What Is Comprehensive Error Rate Testing (CERT)?

Comprehensive Error Rate Testing (CERT) is a federal audit program administered by the Centers for Medicare & Medicaid Services (CMS) to measure the accuracy of Medicare payments and determine the national improper payment rate.

Unlike Recovery Audit Contractors (RACs), which focus on recovering overpayments, the CERT program evaluates a statistically valid sample of claims to estimate overall program accuracy and identify patterns of payment errors.

Established under the Improper Payments Information Act (IPIA) and managed by CMS’s Center for Program Integrity (CPI), CERT serves as an independent validation system for Medicare claims processing. It determines whether payments were made in accordance with Medicare coverage, coding, and billing regulations.

The CERT program reviews both paid and denied claims, requesting medical records from providers to verify that submitted documentation supports the billed services.

Findings from these reviews feed directly into CMS’s Improper Payment Measurement Framework, which guides national policy decisions, contractor oversight, and provider education efforts aimed at reducing payment error rates.

By quantifying and categorizing the root causes of payment errors—such as insufficient documentation, coding mistakes, or policy misapplication—CERT enables CMS to improve operational accuracy, fiscal accountability, and data-driven compliance across the entire Medicare system.

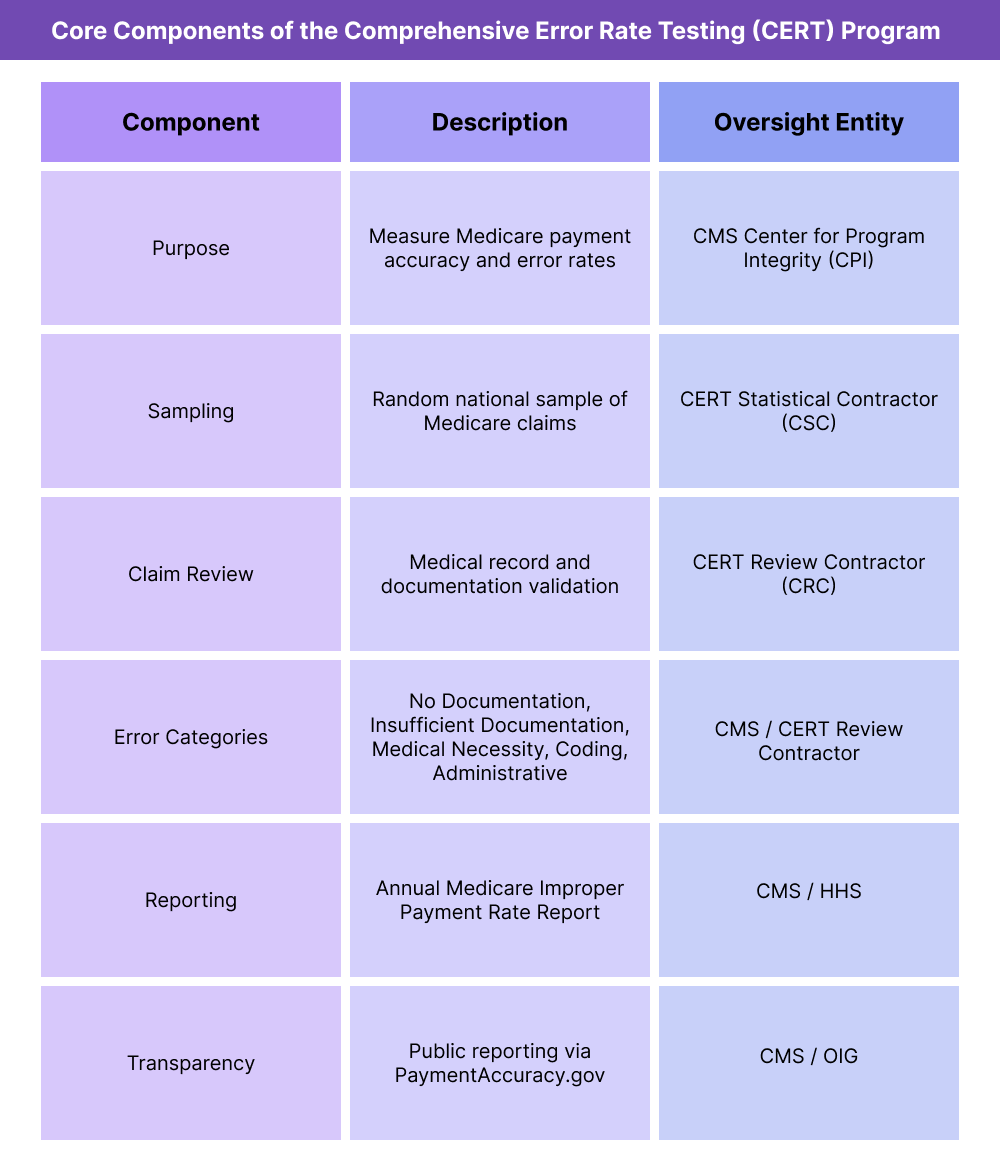

Key Components of Comprehensive Error Rate Testing (CERT) Program

The Comprehensive Error Rate Testing (CERT) program serves as CMS’s national quality control system for Medicare payments, measuring the rate, type, and cause of improper reimbursements.

Through statistically valid sampling, documentation review, and detailed error categorization, CERT provides CMS with quantitative insight into the accuracy of the Medicare claims payment process.

Its results inform policy decisions, contractor performance evaluations, and the development of targeted provider education initiatives.

1. CERT Program Purpose and Oversight

- Established under the Improper Payments Information Act (IPIA) and subsequent updates through the Payment Integrity Information Act (PIIA).

- Administered by CMS’s Center for Program Integrity (CPI).

- Designed to measure and report:

- The Medicare improper payment rate (percentage of total payments that were inaccurate).

- The causes of improper payments, including documentation, coding, or administrative errors.

- The financial impact of overpayments and underpayments on the Medicare Trust Funds.

- CERT results are published annually in CMS’s Medicare Fee-for-Service Improper Payment Rate Report.

2. Program Structure and Responsibilities

- CERT operations are divided into three major contractor functions:

- CERT Statistical Contractor (CSC) – Selects random claim samples and calculates the national improper payment rate.

- CERT Review Contractor (CRC) – Requests medical records from providers, performs claim reviews, and determines payment accuracy.

- CERT Documentation Contractor (CDC) – Manages provider communication and receipt of medical documentation.

- These contractors work in coordination with MACs (Medicare Administrative Contractors) and RACs (Recovery Audit Contractors) to ensure data accuracy and reduce redundant audits.

3. Sampling Methodology and Claim Selection

- CERT employs a statistically valid random sampling approach to review Medicare Fee-for-Service (FFS) claims.

- Each year, thousands of claims are randomly selected across:

- Part A (institutional)

- Part B (professional)

- DMEPOS (Durable Medical Equipment, Prosthetics, Orthotics, and Supplies)

- The sample size ensures national representation of provider types, claim categories, and geographic regions.

- Claim selection is retrospective, typically reviewing payments made within the previous fiscal year.

4. Medical Record Review and Error Classification

- Once a claim is selected, the provider receives a Documentation Request Letter from the CERT contractor.

- Providers must submit complete medical records and supporting documents within 45 days.

- The CERT Review Contractor assesses:

- Whether the service was medically necessary.

- Whether it was coded and billed correctly.

- Whether documentation substantiates the claim.

- Improper payments are classified into five key error categories:

- No Documentation

- Insufficient Documentation

- Medical Necessity Errors

- Incorrect Coding

- Administrative or Processing Errors

5. Reporting and Use of Findings

- CERT results are used to:

- Determine the national improper payment rate for Medicare.

- Evaluate MAC performance and identify regional trends.

- Inform CMS’s provider education and outreach initiatives.

- Guide policy adjustments and system edits to reduce future errors.

- The data also supports the Department of Health and Human Services (HHS) Agency Financial Report, contributing to government-wide accountability efforts.

6. CMS Oversight and Transparency

- CMS publishes all CERT findings and error data on the PaymentAccuracy.gov portal.

- The program is subject to annual external audits to validate its methodology and accuracy.

- Transparency measures ensure that the CERT program remains both statistically reliable and operationally independent from enforcement functions like RAC or ZPIC audits.

How Comprehensive Error Rate Testing (CERT) Works in Practice

- Comprehensive Error Rate Testing (CERT) audits are retrospective, data-driven evaluations that measure the accuracy of Medicare Fee-for-Service (FFS) payments.

- While RACs and ZPICs focus on recoupment and fraud prevention, CERT’s role is diagnostic — to quantify and analyze systemic error rates, identify their root causes, and help CMS improve policy consistency, contractor accuracy, and provider education.

- Participation in the CERT program is mandatory for all Medicare-enrolled providers whose claims are randomly selected. The process emphasizes documentation integrity and compliance, not punitive enforcement.

Step 1: Claim Selection and Provider Notification

- The CERT Statistical Contractor (CSC) randomly selects claims from the national pool of Medicare Fee-for-Service payments.

- Selected providers receive a Documentation Request Letter (DRL) from the CERT Review Contractor (CRC).

- The letter includes claim identifiers, the reason for selection, and instructions for submitting supporting documentation.

- Providers typically have 45 calendar days to respond, though CMS allows limited extensions for good cause.

Step 2: Documentation Submission

- Providers must submit complete medical records supporting the claim, including:

- Clinical notes

- Diagnostic test results

- Operative or procedure reports

- Physician orders

- Itemized billing or charge sheets

- Records may be submitted electronically, by fax, or by mail to the CERT Documentation Contractor (CDC).

- Incomplete or late submissions are classified as “No Documentation” or “Insufficient Documentation” errors — both of which negatively affect the national error rate.

Step 3: Medical Review and Determination

- The CERT Review Contractor (CRC) evaluates the claim to determine whether:

- Services were medically necessary and covered under Medicare policy.

- The claim was coded accurately and billed appropriately.

- Submitted documentation supports every billed service or supply.

- Based on the review, the CRC designates the claim as:

- Properly Paid, Overpaid, Underpaid, or Denied.

- Findings are recorded and aggregated to calculate regional and national improper payment rates.

Step 4: Provider Feedback and Error Classification

- Providers receive a Review Results Letter summarizing the audit outcome and any identified deficiencies.

- Common provider error classifications include:

- Insufficient Documentation – Missing or incomplete records.

- Medical Necessity – Service not justified by the medical record.

- Incorrect Coding – Wrong procedure or diagnosis code.

- Administrative Error – Claim processed incorrectly by a contractor.

- Although CERT findings do not trigger recoupment directly, they may inform future RAC or MAC audit priorities.

Step 5: Appeals and Corrections

- Providers may submit rebuttals or clarifications if they believe the CERT determination was based on incomplete or misunderstood documentation.

- These responses help CMS refine future sampling methodologies and review accuracy.

- Unlike RAC audits, CERT determinations are not appealable through the Medicare appeals process, as they are not enforcement actions — but provider feedback remains a critical component of quality control.

Step 6: Using CERT Data for Quality and Compliance Improvement

- CMS and providers use CERT findings to identify systemic weaknesses in billing or documentation practices.

- Provider organizations often analyze CERT data to:

- Improve coding accuracy and EHR documentation completeness.

- Target staff training for high-risk service categories.

- Prepare for potential future audits (RAC, MAC, or ZPIC).

- States and contractors also use CERT results to enhance Medicaid audit alignment and improve payment accuracy benchmarks across programs.

Step 7: Integration with Broader CMS Oversight

- CERT outcomes feed into CMS’s Improper Payment Measurement Framework, which guides annual policy updates and contractor performance metrics.

- The program’s findings help CMS pinpoint areas for process improvement, such as reducing administrative claim errors or refining national coverage determinations.

- By providing independent verification of payment accuracy, CERT supports the integrity and efficiency of the broader Medicare reimbursement system.

CERT in Medicaid Billing, Reimbursement, and Fiscal Limitations

The Comprehensive Error Rate Testing (CERT) program plays a central role in quantifying Medicare’s payment accuracy and shaping CMS’s financial management strategy.

While CERT audits do not recover funds directly, their findings determine the national improper payment rate—a key fiscal indicator used by Congress, the Office of Inspector General (OIG), and CMS leadership to assess program integrity and compliance performance across Medicare.

CERT therefore operates as both a measurement system and a policy accountability tool, driving continuous improvement in billing accuracy, contractor oversight, and reimbursement consistency.

How CERT Affects Medicare Reimbursement Accuracy

- Each year, the CERT Statistical Contractor (CSC) calculates an improper payment rate based on audited claim samples.

- Improper payments include both overpayments (paid in error) and underpayments (missed reimbursements).

- CMS uses these findings to evaluate:

- Medicare Administrative Contractor (MAC) claim-processing accuracy.

- Coverage and documentation compliance across provider types.

- The financial soundness of Medicare’s Fee-for-Service (FFS) system.

- Results directly influence CMS’s Payment Integrity Action Plans, which outline corrective measures to reduce future error rates.

Impact on Contractor Performance and Fiscal Oversight

- CERT results are used to score and evaluate MACs, ensuring consistent claim adjudication standards across all regions.

- MACs with high improper payment rates may be subject to:

- Corrective action plans (CAPs).

- Increased oversight from CMS regional offices.

- Adjustments to contract renewal eligibility.

- RACs (Recovery Audit Contractors) also use CERT data to prioritize issue selection, focusing on areas with documented error prevalence.

- By tying fiscal performance to data-driven metrics, CMS ensures that contractors remain accountable for payment integrity.

Provider-Level Financial Implications

- While CERT does not directly recoup payments, its results can influence future audit targeting and prepayment review trends.

- A high incidence of provider documentation or coding errors within CERT data may trigger RAC or MAC audits in subsequent cycles.

- Providers whose claims are sampled in CERT reviews bear administrative costs associated with document retrieval and submission, similar to other CMS audits.

- Although no repayment is required for CERT findings, identified issues can lead to process improvements or internal compliance adjustments that reduce long-term financial risk.

Data Integrity and Fiscal Transparency

- CERT outcomes feed into CMS’s Improper Payment Measurement Framework, which underpins federal reporting under the Payment Integrity Information Act (PIIA).

- The program quantifies the dollar value and root cause of payment inaccuracies across the Medicare Trust Funds.

- Key reporting outputs include:

- The Medicare Fee-for-Service Improper Payment Rate Report.

- The HHS Agency Financial Report (AFR).

- The PaymentAccuracy.gov public dashboard.

- These reports increase fiscal transparency, enabling policymakers to assess the effectiveness of corrective actions and payment reforms.

Fiscal Limitations and Systemic Challenges

- Because CERT samples are limited in size, statistical projection introduces confidence intervals that reflect national trends rather than individual provider accuracy.

- Some improper payments arise from technical or administrative errors rather than true overbilling, highlighting challenges in distinguishing between documentation gaps and misuse.

- CMS continually refines sampling methods, classification criteria, and error weighting to improve fiscal precision in reported payment accuracy rates.

- Despite these refinements, the inherent lag between claim payment and audit reporting can delay the implementation of corrective measures.

Policy and Reform Considerations

- CMS has expanded CERT’s analytical scope to capture emerging reimbursement models such as value-based care, telehealth, and bundled payments.

- Data from CERT reviews now inform CMS’s targeted provider education and coding compliance programs, reducing repetitive errors.

- Continuous improvement efforts include:

- Greater integration with RAC and MAC data systems.

- Machine learning models to improve error prediction and sampling efficiency.

- Enhanced public transparency in annual CERT reports to sustain trust in program integrity metrics.

Key Takeaway

The CERT program is not a punitive audit but a performance measurement tool that drives system-wide improvements in billing accuracy, fiscal transparency, and payment accountability.

Its findings inform CMS oversight, contractor management, and policy development, ensuring that Medicare funds are spent efficiently and equitably — a cornerstone of sustainable federal healthcare financing.

How CERT Influences Quality, Access, and Equity in Medicaid Financing

Although Comprehensive Error Rate Testing (CERT) focuses on financial accuracy rather than clinical performance, its findings have powerful ripple effects on Medicare quality assurance, policy transparency, and equitable enforcement.

By quantifying where and why payment errors occur, CERT enables CMS to strengthen both operational integrity and equitable oversight across provider types, regions, and service categories.

Advancing Quality Through Accurate Measurement

- CERT provides CMS with the national benchmark for payment accuracy, ensuring the integrity of financial data used to evaluate contractor and program performance.

- Reliable error measurement supports high-quality healthcare administration by promoting consistency in claims processing and timely reimbursement.

- CERT findings inform updates to coding manuals, coverage policies, and system edits, reducing the frequency of future documentation errors.

- As error rates decrease, CMS can redirect administrative resources toward initiatives that directly improve beneficiary care quality and access.

Equitable Oversight Across Provider Types

- CERT’s random sampling methodology ensures equitable inclusion of all provider categories, from large hospital systems to small physician practices.

- This non-targeted audit structure eliminates bias in claim selection and provides a representative view of program accuracy across the nation.

- Because CERT focuses on measurement rather than enforcement, it ensures that providers are evaluated fairly and that audit outcomes reflect systemic performance, not isolated behavior.

- Findings also highlight disparities in documentation or policy comprehension that may disproportionately affect certain provider groups, informing CMS’s educational outreach.

Transparency and Accountability as Quality Drivers

- CERT findings are published annually in CMS’s Improper Payment Rate Report, which is publicly available through PaymentAccuracy.gov.

- This transparency reinforces fiscal accountability and enables stakeholders—including Congress, providers, and beneficiaries—to monitor the performance of Medicare contractors.

- Open reporting ensures that CMS’s quality control activities are data-driven and publicly auditable, increasing trust in the fairness and reliability of federal reimbursement.

- The results guide targeted provider education programs, helping reduce recurring documentation and billing errors in specific regions or service categories.

Provider Education and Continuous Improvement

CERT data reveal patterns of error related to documentation sufficiency, coding accuracy, and policy interpretation.

- CMS uses this information to develop targeted training, webinars, and reference materials for providers.

- By emphasizing education rather than penalty, CERT fosters a collaborative compliance culture, where providers are empowered to correct systemic issues before they trigger audits or recoupments.

- This educational approach contributes to a sustainable cycle of quality improvement, bridging the gap between oversight and operational support.

Health Equity and Access Implications

- Accurate payment measurement helps preserve the financial stability of the Medicare Trust Funds, ensuring continued access for current and future beneficiaries.

- By promoting equitable oversight and reducing administrative errors, CERT supports CMS’s Framework for Health Equity, which emphasizes fairness in both care delivery and administrative processes.

- Error data also help CMS identify regional disparities in payment accuracy, which may correlate with resource or training gaps among providers serving underserved populations.

- Addressing these discrepancies improves payment equity, helping ensure that funding reaches the providers and communities that need it most.

Integration with CMS’s Modernization Agenda

- CERT complements other integrity programs such as RAC, ZPIC/UPIC, and MAC oversight, collectively supporting CMS’s shift toward data-driven, equitable administration.

- Ongoing modernization efforts include:

- Integration of AI-assisted data analytics for predictive error modeling.

- Cross-program collaboration to eliminate redundant audits.

- Expansion of equity-linked metrics within improper payment reporting.

- These initiatives ensure that the CERT program continues to serve as a foundation for transparent, fair, and evidence-based healthcare oversight.

Frequently Asked Questions about CERT

1. What is the Comprehensive Error Rate Testing (CERT) program?

The Comprehensive Error Rate Testing (CERT) program is a federal audit and measurement initiative managed by the Centers for Medicare & Medicaid Services (CMS).

Its purpose is to calculate the national improper payment rate for Medicare by reviewing a statistically valid sample of claims.

CERT evaluates whether payments were made correctly, based on medical necessity, coding accuracy, and documentation sufficiency.

2. How does the CERT audit process work?

CERT contractors select a random sample of paid and denied Medicare Fee-for-Service (FFS) claims each year.

Providers whose claims are selected receive a Documentation Request Letter (DRL) and must submit supporting medical records within 45 days.

The CERT Review Contractor (CRC) examines each claim and classifies it as Properly Paid, Overpaid, Underpaid, or Denied.

The aggregated results determine the annual improper payment rate published by CMS.

3. What types of errors does CERT identify?

CERT classifies improper payments into five categories:

- No Documentation – No medical records provided.

- Insufficient Documentation – Missing or incomplete records.

- Medical Necessity Errors – Service not justified by clinical records.

- Incorrect Coding – Wrong CPT, HCPCS, or diagnosis code used.

- Administrative or Processing Errors – Contractor or system mistakes.

These classifications help CMS and providers identify the root causes of billing inaccuracies.

4. How is CERT different from RAC or MAC audits?

- CERT measures and reports payment accuracy rates but does not recover funds.

- RAC (Recovery Audit Contractors) identify and recoup improper payments through targeted audits.

- MACs (Medicare Administrative Contractors) process and pay claims in real time, managing pre-payment compliance.

Together, these programs ensure that Medicare payments are accurate, justified, and compliant with federal regulations.

5. Are providers penalized for CERT errors?

No. CERT audits are measurement-focused, not punitive.

Providers whose claims are found to be incorrect are not subject to repayment, but the results may inform future audit priorities or education initiatives.

CERT data are used to improve overall payment accuracy, not to penalize individual providers.

6. How can providers prepare for a CERT documentation request?

To respond effectively:

- Maintain complete and legible documentation supporting all billed services.

- Track and respond promptly to Documentation Request Letters (DRLs).

- Verify coding accuracy and medical necessity before claim submission.

- Establish internal audit procedures to ensure compliance with Medicare coverage policies.

Proactive documentation management reduces both audit burden and risk of classification as an improper payment.

7. Why is CERT important for Medicare quality and equity?

The CERT program promotes transparency, accuracy, and fairness in Medicare reimbursement.

By identifying systemic error trends, it helps CMS target education and corrective actions where they are most needed—often in high-volume or underserved service areas.

This ensures that Medicare funds are distributed equitably and efficiently, reinforcing trust in the program’s financial and operational integrity.