What Are Intergovernmental Transfers (IGTs)?

Intergovernmental Transfers (IGTs) are financial transactions between government entities, typically from local or state public hospitals to the state Medicaid agency, used to finance the non-federal share of Medicaid payments. Authorized under Section 1903(w) of the Social Security Act, IGTs allow states to draw federal matching funds (FMAP) while maintaining compliance with federal cost-sharing rules.

IGTs are a cornerstone of Medicaid financing flexibility, enabling states to support hospitals and other public providers without increasing general fund expenditures. Through IGTs, local government entities—such as county-owned hospitals or health systems—transfer funds to the state, which then uses those funds to make supplemental Medicaid payments (e.g., DSH or UPL payments).

All IGTs must be voluntary, non-federal in origin, and properly documented to ensure transparency and prevent impermissible provider donations or circular funding flows. The Centers for Medicare & Medicaid Services (CMS) requires that IGT sources be auditable and derived from state or local tax revenues rather than provider-generated income.

IGTs are frequently paired with Certified Public Expenditures (CPEs) as mechanisms for financing the state share of Medicaid payments. While both achieve similar goals, IGTs involve the transfer of public funds, whereas CPEs rely on documented public expenditures certified by the contributing entity.

Properly structured, IGTs allow states to leverage local public resources to sustain safety-net hospitals, expand access, and support equitable reimbursement across the Medicaid system—while maintaining federal funding integrity under CMS oversight.

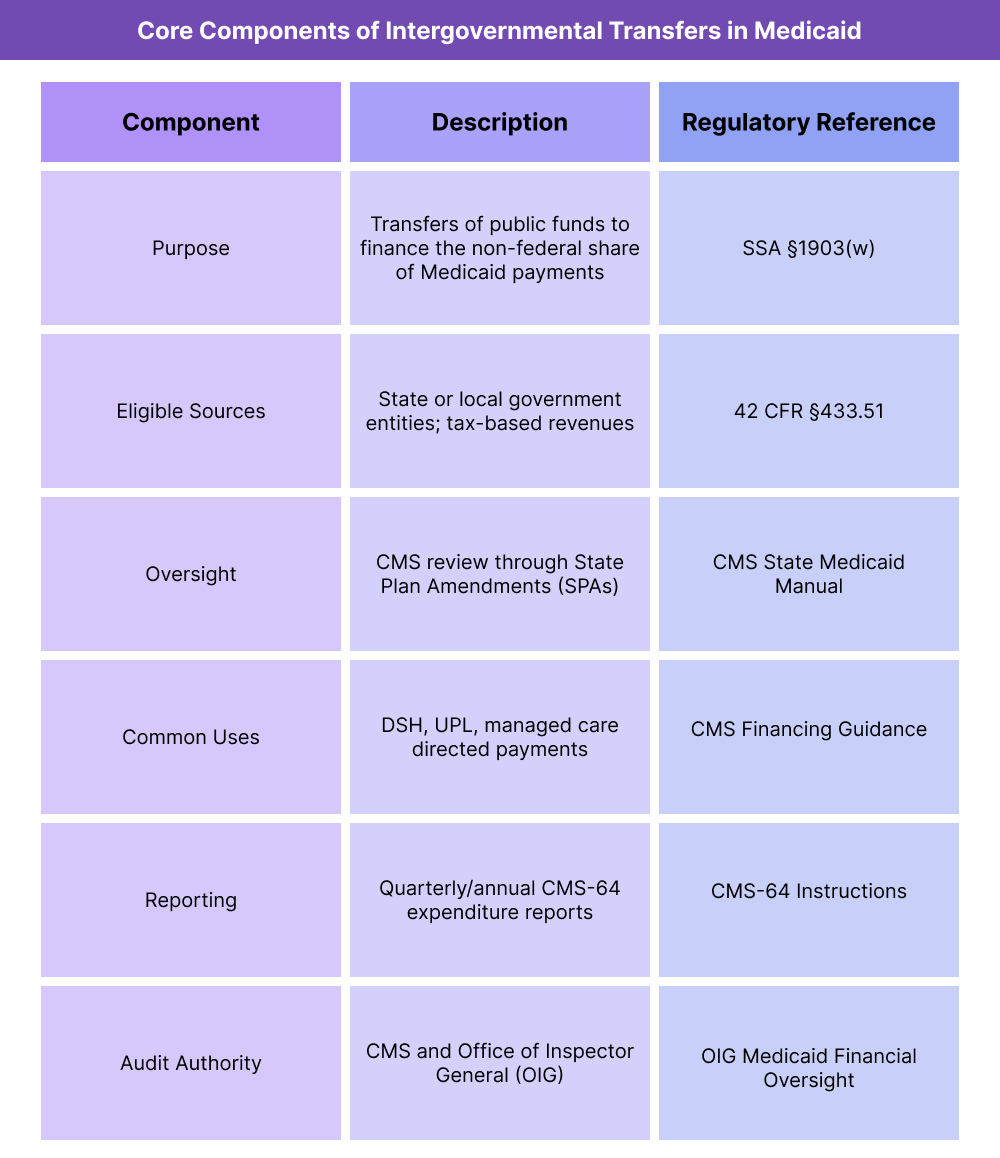

Key Components of Intergovernmental Transfers (IGTs) Payments

Intergovernmental Transfers (IGTs) form the backbone of state Medicaid financing, allowing public entities—such as county or university hospitals—to contribute funds that the state uses to draw down federal matching dollars (FMAP). These transfers help sustain safety-net providers, fund supplemental payments, and maintain budget neutrality within the Medicaid program.

CMS closely regulates IGT use to ensure that all funds are non-federal, transparent, and compliant with federal cost-sharing standards.

1. Purpose and Policy Framework

- IGTs enable states to fund the non-federal share of Medicaid expenditures without relying solely on general state appropriations.

- The transferred funds are used to match federal Medicaid dollars for payments such as:

- DSH (Disproportionate Share Hospital) payments

- UPL (Upper Payment Limit) supplements

- Directed payments in managed care arrangements

- The framework ensures that local governments and public hospitals can directly invest in the Medicaid system, supporting provider stability and access to care.

2. Eligible Sources and Legal Requirements

- Under 42 CFR §433.51, IGTs must come from state or local government entities—not private providers.

- Eligible sources include:

- State general funds

- Local tax revenues

- Transfers from county or district hospital authorities

- All IGT funds must be non-federal in origin, meaning they cannot include other federal grants, loans, or pass-through funds.

- CMS requires traceability and certification that all IGT funds originate from public sources.

3. CMS Oversight and Compliance

- IGT arrangements are reviewed by CMS through State Plan Amendments (SPAs) or Medicaid Managed Care approvals.

- CMS ensures that IGTs are voluntary, properly documented, and free of provider donations or coercion.

- States must report:

- The source and amount of IGT contributions

- The purpose and payment type (DSH, UPL, directed payment, etc.)

- The receiving entity and the timing of the transfer

- CMS may conduct financial management reviews and audits to confirm compliance with federal cost-sharing requirements.

4. Relationship to Other Medicaid Financing Mechanisms

- IGTs frequently operate in tandem with:

- CPEs (Certified Public Expenditures) – documentation-based financing from public providers.

- DSH – hospital payments financed partially through IGTs.

- UPL – supplemental payments supported by IGT-based state share funding.

- Together, these tools form a comprehensive Medicaid financing framework that supports equitable reimbursement and fiscal balance.

5. Transparency, Reporting, and Audit Requirements

- States must submit quarterly and annual expenditure reports (Form CMS-64) that identify IGT sources and uses.

- CMS requires public disclosure of IGT funding sources in State Plan Amendments.

- Independent audits verify that IGT funds are not recycled or used to inflate federal match claims.

- The Office of Inspector General (OIG) periodically reviews IGT programs for compliance and recommends policy corrections where misuse or ambiguity exists.

6. Challenges and Policy Considerations

Although IGTs are vital to Medicaid financing, they present ongoing oversight challenges, including:

- Ensuring documentation integrity across multiple local entities.

- Preventing circular fund flows or “recycling” of federal dollars.

- Maintaining compliance in complex managed care IGT arrangements.

- CMS continues to refine IGT guidance to increase transparency, accountability, and alignment with value-based care objectives.

How Intergovernmental Transfers (IGTs) Work in Practice

Intergovernmental Transfers (IGTs) are a foundational Medicaid financing mechanism that allows local and state public entities to share in funding Medicaid payments.

In practice, IGTs move public dollars from one government body—such as a county hospital district—to the state Medicaid agency, which then uses those funds to draw down federal matching dollars (FMAP) and distribute supplemental payments to providers.

Step 1: Identifying Eligible Funding Entities

- The process begins when the state Medicaid agency identifies public entities capable of providing IGT funding.

- Typical contributors include:

- County and municipal hospital systems

- State university medical centers

- Public health authorities and hospital districts

- Each entity must confirm that its funds are public in origin and not derived from federal sources.

- The state Medicaid agency maintains a registry of IGT-contributing entities as part of its CMS compliance documentation.

Step 2: Structuring the Transfer

- The public entity enters into a funding agreement with the state Medicaid agency, outlining:

- The amount to be transferred

- The timing of the transfer

- The Medicaid program(s) supported (e.g., DSH, UPL, or managed care directed payments**)

- Funds are transferred through state treasury accounts or other authorized financial systems to ensure traceability.

- CMS requires that all IGT transfers be voluntary and non-contingent on payment return to the transferring entity.

Step 3: Drawing Federal Matching Funds

- Once IGT funds are deposited into the state’s Medicaid account, the state can claim the federal match at its applicable Federal Medical Assistance Percentage (FMAP) rate.

- The federal share is drawn from CMS and combined with the IGT amount to create the total payment pool.

- The resulting funds are used to finance Medicaid supplemental payments, such as DSH or UPL distributions.

- This process allows states to maximize federal participation while ensuring no reliance on private or recycled funds.

Step 4: Payment Distribution to Providers

- The state Medicaid agency disburses the combined funds to eligible hospitals or provider groups as supplemental payments.

- Payments may take the form of:

- Disproportionate Share Hospital (DSH) payments

- UPL (Upper Payment Limit) adjustments

- Directed payments for Medicaid managed care plans

- Each payment must comply with federal cost limits and CMS-approved State Plan Amendment (SPA) provisions.

- IGT-funded payments are generally non-claim-based and issued on a quarterly or annual schedule.

Step 5: Documentation and Certification

- For every IGT transaction, the transferring entity must provide:

- A certification letter affirming the public source of funds

- Documentation verifying that funds are not federally sourced or loaned

- The state includes these certifications in its CMS-64 expenditure reports, identifying both the amount and origin of IGT contributions.

- Independent auditors and CMS financial management teams review these certifications during annual Medicaid financial audits.

Step 6: Reporting and Oversight

- States must report IGT activities quarterly via the CMS-64 form, detailing:

- The program category (DSH, UPL, managed care, etc.)

- Total non-federal share financed through IGTs

- Corresponding federal matching amounts

- CMS and the Office of Inspector General (OIG) review IGT records as part of broader Medicaid financial integrity monitoring.

- Any improper fund source or circular transaction may result in federal disallowances or repayment obligations.

Step 7: Coordination with Other Medicaid Financing Tools

- IGTs are often combined with CPEs (Certified Public Expenditures) to finance the full state share of Medicaid payments.

- Both mechanisms allow public entities to sustain Medicaid funding without relying on general appropriations.

- Proper coordination between IGTs, UPL, and DSH programs ensures compliance with federal cost limits while maintaining budget neutrality and provider stability.

IGTs in Medicaid Billing, Reimbursement, and Fiscal Limitations

Intergovernmental Transfers (IGTs) play a crucial role in financing Medicaid reimbursement by supplying the non-federal share of many supplemental payment programs.

While essential to state flexibility, IGTs introduce significant fiscal oversight, reporting, and audit responsibilities to ensure federal funds are used appropriately and that no circular financing arrangements occur.

How IGTs Affect Medicaid Reimbursement

- IGTs directly influence the flow of federal matching funds (FMAP) within state Medicaid programs.

- When a public entity transfers funds to the state, those funds become part of the total Medicaid payment pool, allowing the state to draw the corresponding federal match.

- This structure enables states to maintain or expand Medicaid provider payments without increasing general fund spending.

- Common IGT-financed reimbursements include DSH, UPL, and directed payments in managed care.

- Because IGTs impact total Medicaid expenditures, they must be carefully documented to ensure compliance with federal upper payment and budget neutrality requirements.

Funding Flow and Reimbursement Mechanics

- Once an IGT is received, the state Medicaid agency records it as state share revenue.

- The state then submits a claim to CMS for the federal match under the applicable FMAP rate.

- The combined funds—state share plus federal share—form the payment base for Medicaid disbursements.

- These payments are distributed to providers as supplemental reimbursements, typically outside normal claim cycles.

- Each transaction must be reported in the CMS-64 expenditure report to maintain financial transparency.

Fiscal Limitations and Federal Constraints

- Federal rules prohibit the use of federal-origin funds (e.g., grants, loans, or pass-through dollars) as IGT sources.

- All transfers must represent public funds under governmental control, derived from state or local tax revenues.

- States must certify that IGTs are voluntary and non-recursive—meaning the transferring entity does not receive payment back in exchange for its contribution.

- Failure to comply can result in disallowance of federal match or recoupment of FFP (Federal Financial Participation) funds.

- CMS may request documentation of IGT sources at any time as part of a financial management review or audit.

Audit and Compliance Exposure

- The Office of Inspector General (OIG) and CMS auditors frequently review IGT programs to ensure integrity in Medicaid financing.

- Common audit findings include:

- IGTs traced to federal or ineligible sources.

- Lack of documentation for fund origin or certification.

- Circular transactions where payments are returned to contributors.

- States found in violation must repay the federal share, often triggering program reforms or new CMS-approved State Plan Amendments (SPAs).

- Robust internal audit procedures and quarterly reconciliation reports help minimize exposure and ensure federal compliance.

Fiscal Risks and Reform Trends

- Overreliance on IGTs can lead to budget fragility, especially if local public entities face revenue shortfalls or legal restrictions on transfers.

- Some states have adopted hybrid financing models, pairing IGTs with CPEs to diversify the state share and reduce audit risk.

- CMS continues to refine its IGT oversight through:

- Expanded financial reporting templates within CMS-64.

- Increased transparency requirements in SPAs and managed care approvals.

- Guidance aligning IGTs with value-based purchasing and payment equity objectives.

- These reforms aim to preserve the financial utility of IGTs while strengthening accountability and fiscal sustainability across Medicaid systems.

Key Takeaway

IGTs are both a powerful fiscal tool and a compliance-sensitive mechanism within Medicaid reimbursement. When properly managed, they allow states to leverage local resources and secure federal funding efficiently. However, without rigorous documentation and oversight, they present significant audit and disallowance risks.

Transparency, accurate reporting, and CMS-aligned controls remain essential to ensure IGTs continue supporting Medicaid access, equity, and financial integrity.

How IGTs Influence Quality, Access, and Equity in Medicaid Financing

While Intergovernmental Transfers (IGTs) are primarily a financing mechanism, their impact extends well beyond fiscal operations. By allowing states to leverage local public resources for Medicaid funding, IGTs indirectly shape care access, equity, and sustainability within safety-net systems.

Properly managed, IGTs help ensure that hospitals serving vulnerable populations receive the financial support necessary to maintain quality and continuity of care.

Supporting Access Through Public-Provider Financing

- IGTs enable county and public hospitals to contribute directly to the Medicaid system, ensuring they can recover costs for high volumes of low-income patients.

- This financing structure helps sustain critical access, trauma, and teaching hospitals that form the backbone of care for Medicaid and uninsured populations.

- Without IGTs, many public facilities—particularly in rural or high-need urban areas—would face funding shortfalls that limit services or staffing capacity.

- By stabilizing these hospitals financially, IGTs preserve access to emergency, inpatient, and specialty care for vulnerable groups.

Advancing Equity Across the Medicaid Delivery System

- Because IGTs originate from public sources, they reinforce the principle that state and local governments share responsibility for equitable healthcare access.

- Transfers often flow from higher-revenue counties or public hospital systems into broader statewide payment pools, redistributing resources to areas of greater need.

- This intergovernmental collaboration helps mitigate regional disparities in Medicaid reimbursement and promotes financial fairness among provider networks.

- When aligned with equitable payment models, IGTs support CMS’s overarching goals of reducing health disparities and strengthening the safety net.

Impact on Hospital Quality and Performance

- Stable Medicaid financing through IGTs allows hospitals to maintain adequate staffing, infrastructure, and quality improvement programs.

- Reliable supplemental payments funded by IGTs help prevent care degradation caused by chronic underpayment or delayed reimbursements.

- States incorporating value-based metrics into IGT-supported payment arrangements can further link financial stability to measurable quality outcomes.

- CMS has encouraged states to integrate IGT-funded payment models into delivery system reform and quality improvement initiatives, promoting accountability alongside fiscal flexibility.

Transparency and Accountability as Quality Drivers

- CMS’s increased oversight of IGTs—via public disclosure of funding sources, SPA transparency, and audit verification—is also a quality and equity measure.

- Transparent financing ensures that supplemental Medicaid payments reach intended providers and communities, not intermediaries or administrative layers.

- Clear visibility into IGT flows allows states to align funding with documented health outcome priorities, such as maternal health, behavioral health, and rural access.

- As Medicaid evolves toward value-based care, transparency in IGT operations will remain critical to balancing financial compliance with equitable program delivery.

Ensuring Sustainable Equity Through Oversight and Reform

- CMS continues to refine IGT regulations to improve accountability without undermining local flexibility.

- Policy initiatives focus on:

- Enhanced reporting requirements in the CMS-64 for all non-federal share sources.

- Guidance on managed care IGTs, ensuring fair and transparent payment across regions.

- Integration with equity frameworks, prioritizing funding for hospitals serving medically underserved and minority populations.

- By maintaining strict oversight while encouraging public participation, IGT policy reforms aim to support long-term equity and fiscal integrity in Medicaid financing.

Frequently Asked Questions about IGTs

1. What are Intergovernmental Transfers (IGTs)?

Intergovernmental Transfers (IGTs) are financial transactions between public entities, such as county hospitals or local health authorities, and the state Medicaid agency. These transfers provide the non-federal share of Medicaid payments, allowing states to draw down federal matching funds (FMAP) under Section 1903(w) of the Social Security Act.

2. How do IGTs work in Medicaid financing?

IGTs enable local public providers to contribute public funds to the state Medicaid agency. The state then combines those funds with the federal match to make Medicaid payments such as DSH (Disproportionate Share Hospital), UPL (Upper Payment Limit), or directed payments.

This mechanism allows states to sustain Medicaid reimbursement without increasing general fund spending, while maintaining compliance with CMS financing rules.

3. Who can participate in IGTs?

Only state or local government entities can initiate IGTs—typically:

- County or municipal hospital systems

- Public university medical centers

- State-owned health agencies or hospital districts

Private hospitals and non-governmental organizations cannot contribute IGT funds, as the transfers must originate entirely from public, non-federal sources.

4. What are the CMS rules for IGT compliance?

CMS requires that all IGTs be:

- Voluntary – not coerced or tied to a return payment.

- Non-federal in origin – derived from state or local revenues.

- Documented and traceable – supported by certification letters and financial reports.

States must disclose IGT details through State Plan Amendments (SPAs) and CMS-64 expenditure reports, subject to audit review.

5. How are IGTs related to DSH and UPL payments?

- IGTs often serve as the state funding source for supplemental Medicaid programs:

- DSH – IGTs finance part of the state’s share of payments to safety-net hospitals.

- UPL – IGTs help fund payment adjustments ensuring Medicaid reimbursements stay below Medicare-equivalent ceilings.

In both cases, IGTs expand a state’s ability to maximize federal matching funds while maintaining compliance with cost limits.

6. What are the risks of noncompliance with IGT rules?

Improperly structured IGTs—such as those funded with federal dollars, lacking documentation, or involving circular fund flows—can trigger federal disallowances or repayment demands.

Audit findings by CMS or the Office of Inspector General (OIG) may result in financial penalties, reduced future payments, or mandatory State Plan Amendments to correct compliance issues.

7. Why are IGTs important for Medicaid equity and access?

IGTs ensure that public hospitals serving low-income and uninsured populations receive sustained Medicaid funding. By leveraging local tax-based resources, IGTs promote financial stability, provider retention, and equitable access to care across regions.

Properly managed IGT programs reinforce CMS’s goals of transparency, fiscal integrity, and health equity in the Medicaid system.