment.

It must include:

- Beneficiary name

- Item description or HCPCS code

- Delivery date

- Signature of the beneficiary or authorized representative

POD is commonly requested in audits and missing POD will result in full recoupment.

8. Can a beneficiary choose their DME supplier?

Usually yes—but in competitive bidding areas, beneficiaries must use contract suppliers for certain DME items unless an exception applies.

Outside these areas, they may choose any Medicare-enrolled supplier.

9. Is DME covered for nursing home residents?

Generally no—Medicare covers DME for home use, not for beneficiaries in skilled nursing facilities (SNFs) or other institutional settings.

Coverage resumes when the beneficiary returns home.

10. What is the difference between DME and DMEPOS?

DMEPOS stands for Durable Medical Equipment, Prosthetics, Orthotics, and Supplies, representing the broader category of items covered under Medicare’s Part B DME program.

DME is one subset of DMEPOS.