What Are Certified Public Expenditures (CPEs)?

Certified Public Expenditures (CPEs) are state or local government expenditures on Medicaid-covered services that are formally certified as the non-federal share of Medicaid funding. Authorized under Section 1903(w) of the Social Security Act, CPEs enable states to claim federal matching funds (FMAP) without requiring a direct cash transfer, unlike Intergovernmental Transfers (IGTs).

In a CPE arrangement, a public healthcare provider—such as a state university medical center or county hospital—documents its actual incurred costs for delivering Medicaid services. The state then uses that certified cost data to claim the federal match from the Centers for Medicare & Medicaid Services (CMS). Once approved, the federal share is reimbursed to the state, completing the payment cycle.

CPEs provide a transparent, auditable means for public entities to finance Medicaid payments while maintaining compliance with federal cost-sharing rules. They are widely used in DSH (Disproportionate Share Hospital), UPL (Upper Payment Limit), and directed payment programs, particularly when states seek to leverage public hospital expenditures instead of transfers.

Unlike IGTs, which involve movement of funds, CPEs are documentation-based, relying on verified financial records to establish eligibility for federal matching. When properly managed, CPEs enhance accountability, reduce circular funding risks, and reinforce fiscal integrity in Medicaid financing.

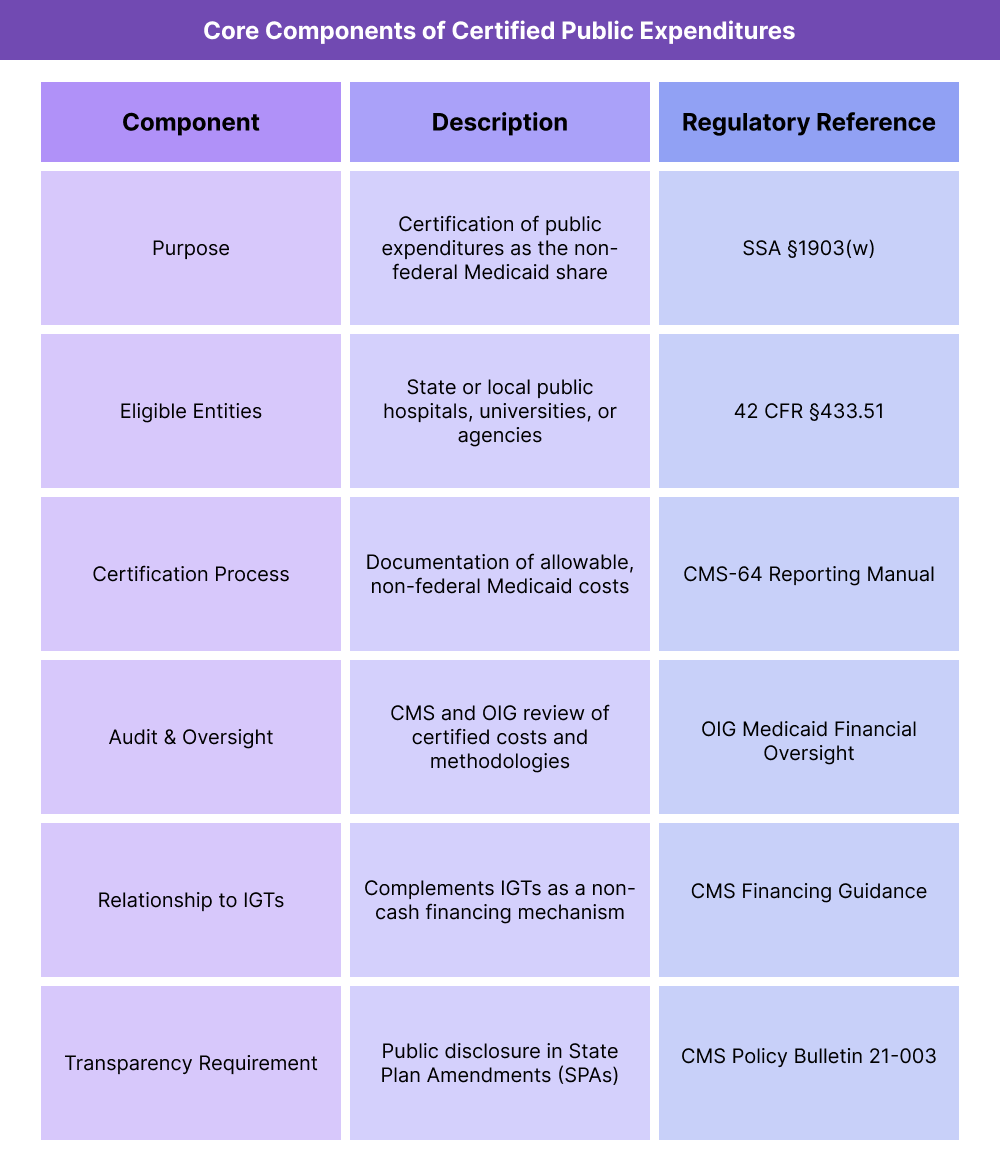

Key Components of Certified Public Expenditures (CPEs)

Certified Public Expenditures (CPEs) are a federally authorized method that allows state and local government entities to document their public healthcare costs as the non-federal share of Medicaid payments.

CPEs form a cornerstone of Medicaid’s financing flexibility—particularly for public hospitals, academic medical centers, and state-operated facilities—by replacing cash transfers with certified cost documentation.

CMS oversees all CPE arrangements to ensure accuracy, transparency, and compliance with the Social Security Act and federal cost-sharing regulations.

1. Purpose and Policy Framework

- CPEs allow public providers to finance Medicaid payments by certifying actual expenditures instead of transferring funds to the state.

- This approach enables states to draw federal matching funds (FMAP) for qualifying costs incurred by publicly owned or operated facilities.

- The structure promotes fiscal accountability, as only verified, documented expenditures are eligible for federal match.

- CPEs are often used in DSH, UPL, and Medicaid managed care directed payment programs.

2. Eligible Entities and Expenditures

- Only governmental entities—such as state, county, or university hospitals—can generate CPEs.

- Eligible expenditures include:

- Direct costs associated with providing Medicaid services.

- Administrative or overhead costs allocable to Medicaid operations.

- Uncompensated-care costs included in DSH or UPL payment programs.

- Private providers are not eligible to certify expenditures under CPE arrangements.

- All costs must be supported by auditable accounting records and comply with OMB Circular A-87 (2 CFR Part 225) cost principles.

3. Certification Process and CMS Approval

- The public entity prepares a certification statement affirming that expenditures are:

- (a) Allowable under Medicaid;

- (b) Funded with non-federal public funds; and

- (c) Properly documented and auditable.

- The state Medicaid agency reviews and compiles the certifications and submits them to CMS as part of its quarterly expenditure reporting (Form CMS-64).

- CMS may request additional documentation to validate cost sources or review methodologies before approving the federal match.

- The certification process eliminates the need for an Intergovernmental Transfer (IGT) but carries similar compliance requirements.

4. Reporting, Documentation, and Audit Requirements

- States must maintain detailed expenditure records, cost allocations, and certification forms for each CPE-contributing entity.

- CMS requires annual audits or reviews to confirm that CPE claims align with actual costs.

- Documentation must demonstrate:

- That expenditures were incurred by an eligible public entity.

- That funds were not used as a match for other federal programs.

- That costs are linked to covered Medicaid services.

- Noncompliance or lack of adequate documentation may result in disallowance of the federal share.

5. Relationship to Other Medicaid Financing Mechanisms

- CPEs and IGTs are complementary mechanisms:

- CPEs are documentation-based (certifying costs already incurred).

- IGTs are cash-based (transferring funds prior to payment).

- States often use both approaches to finance DSH and UPL payments, ensuring full utilization of the non-federal share.

- Both methods must adhere to CMS’s requirements for transparency, non-federal funding sources, and audit readiness.

6. Transparency and Oversight

- CMS mandates disclosure of all CPE arrangements in State Plan Amendments (SPAs) or managed care contract approvals.

- Public posting of CPE methodologies increases transparency and public accountability.

- The Office of Inspector General (OIG) conducts periodic audits to verify that CPE funds are accurately reported and compliant with cost principles.

- Ongoing transparency reforms aim to reduce reporting variability and standardize CPE documentation across states.

How Certified Public Expenditures (CPEs) Work in Practice

Certified Public Expenditures (CPEs) operate as a documentation-based funding mechanism that allows public hospitals, universities, and health systems to certify their actual Medicaid-related expenditures as the non-federal share of Medicaid payments.

Rather than transferring funds like an Intergovernmental Transfer (IGT), the public entity certifies costs already incurred, and the state Medicaid agency uses those certified expenditures to draw down federal matching funds (FMAP) from CMS.

Step 1: Identifying Participating Public Providers

- States first identify eligible public entities that incur allowable Medicaid costs—typically:

- State-operated hospitals and clinics

- County or municipal hospital systems

- University teaching hospitals or health centers

- Each provider must operate under governmental control and use public (non-federal) funds for expenditures.

- The state Medicaid agency maintains a list of participating entities and verifies their compliance with federal funding requirements.

Step 2: Tracking and Documenting Expenditures

- Participating public providers maintain detailed accounting records of Medicaid-related costs, including:

- Direct care delivery expenses

- Administrative overhead allocated to Medicaid

- Uncompensated or undercompensated care tied to Medicaid patients

- Documentation must meet OMB Circular A-87 standards for cost allowability and allocation.

- States may require providers to use standardized cost reporting templates or CMS-approved accounting methodologies to ensure audit readiness.

Step 3: Certifying the Expenditures

- At the end of each reporting period, the public entity prepares a Certification of Public Expenditures (CPE Statement) confirming that:

- The reported costs were incurred by a public provider.

- The expenditures were allowable under Medicaid.

- The funds were non-federal in origin.

- The certification is signed by an authorized financial officer and submitted to the state Medicaid agency for review and inclusion in the CMS-64 report.

Step 4: State Review and Federal Match Claim

- The state Medicaid agency aggregates all CPE certifications and verifies the supporting documentation.

- The state then submits the total certified expenditures as part of its quarterly CMS-64 filing to claim the federal match (FMAP).

- Once CMS approves the claim, the federal funds are transferred to the state, completing the reimbursement process.

- Unlike IGTs, no physical fund transfer occurs from the public provider to the state—only certification and documentation.

Step 5: Payment Distribution and Reconciliation

- After receiving the federal share, the state may issue supplemental payments to public providers, often under DSH or UPL programs.

- Providers reconcile the received payments against their certified costs to ensure no overpayment or duplication.

- The state Medicaid agency must maintain clear documentation of both CPE submissions and payment distributions for federal audit review.

Step 6: Reporting and CMS Oversight

- All CPE activity must be reported in the CMS-64 and supported by cost documentation available for CMS or OIG audit.

- CMS reviews CPE data to confirm that:

- Expenditures were appropriately certified.

- The entity was eligible to participate.

- Federal funds were matched only to allowable costs.

- CMS and the Office of Inspector General (OIG) may audit CPE programs periodically to validate data accuracy and compliance.

- States must retain CPE documentation for at least three years after the payment year.

Step 7: Integration with Broader Medicaid Financing

- CPEs complement IGTs in financing Medicaid supplemental payment programs.

- Many states combine CPEs with IGTs to diversify funding and strengthen documentation integrity.

- CPEs also support CMS’s goals for transparency and accountability by providing clear, auditable records of public spending on Medicaid services.

- Properly managed CPE systems ensure budget neutrality, financial integrity, and sustained provider participation in Medicaid.

CPEs in Medicaid Billing, Reimbursement, and Fiscal Limitations

Certified Public Expenditures (CPEs) function as a cost-based reimbursement mechanism, allowing states to claim federal matching funds for publicly incurred Medicaid expenditures.

While CPEs promote transparency and reduce the risks associated with cash transfers, they also introduce significant documentation, timing, and audit challenges that can affect payment accuracy and fiscal compliance.

How CPEs Affect Medicaid Reimbursement

- CPEs provide the non-federal share of Medicaid funding for payments such as DSH, UPL, and directed payment programs.

- States claim the federal share (FMAP) based on verified, allowable expenditures certified by public hospitals, universities, or agencies.

- The total Medicaid reimbursement equals the certified public cost plus the federal match.

- This method is particularly common in state-operated hospitals and academic medical centers, where documentation systems support complex cost accounting.

- Unlike other financing mechanisms, CPEs do not involve actual fund transfers, which simplifies treasury operations but heightens reliance on data accuracy and reporting compliance.

Funding Flow and Payment Mechanics

- The public provider incurs costs for Medicaid services using its own public funds.

- Those costs are certified and reported to the state Medicaid agency, which claims the federal matching funds through its CMS-64 submission.

- CMS reimburses the state for the federal share, and the state then distributes those funds to eligible providers, often through supplemental payments.

- Because the reimbursement is tied to actual expenditures, payment timing may lag behind service delivery, depending on reporting and audit cycles.

- States must ensure that CPE reimbursements do not exceed the allowable cost of delivering Medicaid services.

Fiscal and Administrative Limitations

- CPE-based financing depends on the provider’s ability to produce accurate, timely cost data aligned with federal accounting standards.

- Complex cost allocations—such as distinguishing Medicaid from non-Medicaid expenses—can introduce calculation errors that affect reimbursement levels.

- States must monitor for double-counting risks where costs are included in both CPE and IGT claims.

- CMS requires that all claimed expenditures be final, verified, and auditable—not estimates or projections.

- Because CPEs rely on retrospective cost reporting, they may delay provider cash flow compared to prospective payment models.

Audit and Compliance Risk

- The Office of Inspector General (OIG) and CMS Financial Management teams conduct regular reviews of CPE programs to validate reported costs.

- Common audit findings include:

- Certification of ineligible or unallowable costs.

- Inadequate cost allocation documentation.

- Failure to segregate Medicaid and non-Medicaid expenditures.

- Use of unsupported data or interim estimates.

- When discrepancies arise, CMS can issue disallowances, requiring states to repay the federal share or revise their State Plan Amendment (SPA) to correct methodology issues.

- To avoid findings, states typically implement standardized CPE templates and conduct internal pre-audits before CMS submission.

- Fiscal Reform and Transparency Initiatives

- CMS continues to refine CPE policy to promote transparency and consistency across states.

Key trends include:

- Expanded public disclosure requirements for CPE methodologies.

- Integration of value-based performance metrics into CPE-based payment programs.

- Standardized CMS-64 reporting guidance to reduce variation across state audits.

- These reforms aim to maintain program integrity while allowing states to continue leveraging public expenditures as part of a sustainable Medicaid financing strategy.

Key Takeaway

CPEs offer a compliant, auditable pathway for states to finance Medicaid payments without transferring funds.

However, their success depends on accurate documentation, strict adherence to federal cost principles, and proactive audit preparation.

When properly managed, CPE programs strengthen fiscal integrity, improve transparency, and ensure that public dollars directly support care for Medicaid beneficiaries.

How CPEs Influence Quality, Access, and Equity in Medicaid Financing

Although Certified Public Expenditures (CPEs) are primarily an accounting and compliance mechanism, they have meaningful downstream effects on healthcare quality, access, and equity.

By enabling public hospitals and health systems to document and recover their Medicaid-related costs, CPEs reinforce the stability of safety-net providers that serve disproportionately low-income and uninsured populations.

Ensuring Access Through Public Accountability

- CPEs ensure that publicly owned or operated hospitals receive Medicaid funding directly tied to actual service costs, protecting against underpayment for high-need populations.

- This mechanism helps maintain essential hospital services—emergency care, maternity wards, trauma, behavioral health—that often operate at financial loss.

- Because CPEs rely on real expenditure data, they help align Medicaid reimbursement with true cost of care, ensuring that providers remain solvent and accessible.

- The model strengthens community-level accountability, since public entities certify and report their own expenditures under transparent state and CMS oversight.

Advancing Equity Through Transparent Financing

- CPEs reduce disparities in Medicaid financing by tying funding to verified public spending rather than negotiated transfer arrangements.

- The certification process enhances equity and transparency, preventing hidden or circular funding flows and ensuring that federal dollars reach service providers.

- States can use CPE methodologies to identify gaps in Medicaid payment adequacy across urban, rural, and academic hospitals, helping target future policy reforms.

- By maintaining clear documentation, CPE programs provide an equitable audit trail, improving public trust and fiscal integrity within Medicaid financing systems.

Impact on Quality and Performance Improvement

- Reliable CPE funding allows hospitals—especially teaching and safety-net institutions—to reinvest in clinical staffing, training, and infrastructure that directly influence care quality.

- Hospitals supported through CPE programs often participate in Medicaid Delivery System Reform Incentive Payment (DSRIP) or directed payment programs that tie funding to measurable outcomes.

- CMS encourages states to align CPE-supported programs with quality metrics, such as reduced readmissions, improved maternal outcomes, and expanded preventive care.

- In this way, CPE-based financing supports the broader shift from volume-based reimbursement toward value-based, performance-linked Medicaid models.

Transparency as a Foundation for Equity

- CPEs reinforce transparency by requiring full documentation of every dollar spent on Medicaid services.

- States and providers must disclose funding sources, methodologies, and expenditure details within State Plan Amendments (SPAs) and public financial reports.

- This openness supports CMS’s health equity framework, which links fiscal transparency to fair resource distribution and accountability in underserved communities.

- The resulting data infrastructure gives states the ability to track payment equity, access outcomes, and regional performance gaps more accurately than with transfer-based models.

Sustaining Equity Through Oversight and Modernization

- CMS continues to refine CPE oversight to balance compliance with flexibility. Key initiatives include:

- Standardized cost-reporting templates for public hospitals.

- Centralized audit protocols to ensure consistent national oversight.

- Integration of health equity and performance measures into CPE-supported payment reforms.

- These modernization efforts help ensure that CPEs remain a tool for both financial accountability and equitable access, not just fiscal compliance.

- By aligning funding with verified need and measurable outcomes, CPEs advance CMS’s dual goals of fiscal integrity and healthcare equity.

Frequently Asked Questions about CPEs

1. What are Certified Public Expenditures (CPEs)?

Certified Public Expenditures (CPEs) are documented public costs for Medicaid-covered services that are certified by a state or local government entity as the non-federal share of Medicaid funding.

Authorized under Section 1903(w) of the Social Security Act, CPEs allow states to claim federal matching funds (FMAP) for actual costs incurred by public hospitals and health systems, rather than transferring funds like in Intergovernmental Transfers (IGTs).

2. Who can use CPEs in Medicaid financing?

Only government-owned or operated providers may participate in CPE programs. Eligible entities include:

- State-operated hospitals and clinics

- County or municipal hospital systems

- Public university medical centers

These entities must use non-federal public funds for their expenditures and maintain auditable cost documentation aligned with CMS and OMB requirements.

3. How does the CPE process work?

A public provider tracks its Medicaid-related costs throughout the fiscal year.

At the reporting period’s end, it certifies those expenditures as allowable Medicaid costs using a CPE statement.

The state Medicaid agency aggregates these certifications and claims the federal matching funds from CMS via its CMS-64 report.

The federal funds are then used to reimburse eligible providers or support supplemental payment programs such as DSH or UPL.

4. How do CPEs differ from IGTs (Intergovernmental Transfers)?

- CPEs are based on documented expenditures — no physical fund transfer occurs.

- IGTs involve cash transfers from public entities to the state to fund Medicaid payments.

Both methods finance the non-federal share of Medicaid funding, but CPEs rely on cost certification, while IGTs rely on fund transfers.

States often use both mechanisms together for comprehensive financing of supplemental payment programs.

5. What are CMS’s requirements for CPE compliance?

CMS requires that all CPEs be:

- Documented and auditable — supported by detailed accounting records.

- Non-federal in origin — derived from public tax-based funding.

- Allowable under Medicaid — tied directly to Medicaid services or administrative costs.

States must disclose all CPE methodologies in State Plan Amendments (SPAs) and retain documentation for at least three years after the payment year.

6. What are the risks of CPE noncompliance?

Improperly documented CPEs can result in federal disallowances, repayment demands, or mandatory plan revisions.

Common issues include:

- Misclassification of non-Medicaid costs

- Use of federal or private funds in the certified amount

- Missing or unsigned certification statements

- Inadequate reconciliation between reported costs and CMS-64 data

CMS and the Office of Inspector General (OIG) regularly audit CPE programs to ensure compliance.

7. Why are CPEs important for Medicaid equity and fiscal transparency?

CPEs strengthen Medicaid equity by ensuring that funding reflects verified, real-world public expenditures.

They reduce reliance on transfers or opaque financing mechanisms, promoting accountability and transparency in Medicaid payments.

By aligning reimbursement with documented costs, CPEs help sustain safety-net hospitals and teaching institutions that serve high-need populations, reinforcing CMS’s equity and access goals.