What is OIG (Office of Inspector General) in Healthcare

The Office of Inspector General (OIG) is an oversight agency that helps protect the integrity of federal healthcare programs by detecting and preventing fraud, waste, and abuse. In healthcare operations, “OIG” most commonly refers to the U.S. Department of Health and Human Services OIG, which evaluates program performance, investigates misconduct, and issues guidance that influences compliance practices across providers, payers, and health IT vendors.

From a business perspective, OIG matters because its audits, investigations, and enforcement actions can directly impact reimbursement, contracting, and organizational risk. OIG also publishes compliance resources—including work plans, advisory guidance, and exclusion tools—that help healthcare organizations understand what regulators are prioritizing and how to reduce exposure.

In practice, OIG is a signal. When OIG focuses on a billing pattern, documentation gap, or program vulnerability, health systems and their partners often respond by tightening workflows, standardizing documentation, improving monitoring, and reinforcing fraud, waste, and abuse controls.

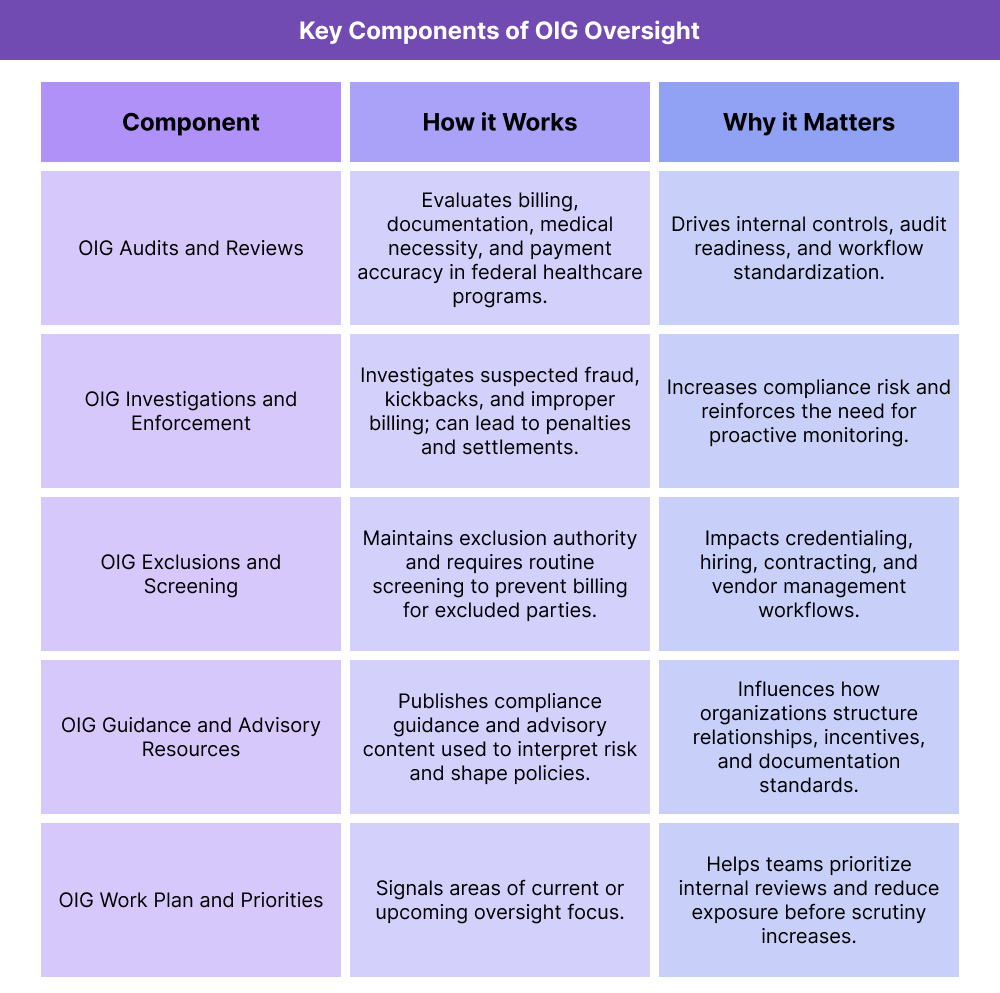

Key Components of OIG Oversight in Healthcare

OIG influences healthcare in several predictable ways: it sets enforcement pressure through investigations and exclusions, shapes compliance behavior through guidance, and drives operational change through audits and published findings. Understanding these components is essential for compliance leaders, revenue-cycle stakeholders, and vendors supporting regulated workflows.

OIG Audits and Reviews in Healthcare

OIG conducts audits and evaluations to determine whether federal healthcare dollars are being used appropriately and whether providers and plans are meeting program requirements. These reviews may examine billing patterns, medical necessity, documentation standards, payment accuracy, and program administration.

For operations teams, OIG audits are often a catalyst for workflow changes—especially around coding, documentation quality, claims edits, internal monitoring, and audit readiness.

OIG Investigations and Enforcement

OIG investigations focus on suspected fraud, kickbacks, improper billing, and other misconduct tied to federal healthcare programs. These cases can involve providers, suppliers, pharmacies, managed care entities, and sometimes vendors or contractors when their systems or practices contribute to improper claims.

For B2B stakeholders, this is the “risk reality” layer of OIG: organizations must be able to show they have controls, oversight, and compliant processes—not just good intentions.

OIG Exclusions and Screening Requirements

One of the most operationally important OIG functions is exclusions. Individuals or entities can be excluded from participation in federal healthcare programs, which means organizations cannot bill federal programs for items or services furnished by excluded parties.

This creates a practical requirement for routine screening across hiring, credentialing, vendor management, and contracting workflows—especially for organizations billing Medicaid and Medicare.

OIG Compliance Guidance and Advisory Resources

OIG publishes compliance guidance, advisory materials, and education resources that help organizations understand acceptable practices and avoid high-risk arrangements. While not every document is “binding law,” it strongly influences how compliance teams interpret risk and how organizations design policies.

Healthcare organizations often use OIG guidance to inform topics like referral relationships, incentive structures, documentation standards, third-party contracting, and monitoring programs.

OIG Work Plan and Priority Signals

OIG publishes a work plan that outlines areas it plans to review or is actively reviewing. For compliance and revenue-cycle teams, the work plan is a practical roadmap of what to prioritize: if OIG is focusing on a specific service category, billing pattern, or program vulnerability, organizations often respond proactively by reviewing internal data and tightening controls.

For vendors, the work plan can also act as a product signal: workflows that reduce documentation risk, improve monitoring, or enhance audit readiness become higher-value when OIG scrutiny increases.

How OIG Oversight Works in Practice in Healthcare

OIG oversight affects healthcare through a practical loop: priorities are signaled, audits and investigations examine real-world billing and operational patterns, and enforcement outcomes drive changes in policy, workflows, and technology controls.

Step 1: OIG Signals Risk Areas Through the OIG Work Plan and Published Findings

OIG communicates what it is paying attention to through work plan topics, reports, and enforcement announcements. These signals often highlight where documentation, billing, or oversight is inconsistent across the market.

For healthcare organizations, this is the earliest point to act—review internal patterns, validate documentation standards, and strengthen controls before issues scale.

Step 2: Organizations Respond With Internal Monitoring and Policy Alignment

When OIG focuses on a service line or billing pattern, compliance and revenue-cycle teams often implement targeted actions such as:

- Internal audits or chart reviews

- Claims monitoring for outliers

- Documentation playbooks and provider education

- Updated policies for ordering, referrals, and medical necessity

- Enhanced screening and credentialing workflows

This is where operational discipline matters: consistent rules, consistent documentation, and consistent reporting.

Step 3: Audits and Investigations Test Whether Workflows Are Defensible

OIG audits and investigations assess whether billing and program behaviors match requirements and whether organizations can substantiate what happened. The “defensibility” layer depends on:

- Clear documentation at the point of care

- Repeatable billing logic and claims edits

- Traceable oversight (who reviewed what, and when)

- Evidence of screening and compliance routines

For vendors and partners, system design becomes part of compliance—tools must support audit-ready records, consistent workflows, and reliable reporting.

Step 4: Outcomes Drive Program Changes and Industry-Wide Behavior

OIG findings and enforcement outcomes influence the broader healthcare system. Payers tighten edits, providers change workflows, and organizations invest in systems that improve compliance visibility.

Over time, the effect is compounding: OIG scrutiny shapes what “standard practice” looks like in regulated billing and program administration—especially in Medicaid and Medicare environments.

OIG (Office of Inspector General) in Billing, Reimbursement, and System Limitations

The Office of Inspector General (OIG) plays a central role in shaping how healthcare organizations approach billing, reimbursement, and compliance. While OIG does not process claims or set payment rates, its oversight authority directly influences how Medicaid, Medicare, and other federally funded programs are administered and audited.

For healthcare organizations, OIG risk is rarely theoretical. Billing patterns, documentation practices, referral relationships, and internal controls are all subject to scrutiny when federal funds are involved.

How OIG Oversight Affects Healthcare Billing and Reimbursement

OIG oversight affects billing indirectly by driving enforcement expectations. When OIG identifies improper payments, weak documentation, or high-risk billing behavior, payers and regulators often respond by tightening rules and increasing reviews.

This shows up operationally as:

- More frequent audits of high-risk services or providers

- Increased documentation requirements to support medical necessity

- Stricter claims edits and utilization controls

- Expanded monitoring of fraud, waste, and abuse indicators

Organizations that fail to adapt to these pressures may experience denials, payment delays, recoupments, or referrals for further investigation.

OIG Compliance Expectations and Documentation Standards

One of the most consistent themes in OIG findings is documentation. Even when services are clinically appropriate, weak or inconsistent documentation can create compliance exposure.

From an operational standpoint, OIG-driven documentation expectations often include:

- Clear linkage between services billed and clinical justification

- Evidence that services were actually rendered as claimed

- Consistent use of coding, modifiers, and provider identifiers

- Documentation that supports referrals, orders, and supervisory requirements

For revenue-cycle and compliance teams, this means documentation standards must be enforced across clinical, care management, and billing workflows—not treated as a downstream clean-up task.

OIG Exclusions and Payment Risk

OIG exclusion authority creates a direct payment risk for healthcare organizations. If an excluded individual or entity is involved in furnishing services that are billed to federal healthcare programs, those claims may be considered improper—even if the services themselves were necessary.

This has broad operational implications:

- Routine screening of employees, contractors, and vendors

- Clear ownership of exclusion checks across departments

- Ongoing monitoring, not just one-time screening

- Rapid remediation workflows when issues are identified

Failure to manage exclusion risk can result in repayment obligations and significant compliance exposure.

System Limitations and Common OIG-Related Risk Areas

Many OIG findings point to predictable system and process gaps, including:

- Siloed compliance tools: exclusion screening, auditing, and documentation tracking living in separate systems

- Inconsistent workflows: different departments applying different rules for the same service

- Limited audit readiness: difficulty retrieving records, logs, or historical documentation

- Reactive compliance: changes only made after audits instead of proactively

Health IT systems and care management platforms play an increasingly important role in mitigating these risks by embedding compliance visibility directly into day-to-day workflows.

How OIG Influences Quality, Access, and Equity in Healthcare

Although OIG is often associated with enforcement, its influence extends beyond compliance and into how healthcare systems deliver care, prioritize quality, and allocate resources. The way organizations respond to OIG oversight can either strengthen or strain access and equity.

OIG and Healthcare Quality Improvement

OIG audits and evaluations often reveal gaps in quality, not just billing accuracy. Findings related to incomplete care, missed follow-up, or inadequate oversight can prompt broader quality improvement initiatives.

In practice, OIG influence can lead organizations to:

- Strengthen care coordination and follow-up processes

- Improve documentation of clinical decision-making

- Standardize workflows that support evidence-based care

- Invest in monitoring tools that surface quality risks earlier

When aligned well, compliance and quality efforts reinforce each other rather than competing.

OIG Oversight and Access to Care

Compliance pressure can have mixed effects on access. On one hand, stronger oversight can protect patients from unsafe or fraudulent practices. On the other, overly rigid interpretations of compliance requirements may discourage providers from serving high-risk or complex populations.

Access challenges can emerge when:

- Providers avoid certain services due to audit risk

- Administrative burden limits appointment availability

- Smaller or under-resourced organizations struggle to meet compliance demands

Balancing compliance with access requires thoughtful workflow design and support, especially in Medicaid-heavy and safety-net environments.

Equity Considerations in OIG-Driven Compliance Models

OIG oversight is applied uniformly, but its impact is not always evenly distributed. Organizations serving underserved populations often face greater administrative strain, fewer resources, and higher patient complexity.

Equity-sensitive compliance approaches focus on:

- Supporting documentation without penalizing complexity

- Designing workflows that reduce administrative burden

- Ensuring compliance tools are usable in resource-constrained settings

- Aligning enforcement responses with patient safety and access goals

When compliance is treated purely as a punitive exercise, it can reinforce inequities. When treated as a shared accountability framework, it can improve trust, safety, and care consistency across populations.

Frequently Asked Questions about OIG

1. What is the Office of Inspector General (OIG) in healthcare?

The Office of Inspector General (OIG) is a federal oversight agency that monitors and protects the integrity of healthcare programs funded by the federal government. In healthcare, OIG is best known for auditing billing practices, investigating fraud, waste, and abuse, and issuing compliance guidance that affects providers, payers, and vendors.

2. What does OIG do in Medicaid and Medicare programs?

OIG conducts audits, evaluations, and investigations related to Medicaid and Medicare spending. Its work focuses on payment accuracy, medical necessity, program integrity, and whether organizations are complying with federal healthcare requirements.

3. How does OIG oversight affect healthcare billing and reimbursement?

OIG oversight influences billing by driving stricter documentation standards, increased audits, and tighter payer controls. When OIG identifies high-risk billing patterns, health plans and regulators often respond with new edits, reviews, and compliance expectations.

4. What is the OIG exclusion list and why does it matter?

The OIG exclusion list identifies individuals and entities barred from participating in federal healthcare programs. Healthcare organizations must routinely screen staff, contractors, and vendors to ensure they are not billing for services provided by excluded parties, which could result in repayment and penalties.

5. What is the OIG Work Plan and how should organizations use it?

The OIG Work Plan outlines areas the agency plans to review or is actively reviewing. Organizations use it as an early warning system to identify compliance risks, prioritize internal audits, and strengthen workflows before issues escalate.

6. Does OIG only focus on fraud, or does it affect routine operations too?

OIG oversight extends beyond fraud investigations. Routine audits often examine documentation quality, billing accuracy, care coordination, and program administration. As a result, OIG influences everyday operational practices across healthcare organizations.

7. How can healthcare organizations reduce OIG compliance risk?

Organizations reduce OIG risk by standardizing documentation, performing regular internal audits, screening for exclusions, training staff on compliance expectations, and using systems that support audit readiness and visibility into billing and care workflows.

8. How does OIG oversight relate to quality and patient safety?

Many OIG reviews highlight quality and safety concerns, such as incomplete follow-up or inadequate oversight. When compliance and quality initiatives are aligned, OIG-driven improvements can enhance patient safety and care consistency.