What is a ABN (Advance Beneficiary Notice of Noncoverage)?

An Advance Beneficiary Notice of Noncoverage (ABN) is a standardized Medicare form that providers give to Original Medicare beneficiaries when they believe Medicare may not pay for a specific item or service. The ABN warns the patient before the service is delivered that Medicare is likely to deny payment, explains why, and states that the patient may be financially responsible if Medicare does not pay.

ABNs are most often used when there is a medical-necessity or coverage issue—for example, when a service is not covered for the beneficiary’s diagnosis, exceeds frequency limits, or is considered not reasonable and necessary under a Local or National Coverage Determination (LCD/NCD). The ABN gives the beneficiary a choice to receive or decline the service with this information in hand.

In practice, a correctly issued ABN protects both parties: it helps beneficiaries make informed decisions about using services that may not be covered, and it allows providers to bill the patient if Medicare denies the claim, as long as ABN requirements are met.

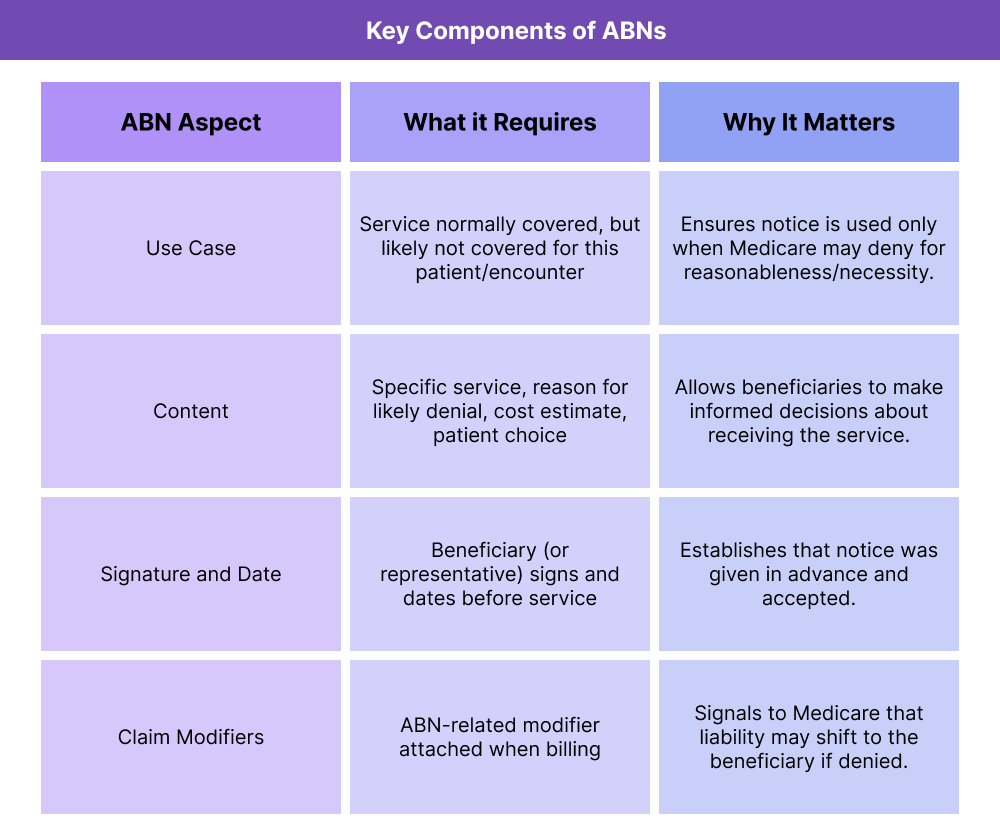

Key Components of ABN in Healthcare

The ABN is a structured, conditional notice: it is only used in specific scenarios, must be completed on the official CMS form, and has required content elements that determine whether it is valid. When any of these elements are missing or incorrect, the ABN may not protect the provider from financial liability.

When an ABN Is Required (and When It Is Not)

An ABN is required for Original Medicare (Part B) beneficiaries when a provider believes that Medicare is likely to deny a normally covered item or service for that specific patient, on that specific date—usually because the service is not reasonable and necessary under Medicare’s rules.

Common ABN use cases include:

- Services that exceed frequency limits or utilization thresholds

- Services that do not meet diagnosis or medical-necessity criteria under an LCD/NCD

- Items or services outside the coverage indications for a particular benefit

ABNs are not used for services that Medicare never covers (such as purely cosmetic services); those are patient-liable without an ABN under “never covered” rules.

Required Information on the ABN Form

The ABN must be issued on the correct CMS form and must clearly identify:

- The specific item or service in question

- The reason Medicare is expected to deny (e.g., “Medicare only pays for this test once every 12 months”)

- An estimated cost for the patient

- The beneficiary’s choice to receive or decline the service, documented by their signature and date

Generic or blanket language (“Medicare might not pay for some services”) is not sufficient. The notice must be specific enough that the beneficiary understands what is at risk.

ABN as a Financial Liability Notice

The ABN is fundamentally a financial liability notice. By signing, the beneficiary acknowledges that if Medicare denies the claim, they agree to be responsible for payment. If the ABN is missing, incomplete, or invalid when required, the provider usually cannot bill the patient and may have to absorb the cost.

ABN and Claim-Level Modifiers

When a valid ABN is on file and the service is provided, the provider typically appends the appropriate ABN-related modifier to the claim to indicate that the patient was properly notified. This tells Medicare that liability may transfer to the beneficiary if the claim is denied.

How ABNs Work in Practice

ABNs fit into the workflow before a service is delivered. They are time-sensitive, service-specific notices that must be handled correctly to shift financial liability when Medicare is likely to deny payment.

Step 1: Provider Identifies That Medicare May Not Pay

Before furnishing an item or service, the provider determines that Medicare may deny payment due to a coverage rule—commonly tied to an LCD/NCD, medical necessity, diagnosis restrictions, or frequency limits.

If the service is normally covered but not for this particular scenario, an ABN is required.

Step 2: Provider Completes and Issues the ABN

The provider fills out the approved CMS ABN form with:

- A clear description of the item/service

- A specific, policy-based reason Medicare may deny

- An estimated out-of-pocket cost

- Instructions for selecting one of the beneficiary options

The beneficiary must receive the notice in advance and have the opportunity to ask questions.

Step 3: Beneficiary Makes a Choice

The beneficiary must select one of the ABN options:

- Yes, proceed and bill Medicare — beneficiary agrees to pay if Medicare denies.

- No, do not provide the service — beneficiary declines the service.

- Yes, proceed but do not bill Medicare — used rarely, usually when a patient chooses to self-pay entirely.

- The signature and date validate the ABN.

Step 4: Service Is Furnished and Billed

If the beneficiary chooses to proceed, the provider furnishes the service and bills Medicare with the correct ABN modifier indicating that the patient was notified.

Step 5: Medicare Denies or Pays the Claim

If Medicare denies the service, the provider may bill the beneficiary only if the ABN was valid and properly completed.

If Medicare pays the claim, the beneficiary is not responsible beyond normal cost-sharing.

ABN in Billing, Reimbursement, and System Limitations

ABNs sit at a critical intersection of compliance and reimbursement because they determine who becomes financially responsible when Medicare denies a service. A correct ABN preserves the provider’s ability to bill the beneficiary. An incorrect or missing ABN usually shifts liability back to the provider, even if Medicare’s denial was appropriate.

How ABNs Affect Medicare Billing

ABNs allow providers to bill beneficiaries only when three conditions are met:

- The service is normally covered by Medicare

- There is a specific reason Medicare may deny it this time

- The ABN is issued correctly before the service is furnished

When these conditions are satisfied, the beneficiary may be billed if Medicare denies the claim.

If a required ABN is not issued:

- The provider cannot bill the patient

- Medicare’s denial becomes a provider write-off

- Appeal options do not resolve liability

This makes ABN workflow accuracy a core revenue-protection task in Medicare Part B operations.

ABNs and Coverage Criteria (LCDs/NCDs)

Most ABNs stem from anticipated denials tied to:

- LCD diagnosis restrictions

- NCD coverage limitations

- Frequency limits

- Missing medical-necessity indications

An ABN must cite the actual policy reason, not general language like “Medicare might not pay.”

System Limitations and Operational Watch-Outs

ABN problems frequently arise from:

- Issuing ABNs for services Medicare never covers (ABN not needed)

- Forgetting to issue ABNs for frequency-limit or diagnosis-restricted services

- Using generic ABN language instead of specific policy-based reasoning

- Failing to obtain a patient signature before the service

- Missing ABN-related modifiers on the claim

- Staff using outdated ABN forms

Operational accuracy relies on consistent training, policy awareness, and front-end workflows that flag ABN-triggering services.

How ABN Influences Quality, Access, and Equity in Healthcare

ABNs affect much more than billing—they shape patient understanding, shared decision-making, and trust in the healthcare process.

Quality and Patient Communication

ABNs improve transparency by helping beneficiaries understand:

- Why Medicare may not cover a service

- What their potential financial responsibility is

- How to decide whether to receive the service

Clear communication during ABN delivery reduces confusion, helps patients make informed choices, and ensures that unexpected medical bills do not undermine satisfaction or trust.

Access Implications

While ABNs protect providers from unreimbursed care, incorrect or overused ABNs can discourage necessary services. When ABNs are communicated poorly—or issued unnecessarily—patients may decline important diagnostic or preventive services due to cost concerns.

Well-designed ABN workflows ensure:

- Patients understand the clinical value of the service

- Staff provide context rather than merely presenting a form

- ABNs are only used when appropriate, not as routine disclaimers

Equity Considerations

Beneficiaries with fewer financial resources or lower health literacy may feel disproportionately burdened by ABNs. Thoughtful communication and culturally competent delivery help mitigate inequitable outcomes.

Frequently Asked Questions about ABN

1. What is an ABN (Advance Beneficiary Notice)?

An ABN is a Medicare-required notice that informs a patient when a normally covered service is likely to be denied for a specific reason, allowing the patient to decide whether to receive the service and accept financial liability.

2. When must an ABN be issued?

An ABN must be issued before providing a service when Medicare may deny it based on medical necessity, frequency limits, or coverage rules.

3. What happens if an ABN is not provided?

If a required ABN is not issued, the provider generally cannot bill the beneficiary if Medicare denies the service.

4. Can an ABN be used for services Medicare never covers?

No. For non-covered services (e.g., cosmetic procedures), an ABN is not required. The patient is automatically liable.

5. Does the patient need to sign the ABN?

Yes. The beneficiary (or their representative) must sign and date the ABN before the service is provided for it to be valid.

6. Do I need modifiers when billing a service with an ABN?

Yes. ABN modifiers indicate whether a mandatory or voluntary ABN was issued and help Medicare process liability correctly.

7. Can a beneficiary appeal after signing an ABN?

Yes. Signing an ABN does not waive the right to appeal the denial—it only acknowledges potential financial liability.