What are What are UPICs (Unified Program Integrity Contractors)?

Unified Program Integrity Contractors (UPICs) are specialized organizations contracted by the Centers for Medicare & Medicaid Services (CMS) to detect, prevent, and investigate fraud, waste, and abuse (FWA) in the Medicare and Medicaid programs.

UPICs represent the modern, consolidated framework for CMS program integrity enforcement—replacing earlier contractor models such as the Zone Program Integrity Contractors (ZPICs) and Medicaid Integrity Contractors (MICs).

Established under CMS’s Center for Program Integrity (CPI), UPICs perform data-driven audits, medical record reviews, and field investigations to identify improper billing, recover overpayments, and refer potential fraud cases to the Office of Inspector General (OIG) or Department of Justice (DOJ).

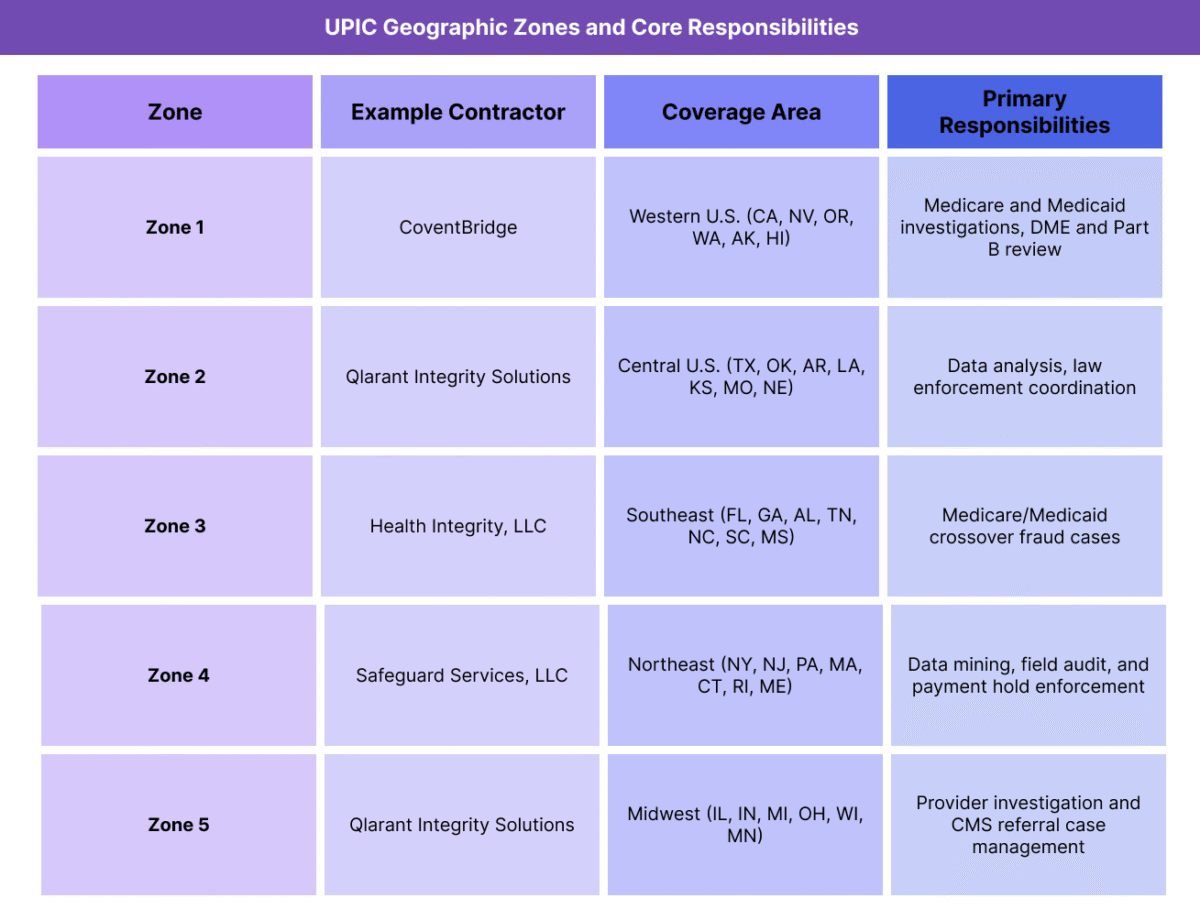

UPICs operate across multiple geographic regions (“zones”) that align with the jurisdictions used by Medicare Administrative Contractors (MACs). This alignment promotes efficiency, data interoperability, and coordination among CMS oversight entities such as Recovery Audit Contractors (RACs) and Comprehensive Error Rate Testing (CERT) programs.

Through their integrated structure, UPICs provide CMS with a unified enforcement and monitoring system that strengthens fiscal integrity, enhances transparency, and ensures the responsible use of federal healthcare funds.

Legacy Note: Transition from ZPICs to UPICs

The UPIC framework replaced the legacy Zone Program Integrity Contractors (ZPICs) beginning in 2016, completing the transition by approximately 2019.

While ZPICs focused primarily on Medicare fraud within defined regional zones, UPICs expanded the scope to include both Medicare and Medicaid investigations under a single contractor system.

ZPIC terminology remains common in older CMS audit letters, compliance manuals, and OIG reports, so healthcare organizations may still encounter references to “ZPIC audits” even though the functions are now managed by UPICs.

Key Components of Unified Program Integrity Contractors (UPICs)

Unified Program Integrity Contractors (UPICs) are the core enforcement and investigation entities within CMS’s Center for Program Integrity (CPI). They are tasked with identifying, investigating, and preventing fraud, waste, and abuse (FWA) across both Medicare and Medicaid.

By integrating multiple legacy programs—including the Zone Program Integrity Contractors (ZPICs) and Medicaid Integrity Contractors (MICs)—UPICs create a single, streamlined oversight framework that strengthens the integrity of federal healthcare payments.

1. Purpose and Oversight

- UPICs operate under the authority of Section 1893 of the Social Security Act, which allows CMS to use private contractors to ensure program integrity.

- Oversight is centralized under the CMS Center for Program Integrity (CPI), which defines audit protocols, investigative priorities, and data-sharing standards.

- UPICs are designed to:

- Detect and prevent fraudulent or abusive billing practices.

- Investigate data anomalies and high-risk providers.

- Support law enforcement and CMS regional offices with actionable case files.

- Recommend administrative sanctions, such as payment suspensions or provider exclusions.

2. Integrated Program Model

- The UPIC model consolidates several older contractor programs into one structure:

- ZPICs (Zone Program Integrity Contractors) – Formerly handled Medicare-only fraud investigations.

- MICs (Medicaid Integrity Contractors) – Managed Medicaid program integrity reviews.

- Program Safeguard Contractors (PSCs) – Earlier oversight model under the Health Care Fraud and Abuse Control (HCFAC) program.

- By merging these entities, CMS created a unified investigative infrastructure that reduces redundancy, enhances data integration, and ensures consistent standards across both programs.

3. Core Functional Responsibilities

- UPICs perform both preventive and enforcement-oriented activities, including:

- Data Analysis and Pattern Detection – Using advanced analytics, AI, and predictive modeling to identify outliers and billing anomalies.

- Medical Review and Audit – Conducting clinical reviews and verifying documentation to confirm the legitimacy of claims.

- Field Investigation – Interviewing providers, performing on-site audits, and coordinating with state Medicaid agencies or law enforcement.

- Case Development and Referral – Preparing detailed investigative reports for OIG, DOJ, or state Attorney General offices.

- Administrative Enforcement – Recommending payment holds, suspensions, or provider deactivations where credible evidence of fraud exists.

4. Coordination Across Oversight Entities

- UPICs operate as part of CMS’s broader Program Integrity Network, collaborating closely with:

- Medicare Administrative Contractors (MACs) – For data sharing, provider enrollment verification, and payment actions.

- Recovery Audit Contractors (RACs) – To prevent duplicate reviews and coordinate recovery activity.

- Comprehensive Error Rate Testing (CERT) – To benchmark payment accuracy data.

- State Medicaid Agencies – For joint investigations involving dual-eligible beneficiaries or cross-program billing.

- Law Enforcement Partners – Including OIG, FBI, and DOJ, for criminal fraud prosecution and civil recovery.

- This integrated ecosystem ensures that UPIC investigations are data-driven, coordinated, and evidence-based.

5. Case Workflow and Investigative Process

- The typical UPIC investigative workflow includes:

- Data Analysis – Identification of aberrant billing or utilization patterns.

- Preliminary Review – Verification of anomalies against known compliance thresholds.

- Medical Record Request – Provider notification and document submission.

- Clinical Review – Evaluation of medical necessity, documentation, and coding.

- Case Development – Summarizing findings and calculating potential overpayments.

- Referral and Resolution – Forwarding substantiated cases to OIG, DOJ, or CMS for action.

6. Regional Zone Structure and Contractors

- UPICs are assigned to five regional zones, each managing multiple states and jurisdictions. Their territories align with MAC regions for consistent oversight.

7. ZPIC Legacy Alignment (SEO and Contextual Note)

- The Zone Program Integrity Contractors (ZPICs) served as the direct precursors to UPICs.

- ZPICs were Medicare-only integrity contractors that operated in seven geographic zones from 2008–2018.

- Their responsibilities—fraud detection, medical review, and enforcement referrals—were fully incorporated into the UPIC structure.

- Providers may still encounter ZPIC terminology in audit letters, CMS archives, or training materials, but all new activity now falls under UPIC contracts.

How Unified Program Integrity Contractors (UPICs) Work in Practice

Unified Program Integrity Contractors (UPICs) operate as CMS’s investigative arm for detecting and addressing fraud, waste, and abuse (FWA) in Medicare and Medicaid.

Unlike Recovery Audit Contractors (RACs), which focus on post-payment recovery, UPICs conduct real-time and retrospective investigations that may lead to administrative sanctions, payment holds, or law enforcement referrals.

Every Medicare-enrolled provider is subject to UPIC oversight, and participation is mandatory when documentation or records are requested. For compliance teams, understanding the UPIC process is critical for ensuring accuracy, transparency, and proper response coordination.

Step 1: Data Analytics and Case Identification

- UPICs use predictive modeling, anomaly detection, and comparative billing analysis to identify patterns suggesting potential fraud or abuse.

- Data sources include:

- Medicare and Medicaid claims across Parts A–D.

- Provider enrollment data from PECOS and NPPES.

- Cross-program data from MACs, RACs, and state Medicaid agencies.

- Common triggers include:

- Abnormally high utilization or billing volumes.

- Repetitive use of high-value CPT or HCPCS codes.

- Inconsistent beneficiary demographics or treatment patterns.

- Cases are risk-scored and prioritized for further review based on financial impact and fraud potential.

Step 2: Preliminary Review and Provider Notification

- Once a case is flagged, the UPIC conducts a preliminary review to verify potential irregularities.

- If warranted, the provider receives a Documentation Request Letter (similar to a RAC or MAC ADR).

- The letter outlines:

- The claims or transactions under review.

- The records required (e.g., medical notes, test results, orders, or billing documents).

- The deadline for submission (typically 30–45 days).

- Failure to respond on time may result in claim denials or payment suspensions.

Step 3: Medical Record Review and Analysis

- Upon receipt, the UPIC’s review team—comprising clinicians, auditors, and investigators—evaluates:

- Whether documentation substantiates medical necessity.

- Whether coding and billing are accurate and consistent with CMS policy.

- Whether services were actually rendered to the beneficiaries billed.

- Reviews can occur off-site (desk review) or on-site (field audit) depending on the case’s risk level.

- UPICs maintain strict evidence protocols, as findings may lead to referrals for civil or criminal prosecution.

Step 4: Investigative and Enforcement Actions

- If findings indicate credible evidence of fraud or abuse, the UPIC may:

- Recommend a payment suspension under 42 CFR §405.371.

- Refer the case to the Office of Inspector General (OIG) or Department of Justice (DOJ).

- Initiate prepayment or postpayment review of future claims.

- Recommend revocation of Medicare billing privileges through coordination with the MAC.

- Administrative sanctions are enforced only after CMS approval, ensuring due process and consistency across jurisdictions.

Step 5: Provider Response and Appeals Process

- Providers under UPIC review should:

- Respond completely and on time to all document requests.

- Maintain a log of communications with the contractor and CMS.

- Engage compliance or legal counsel experienced in CMS audits.

- If the provider disputes findings, they may:

- Submit a corrective action plan (CAP).

- Request a rebuttal or reconsideration through CMS channels.

- Pursue formal appeal rights if a payment action or exclusion is imposed.

- Transparency and timely cooperation are critical for minimizing escalation and maintaining compliance standing.

Step 6: Collaboration with Law Enforcement

- UPICs coordinate with:

- OIG, FBI, and DOJ for potential criminal or civil actions.

- State Medicaid Fraud Control Units (MFCUs) for dual-eligible or state-level investigations.

- When fraud is substantiated, cases may result in:

- Civil monetary penalties (CMPs).

- Provider exclusion from Medicare and Medicaid.

- Criminal prosecution for willful fraud or false claims.

- UPICs also provide CMS with trend analysis and risk reports that help identify systemic vulnerabilities across the healthcare system.

Step 7: Preventive Education and Compliance Guidance

- While primarily investigative, UPICs also support CMS’s preventive education mission by:

- Sharing findings and trends with MACs and provider associations.

- Contributing to targeted training on recurring billing or documentation errors.

- Issuing technical advisories that clarify CMS policies.

- This educational feedback loop helps providers strengthen compliance and reduce future audit exposure.

Legacy Context: ZPIC Workflow Continuity

- The UPIC investigative model retains most procedural elements of the former ZPIC framework, including:

- Use of data analytics to initiate cases.

- Clinical documentation review as a primary evidence tool.

- Coordination with OIG and DOJ for prosecutable cases.

- The major distinction is scope — UPICs now oversee both Medicare and Medicaid, ensuring unified enforcement across programs.

- Providers encountering “ZPIC audit” references should interpret them as legacy terminology for what are now UPIC-led investigations.

UPICs in Billing, Reimbursement, and Compliance Limitations

Unified Program Integrity Contractors (UPICs) directly influence the financial accuracy and integrity of Medicare and Medicaid reimbursement.

Their investigations ensure that provider payments are legitimate, compliant, and supported by complete documentation, while also protecting the federal healthcare system from fraudulent or abusive billing practices.

However, because UPIC audits can result in payment suspensions, recoupments, or extended investigations, they also present temporary cash flow and administrative challenges for providers—especially those with high claims volumes or complex billing patterns.

How UPICs Affect Medicare and Medicaid Reimbursement

- UPICs review claims after payment or in near real time, identifying overpayments and potential fraud indicators.

- When irregularities are found, UPICs:

- Notify CMS of improper payments for recovery or offset through the Medicare Administrative Contractor (MAC).

- Recommend prepayment edits or postpayment reviews to prevent recurrence.

- Share data with RACs and CERT programs to refine broader payment accuracy models.

- The resulting corrective actions improve system-wide reimbursement consistency and policy compliance, strengthening trust in federal payment systems.

Payment Suspensions and Administrative Impact

- Under 42 CFR §405.371, UPICs can recommend payment suspension when there is credible evidence of fraud or willful misrepresentation.

- CMS must approve all suspensions, but once in effect, providers may experience:

- Temporary cash flow interruption until the investigation concludes.

- Increased administrative workload for record submission, communication, and appeal tracking.

- Stricter scrutiny from MACs and other contractors during the review period.

- Payment suspensions are time-limited but can be extended if CMS deems ongoing review necessary to protect program funds.

Overpayment Identification and Recovery

- When UPICs identify confirmed overpayments, CMS directs the corresponding MAC to:

- Issue a demand letter to the provider.

- Apply recoupment offsets against future claims.

- Initiate debt collection under federal regulations if the provider fails to repay.

- Providers retain appeal rights for any overpayment determinations, following the standard Medicare five-level appeals process.

- Unlike RACs, UPICs are not compensated through contingency fees — ensuring their incentive structure remains focused on accuracy and program integrity, not recovery volume.

Fiscal Integrity and System-Wide Oversight

- UPIC data are integral to CMS’s Payment Integrity Information Act (PIIA) reporting framework.

- Investigations contribute to fraud loss prevention metrics within the HHS Agency Financial Report (AFR).

- By integrating Medicare and Medicaid oversight, UPICs provide CMS with a holistic fiscal view of provider behavior and cross-program risks.

- These insights help CMS strengthen internal controls, refine predictive models, and reduce improper payment rates over time.

Provider-Level Financial Implications

- For providers, UPIC investigations can cause short-term financial uncertainty, particularly if payments are suspended pending review.

- Direct fiscal implications may include:

- Delays in reimbursement processing.

- Costs associated with compliance audits, legal counsel, or appeals.

- Reputational impact if enforcement actions become public.

- Many organizations now designate internal “audit response teams” to manage communication, track deadlines, and ensure financial continuity during investigations.

Technology and Administrative Limitations

- Despite modernization, UPIC audits still face operational challenges:

- Legacy data systems that limit interoperability with MAC or state Medicaid databases.

- Inconsistent record submission portals across contractors.

- Administrative delays in reconciling duplicate reviews between federal and state agencies.

- CMS is investing in data standardization and shared analytics platforms to reduce these inefficiencies, improving timeliness and reducing provider burden.

Fiscal Accountability and Reform Initiatives

- CMS continues to refine UPIC oversight through:

- Performance-based contracts tied to accuracy and timeliness metrics.

- Cross-program integration between UPICs, RACs, and state agencies.

- Enhanced transparency reporting, including publication of fraud prevention outcomes.

- These reforms aim to maintain the balance between strong fiscal accountability and reasonable administrative expectations for providers.

Key Takeaway

UPICs play a vital role in ensuring that federal healthcare payments are accurate, justified, and defensible.

While their audits can temporarily disrupt provider operations, their overarching mission supports long-term financial integrity, policy compliance, and equitable reimbursement across both Medicare and Medicaid programs.

For healthcare organizations, proactive compliance and strong documentation practices remain the best defense against audit-related fiscal exposure.

How UPICs Influence Quality, Access, and Equity in Healthcare

While Unified Program Integrity Contractors (UPICs) operate primarily within the fiscal and compliance domains, their activities have significant downstream effects on care quality, administrative equity, and provider accountability.

By detecting improper payments and preventing fraud, UPICs preserve the financial resources necessary to sustain beneficiary access and equitable reimbursement across the healthcare system.

Through transparency, uniform enforcement, and data integration, UPIC oversight supports CMS’s commitment to a fair and consistent administration of federal healthcare programs.

Promoting Quality Through Fiscal Accuracy

- UPIC investigations help ensure that payments align with medically necessary, properly documented services, reinforcing the clinical and operational standards that underpin care quality.

- By identifying overpayments tied to incorrect coding or insufficient documentation, UPICs encourage providers to adopt stronger compliance and documentation practices, which in turn improve data accuracy for care management and outcomes tracking.

- Accurate financial stewardship allows CMS to redirect resources toward patient-centered innovation, such as value-based care models and equity-driven quality programs.

- Reducing waste and improper billing ultimately enhances the sustainability and reliability of care delivery networks.

Ensuring Equity in Oversight and Enforcement

- The UPIC model is designed for nationwide consistency, ensuring that fraud detection and enforcement standards are applied uniformly across regions, provider types, and populations.

- CMS requires all UPICs to follow standardized procedures for:

- Data analysis and risk scoring.

- Medical record review methodology.

- Enforcement recommendations and escalation.

- These controls reduce regional bias and ensure that compliance expectations are equitable and transparent for all healthcare organizations, from small practices to large hospital systems.

- CMS continuously monitors contractor performance to confirm that investigations are evidence-based and free of discriminatory targeting.

Transparency and Accountability in Program Integrity

- UPIC findings are incorporated into CMS’s annual fraud prevention and payment integrity reports, which are made publicly available through PaymentAccuracy.gov.

- Transparency around UPIC activity fosters provider trust and demonstrates CMS’s commitment to data-driven oversight rather than arbitrary enforcement.

- Public visibility of improper payment reductions reinforces confidence among stakeholders—including providers, policymakers, and taxpayers—that federal healthcare programs are managed responsibly.

- This transparency also acts as a deterrent, discouraging opportunistic or high-risk billing behaviors.

Educational and Preventive Value

- UPIC investigations frequently identify recurring compliance weaknesses—such as documentation gaps or coding misinterpretations—that inform CMS’s provider education initiatives.

- By analyzing audit findings across multiple contractors, CMS develops targeted training resources to prevent repeated errors.

- This shift from punitive oversight to preventive education improves provider relationships and fosters a shared accountability model between CMS and the healthcare community.

- UPICs thus function as both enforcement and quality improvement partners, helping shape more consistent billing and clinical documentation practices.

Supporting Health Equity Objectives

- UPICs contribute indirectly to CMS’s Framework for Health Equity by ensuring that program funds are allocated fairly and that all providers are held to the same compliance standards.

- Detecting and preventing fraud helps protect resources for underserved and vulnerable populations, particularly in Medicaid and dual-eligible programs.

- By integrating Medicare and Medicaid oversight, UPICs help CMS identify cross-program disparities—such as higher denial rates or claim anomalies in resource-limited regions—and address them through policy refinement.

- Equitable enforcement ensures that legitimate providers in disadvantaged communities are not penalized by systemic inconsistencies or lack of clarity in CMS guidance.

Continuous Improvement and Modernization

- CMS’s ongoing modernization initiatives aim to enhance UPIC operations through:

- AI-assisted fraud detection and machine learning models for predictive risk scoring.

- Unified data platforms that merge state and federal claims data for holistic oversight.

- Performance-based contractor metrics emphasizing fairness, timeliness, and transparency.

- These improvements advance CMS’s vision for a compliance ecosystem that is both rigorous and equitable, ensuring sustainable program integrity without overburdening providers.

The Equity Imperative in Enforcement

- UPICs exemplify the principle that financial oversight and health equity are interdependent—each reinforces the other.

- When payments are accurate, audits are consistent, and enforcement is transparent, providers can focus on delivering quality care rather than navigating administrative uncertainty.

- In this way, UPIC operations serve as a foundation for ethical, data-driven healthcare administration, ensuring that federal programs remain fair, efficient, and accountable to the populations they serve.

Frequently Asked Questions about UPICs

1. What are Unified Program Integrity Contractors (UPICs)?

Unified Program Integrity Contractors (UPICs) are organizations contracted by the Centers for Medicare & Medicaid Services (CMS) to detect, prevent, and investigate fraud, waste, and abuse (FWA) across Medicare and Medicaid.

They consolidate multiple former contractor models—such as ZPICs (Zone Program Integrity Contractors) and Medicaid Integrity Contractors (MICs)—into a single, unified system for program integrity enforcement.

2. How do UPICs differ from ZPICs?

ZPICs were the previous generation of CMS integrity contractors, focused primarily on Medicare fraud and abuse within specific geographic zones.

In 2016, CMS transitioned from ZPICs to UPICs, expanding oversight to include both Medicare and Medicaid under one integrated framework.

While the functions are similar—data analysis, medical review, and investigation—UPICs offer broader scope, standardized processes, and cross-program coordination.

Providers may still encounter the term “ZPIC audit” in older documents or correspondence, but all current activity is handled by UPICs.

3. What triggers a UPIC audit or investigation?

UPICs initiate reviews based on data anomalies, high-risk billing patterns, or credible allegations of fraud.

Common triggers include:

- Unusual billing volumes or utilization rates.

- Repetitive use of high-value or non-covered codes.

- Billing for services not supported by medical documentation.

- Referrals from MACs, RACs, OIG, or state Medicaid agencies.

- Public or whistleblower complaints under the False Claims Act.

4. What happens during a UPIC investigation?

When a provider is selected for review, the UPIC sends a Documentation Request Letter specifying claims and required records.

The provider must submit supporting documentation—typically within 30–45 days—to substantiate services billed.

The UPIC then performs a medical and data review, assessing whether the services were medically necessary, properly coded, and compliant with CMS policies.

Depending on findings, outcomes may include no action, payment suspension, referral to law enforcement, or revocation of billing privileges.

5. How can providers prepare for or respond to a UPIC audit?

To minimize audit risk and ensure readiness:

- Maintain comprehensive documentation for every billed service.

- Verify that coding and medical necessity align with CMS guidelines.

- Respond promptly and completely to any documentation requests.

- Establish a centralized audit response process within your compliance or revenue cycle team.

- Consult legal or compliance counsel familiar with CMS integrity audits.

Timely and transparent cooperation significantly reduces escalation or prolonged payment holds.

6. Are UPICs the same as RACs or MACs?

No. While they collaborate, each serves a distinct role:

- UPICs investigate fraud, waste, and abuse across Medicare and Medicaid.

- RACs (Recovery Audit Contractors) identify and recover overpayments after claims have been paid.

- MACs (Medicare Administrative Contractors) handle claims processing, enrollment, and local coverage determinations.

Together, they form the CMS Program Integrity Network, which ensures that payments are accurate, justified, and compliant.

7. What rights do providers have during a UPIC audit?

Providers maintain several important rights during UPIC audits:

- The right to be notified of all audit requests and actions.

- The right to submit complete documentation for review.

- The right to appeal adverse determinations through CMS’s established appeals process.

- The right to representation by compliance or legal professionals.

CMS also enforces strict contractor performance standards to ensure that UPIC audits are fair, evidence-based, and procedurally transparent.