What is the Medicare CBP(Competitive Bidding Program)?

The Medicare Competitive Bidding Program (CBP) is a CMS payment and supplier selection system for certain categories of Durable Medical Equipment, Prosthetics, Orthotics, and Supplies (DMEPOS). Under CBP, Medicare sets reimbursement rates for selected DMEPOS items through a supplier bidding process rather than relying solely on the standard fee schedule. Suppliers submit bids to provide specific products within defined geographic regions, and CMS uses those bids to establish payment amounts and award contracts.

CBP applies only to designated product categories and Competitive Bidding Areas (CBAs). In CBAs, Medicare beneficiaries generally must obtain covered CBP items from contract suppliers to receive full coverage. The program is intended to reduce unnecessary cost variation, limit overutilization, and strengthen oversight of high-spend equipment categories while maintaining access and quality standards.

From an operational and billing standpoint, CBP introduces additional compliance and market constraints for suppliers and ordering providers. Suppliers must meet contract requirements to bill Medicare for CBP items in a given CBA, and ordering workflows must confirm beneficiary location, product category status, and supplier eligibility to avoid denials or unexpected patient liability. For healthcare organizations, understanding CBP rules is essential to ensuring compliant DMEPOS ordering, accurate reimbursement, and continuity of equipment access for Medicare patients.

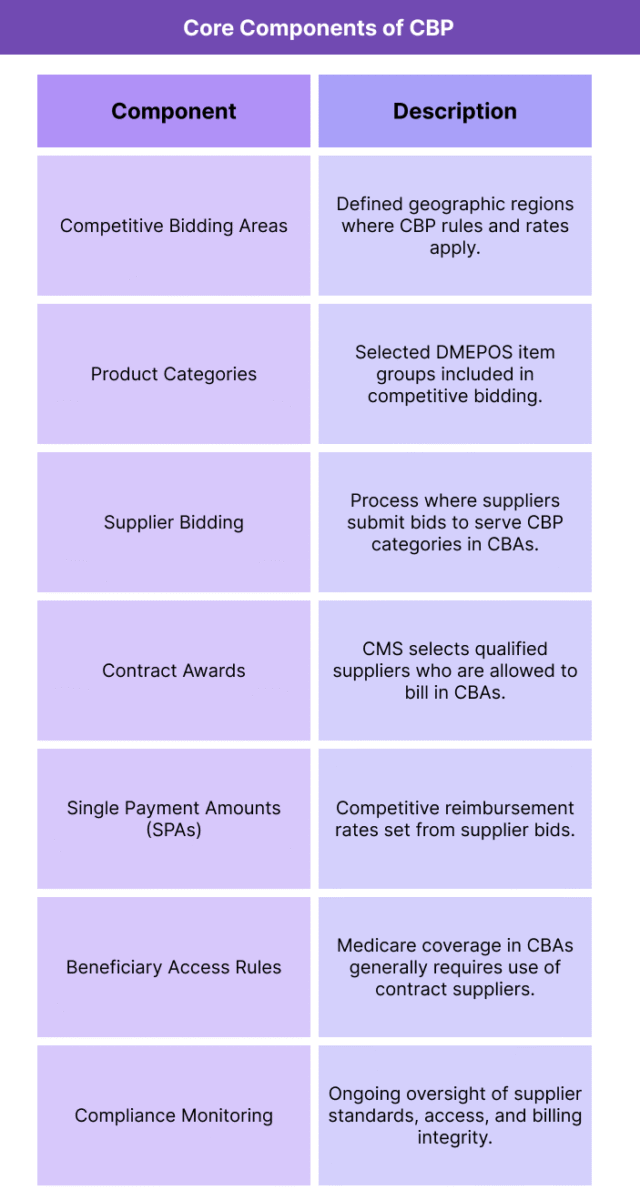

Key Components of the CBP

The Medicare Competitive Bidding Program is structured to set DMEPOS payment rates through market-based bidding while controlling which suppliers can serve beneficiaries in specific geographic regions. Its framework combines product category targeting, defined bidding regions, supplier contracting, and beneficiary access rules into one coordinated payment and oversight system.

CBP’s components are designed to lower program costs, reduce improper billing risk, and standardize equipment pricing, while still ensuring that beneficiaries can obtain medically necessary items through qualified suppliers.

Competitive Bidding Areas (CBAs)

CBP operates within geographically defined Competitive Bidding Areas. These are the regions where CMS applies competitive bidding rules and where contract suppliers are authorized to provide selected items to Medicare beneficiaries.

Product Categories

Only certain DMEPOS categories are included in CBP, typically those with high volume, high spending, or higher improper payment risk. CMS defines which products are competitively bid and updates category lists as the program evolves.

Supplier Bidding Process

Suppliers submit bids to provide specific CBP product categories within CBAs. Bids reflect what suppliers are willing to accept for those items, and CMS uses bid data to establish competitive payment rates.

Contract Supplier Awards

Based on bid evaluation and qualification criteria, CMS awards contracts to selected suppliers. Only contract suppliers can bill Medicare for CBP items within a CBA, except in limited grandfathered or special access situations.

Single Payment Amounts (SPAs)

CBP sets a Single Payment Amount for each competitively bid item. The SPA becomes the Medicare reimbursement rate in CBAs, replacing the standard fee schedule amount for those products.

Beneficiary Access and Network Rules

In CBAs, beneficiaries generally must use contract suppliers to receive full Medicare coverage for CBP items. These access rules are supported by supplier network adequacy requirements to ensure availability and service quality.

Compliance and Monitoring Controls

CMS monitors supplier performance, beneficiary access, complaint patterns, and billing integrity. Suppliers that fail contract standards or compliance requirements may face corrective actions or contract termination.

How CBP Works in Practice

The Medicare Competitive Bidding Program operates through a defined cycle that sets payment rates and restricts billing eligibility for certain DMEPOS items in specific regions. In practice, CBP affects how suppliers participate in Medicare, how providers order equipment, and how beneficiaries access covered items.

1. CMS Defines the Bidding Areas and Product Categories

CMS first establishes which geographic regions will function as Competitive Bidding Areas (CBAs) and identifies the DMEPOS product categories that will be included in the next bidding round. These selections are based on spending patterns, utilization volume, and program integrity priorities.

2. Suppliers Submit Bids in Target CBAs

Suppliers that want to serve Medicare beneficiaries in a given CBA submit bids for specific product categories. Bids represent the rates suppliers are willing to accept to provide those items, along with required supplier qualification information.

3. CMS Evaluates Bids and Awards Contracts

CMS reviews bids for price reasonableness and supplier qualifications, then selects contract suppliers for each product category in each CBA. Suppliers that do not win contracts generally cannot bill Medicare for CBP items in that region.

4. Single Payment Amounts Replace Fee Schedule Rates

Using bid results, CMS establishes Single Payment Amounts (SPAs) for CBP items. These SPAs become the reimbursement rates in CBAs, replacing the standard DMEPOS fee schedule amounts for the competitively bid products.

5. Beneficiaries Use Contract Suppliers in CBAs

When a Medicare beneficiary living in a CBA needs a CBP item, they are directed to contract suppliers to receive full Medicare coverage. If a beneficiary uses a non-contract supplier (outside limited exceptions), Medicare may not cover the item or may reduce payment, increasing beneficiary liability.

6. Providers and Care Teams Adjust Ordering Workflows

Ordering clinicians and discharge teams must account for CBP rules by confirming whether an item is competitively bid and whether the patient’s address is within a CBA. Referrals must be routed to eligible contract suppliers to avoid delays and coverage problems.

7. CMS Monitors Access, Quality, and Billing Integrity

After contracts begin, CMS tracks supplier performance, beneficiary access complaints, and billing patterns. Suppliers must maintain contract standards and compliance requirements over time or risk corrective action or removal from the program.

CBP in Billing, Reimbursement, and System Limitations

The Medicare Competitive Bidding Program changes both how certain DMEPOS items are reimbursed and who is allowed to bill for them. Because CBP replaces fee schedule rates with bid-based pricing and restricts supplier eligibility in Competitive Bidding Areas, it directly affects claims outcomes, ordering workflows, and audit exposure.

How CBP Payment Rates Are Determined

In CBAs, CBP establishes Single Payment Amounts (SPAs) for each competitively bid item. These SPAs are the reimbursement rates Medicare will pay, regardless of what a supplier charges. For included product categories, SPAs override the standard DMEPOS fee schedule and become the allowed amount used in claims adjudication.

Billing Rules for Contract vs Non-Contract Suppliers

Only contract suppliers can bill Medicare for CBP items furnished to beneficiaries who live in a CBA, except in limited grandfathering or special access exceptions. Non-contract suppliers that provide competitively bid items in CBAs generally cannot receive payment, which can result in claim denials and beneficiary cost liability if ordering pathways are not aligned.

Impact on Ordering and Referral Workflows

CBP requires providers and discharge teams to confirm two factors before directing a patient to a supplier: whether the ordered item is in a competitively bid product category and whether the beneficiary’s address falls within a CBA. Referral mistakes—such as sending a CBA beneficiary to a non-contract supplier—can delay delivery and trigger payment problems.

Compliance Risk and Medical Review Exposure

CBP items continue to be subject to all standard DMEPOS ordering and documentation rules. Suppliers in CBAs are also monitored for contract compliance, access patterns, and billing integrity. High denial rates, unusual utilization trends, or weak documentation can lead to intensified review, corrective actions, or loss of contract status.

System Limitations and Access Pressure Points

CBP can reduce supplier networks within CBAs, which may create access friction when contracted suppliers are limited, backlogged, or distant from beneficiaries. This is especially challenging for complex equipment needs, time-sensitive discharge scenarios, or patients who require specialized fitting and follow-up support.

Operational Burden for Multi-Region Suppliers

Suppliers serving both CBA and non-CBA regions must maintain dual pricing, inventory, and billing logic. Managing contract renewal cycles, SPA updates, and geographic eligibility rules adds administrative overhead that can strain smaller suppliers or create variability in service availability.

How CBP Influences Quality, Access, and Equity

The Medicare Competitive Bidding Program was designed to lower costs while preserving beneficiary access to essential DMEPOS items. Its influence extends beyond pricing into how reliably beneficiaries receive equipment, how suppliers structure service delivery, and how equity-sensitive access holds up across different communities.

CBP and Quality of DMEPOS Delivery

By requiring contract suppliers to meet enrollment, accreditation, and service standards, CBP aims to maintain baseline quality while discouraging low-quality or noncompliant billing. In well-functioning markets, CBP can support consistent delivery standards and reduce improper utilization without undermining equipment safety or clinical appropriateness.

Access to Equipment in Competitive Bidding Areas

CBP changes access pathways because beneficiaries in CBAs generally must use contract suppliers. When contract networks are adequate, access remains stable. However, if supplier density is low, delivery capacity is limited, or beneficiaries have specialized equipment needs, access can be delayed or narrowed compared with non-CBA regions.

Effects on Rural and Underserved Communities

Access risks are most pronounced in rural or medically underserved areas where supplier numbers are already thin. If competitive bidding reduces local participation or consolidates services into fewer regional suppliers, beneficiaries may face longer wait times, fewer product options, or greater travel burdens.

Equity Implications for High-Need Beneficiaries

CBP can unintentionally amplify disparities when beneficiaries require high-touch DMEPOS support—such as complex mobility equipment, oxygen setup, or prosthetic fitting—and local contract options are limited. Patients with lower health literacy, limited caregiver support, or less ability to navigate supplier networks may be more vulnerable to disruptions.

Balancing Cost Containment With Patient Outcomes

CBP strengthens cost predictability and reduces unnecessary price variation, which helps sustain Medicare resources over time. Equity and quality outcomes improve when cost savings do not come at the expense of supplier responsiveness, product quality, or localized access capacity.

Program Oversight and Responsiveness

CBP’s impact on equity depends heavily on how well CMS monitors network adequacy, beneficiary complaints, and product availability. When gaps are identified and corrected quickly, access and quality risks can be mitigated. When oversight lags, disruptions disproportionately affect vulnerable communities.

Frequently Asked Questions about CBP

1. What is the Medicare Competitive Bidding Program (CBP)?

CBP is a CMS program that sets reimbursement rates for certain DMEPOS items through supplier bidding and limits which suppliers can bill Medicare for those items in specific geographic regions.

2. What items are included in CBP?

CBP applies only to selected DMEPOS product categories. These typically include high-volume or high-spend items such as certain mobility equipment, respiratory supplies, and other commonly used home-based medical equipment.

3. What is a Competitive Bidding Area (CBA)?

A CBA is a geographic region where CBP rules apply. Medicare beneficiaries who live in a CBA must generally use contract suppliers for CBP items to receive full coverage.

4. How does CBP change Medicare payment amounts?

Instead of using standard fee schedule rates, CBP establishes Single Payment Amounts (SPAs) based on supplier bids. SPAs become the Medicare reimbursement rates for CBP items within CBAs.

5. Who can bill for CBP items in a CBA?

Only contract suppliers awarded through the competitive bidding process can bill Medicare for CBP items furnished to beneficiaries in CBAs, except for limited exceptions.

6. What happens if a beneficiary uses a non-contract supplier in a CBA?

In most cases, Medicare will not pay, or will pay less, for CBP items from non-contract suppliers in CBAs. This can lead to claim denials and increased out-of-pocket costs for the beneficiary.

7. How do providers know if a patient is in a CBA?

Providers and discharge teams must check the beneficiary’s home address against CBA maps and confirm whether the ordered item is part of a competitively bid category before referring to a supplier.

8. What is a Single Payment Amount (SPA)?

An SPA is the fixed reimbursement rate CMS sets for a competitively bid item in a CBA. It replaces the standard fee schedule amount for that item within CBP regions.

9. Does CBP affect all Medicare beneficiaries?

No. CBP only affects beneficiaries who live in CBAs and only for items included in competitively bid product categories.

10. Why was CBP created?

CBP was created to reduce Medicare spending on certain DMEPOS categories, prevent overutilization, and strengthen supplier oversight, while maintaining beneficiary access and quality.

11. Can CBP create delays in DMEPOS delivery?

Yes. If contract supplier networks are limited or referrals are sent to non-contract suppliers, beneficiaries may experience ordering delays, reduced product choice, or delivery disruptions.

12. How often does CBP change?

CBP operates in rounds or cycles. CMS periodically updates CBA definitions, product categories, supplier contracts, and SPAs through new bidding and program rulemaking.